House Republicans ignored repeated requests from the Capitol Police to review and approve any Jan. 6 security footage that would be made public, according to Capitol Police general counsel Thomas DiBiase.

Continue reading “Cap Police Attorney: House GOP Ignored Requests To Review Jan. 6 Footage Before Carlson Aired It”Judge Orders Trump Atty To Testify In Mar-a-Lago Case

Outgoing Chief U.S. District Judge Beryl Howell for the District of Columbia ordered a key Trump attorney to testify before the grand jury investigating the Mar-a-Lago document scandal, multiple news outlets reported on Friday.

Continue reading “Judge Orders Trump Atty To Testify In Mar-a-Lago Case”A Bit of Earlier Context on Lab Leak Discourse

At present, my main contribution to Lab Leak Discourse is making fun of it. I say this operating on the distinction provided to us by TPM Reader JS a couple weeks ago, noting that Lab Leak Discourse is now entirely autonomous from the actual ongoing research into the origins of COVID-19. Indeed, I noticed yesterday that it has now taken a new turn focusing on public opinion surveys showing that a majority of Americans believe COVID began with a laboratory accident at the virology lab in Wuhan, China. The “wisdom of crowds,” one Lab Leak advocate told me, should be given its own weight along with the judgments of those with domain expertise in virology, genomics and other fields.

Continue reading “A Bit of Earlier Context on Lab Leak Discourse”What Did The Fed Supervisors Do Before SVB Collapsed?

Pressure has mounted on the Federal Reserve since Silicon Valley Bank collapsed last week.

Continue reading “What Did The Fed Supervisors Do Before SVB Collapsed?”Michael Cohen Says He Believes Prosecutors Have All The Info They Need To Indict Trump

Donald Trump’s former personal attorney Michael Cohen said, in his view, Manhattan prosecutors have enough evidence to indict and convict the former president as part of the office’s investigation into the hush money payment to adult film actress Stormy Daniels.

Continue reading “Michael Cohen Says He Believes Prosecutors Have All The Info They Need To Indict Trump”Is The Western Drought Finally Ending? That Depends On Where You Look

This article is part of TPM Cafe, TPM’s home for opinion and news analysis. It was originally published at The Conversation.

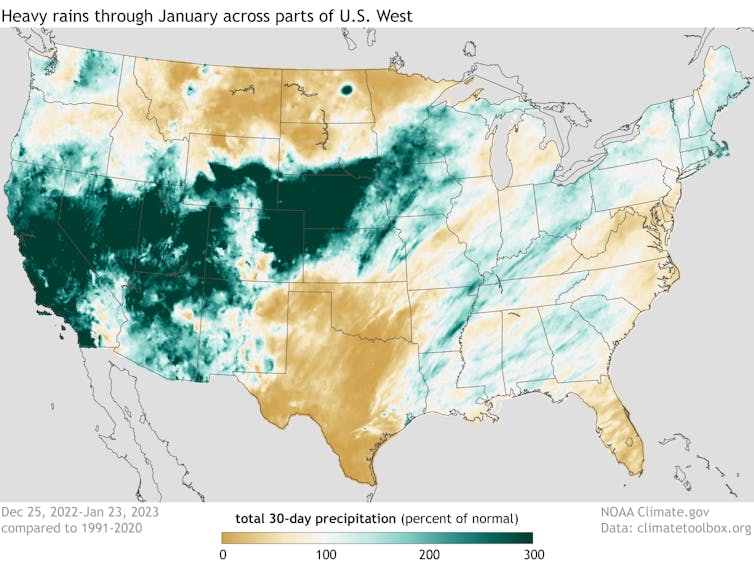

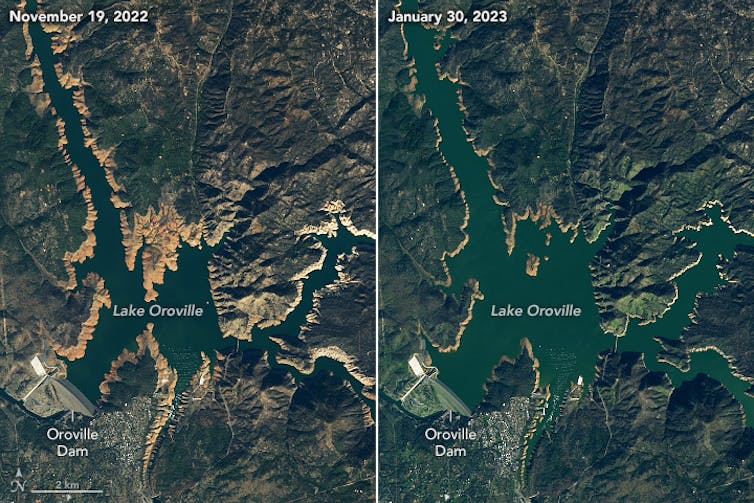

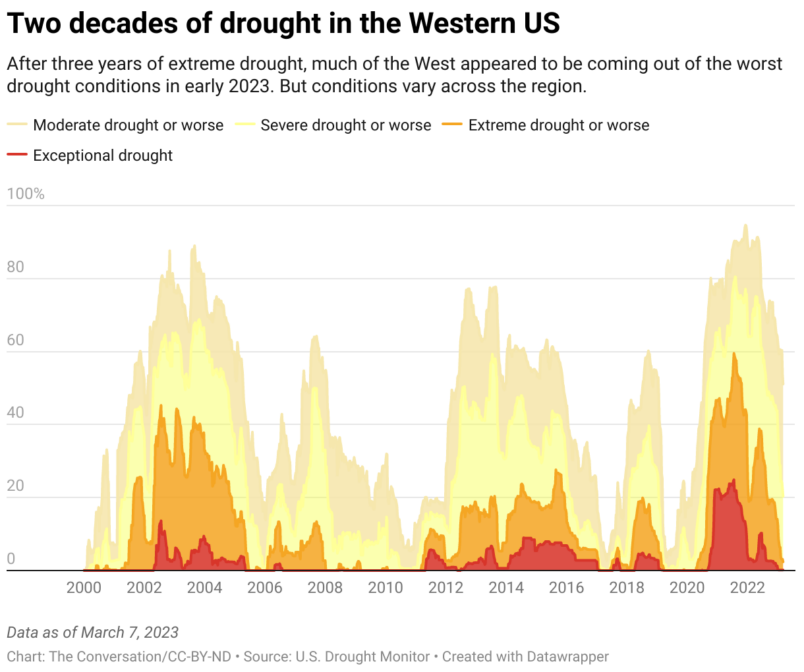

After three years of extreme drought, the Western U.S. is finally getting a break. Mountain ranges are covered in deep snow, and water reservoirs in many areas are filling up following a series of atmospheric rivers that brought record rain and snowfall to large parts of the region.

Many people are looking at the snow and water levels and asking: Is the drought finally over?

There is a lot of nuance to the answer. Where you are in the West and how you define “drought” make a difference. As a drought and water researcher at the Desert Research Institute’s Western Regional Climate Center, here’s what I’m seeing.

How fast each region recovers will vary

The winter of 2023 has made a big dent in improving the drought and potentially eliminating the water shortage problems of the last few summers.

I say “potentially” because in many areas, a lot of the impacts of drought tend to show up in summer, once the winter rain and snow stop and the West starts relying on reservoirs and streams for water. Spring heat waves like the ones we saw in 2021 or rain in the mountains could melt the snowpack faster than normal.

California and the Great Basin

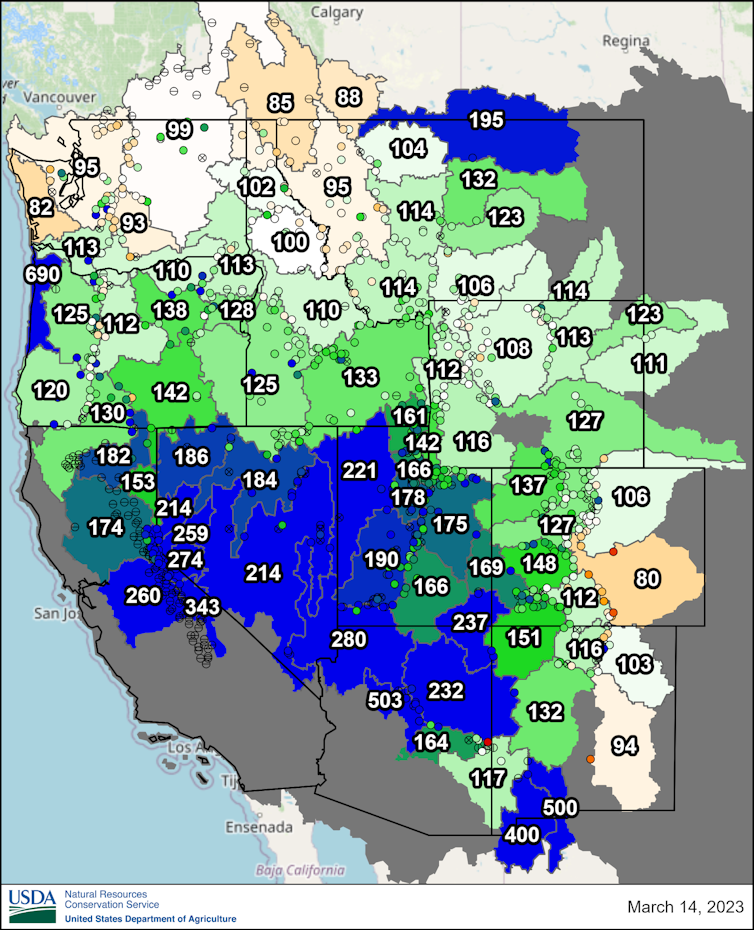

In California, the state’s three-year precipitation deficit was just about erased by the atmospheric rivers that caused so much flooding in December and January. By early March, the snowpack across the Sierra Nevada was well above the historical averages — and more than 200% of average in some areas. The Metropolitan Water District of Southern California announced it was ending emergency water restrictions for nearly 7 million people on March 15.

It seems as though most of the surface water drought — drought involving streams and reservoirs — could be eliminated by summer in California and the Great Basin, across Nevada and western Utah.

But that’s only surface water. Drought also affects groundwater, and those effects will take longer to alleviate.

Studies in California have shown that, even after wet years like 2017 and 2019, the groundwater systems did not fully recover from the previous drought, in part because of years of overpumping groundwater for agriculture, and the aquifers were not fully recharging.

In that sense, the drought is not over. But at the broader scale for the region, a lot of the drought impacts that people experience will be lessened or almost gone by this summer.

The Colorado River Basin

Similar to the Sierra Nevada, the Upper Colorado River Basin — Wyoming, Colorado, Utah and northwestern New Mexico — has a healthy snowpack this year, and it’s looking like a very good water year there.

But one single good water year is not going to fill Lake Mead and Lake Powell. Most of the region relies on those two reservoirs, which have declined to worrying levels over the past two decades. NOAA’s seasonal drought outlook released on March 16 noted that both remained low.

Two good water years won’t do it either. Over the next decade, most years will have to be above average to begin to fill those giant reservoirs. Rising temperatures and drying will make that even harder.

So, that system is still going to be dealing with a lot of the same long-term drought impacts that it has been seeing. The reservoirs will likely rise some, but nowhere close to capacity.

The Pacific Northwest

The Pacific Northwest isn’t having as much rain and snow, and it’s a little drier there. But it’s close to average, so there’s not a huge concern there, at least not right now.

Forests, range land and the fire risk

Drought can also have longer-term impacts on ecosystems, particularly forest health.

The Sierra Nevada range has seen large-scale tree die-offs with the drought in recent years, including in northern areas around Lake Tahoe and Reno that weren’t as affected by the previous drought. Whether the recent die-offs there are due to the severity of the current drought or lingering effects from the past droughts is an open question.

Even with a wet winter, it’s not clear how soon the forests will recover.

Rangelands, since they are mostly grasses, can recover in a few months. The soil moisture is really high in a lot of these areas, so range conditions should be good across the West — at least going into summer.

If the West has another really hot, dry summer, however, the drought could ramp up again, particularly in the Northwest and California. And then communities will have to think about fire risk.

Right now, there’s a below-normal likelihood of big fires in the Southwest for early spring due to lots of soil moisture and snowpack.

In the higher-elevation mountains and forests, the above-average snowpack is likely to last longer than it has in recent years, so those regions will likely have a later start to the fire season. But lower elevations, like the Great Basin’s shrub- and grassland-dominated ecosystem, could see fire danger starting earlier in the year if the land dries out.

Long-term outlooks aren’t necessarily reliable

By a lot of atmospheric measures, California appears to be coming out of drought, and the drought feels like it’s ending elsewhere. But it’s hard to say when exactly the drought is over. Studies suggest the West’s hydroclimate is becoming more variable in its swings from drought to deluge.

Drought is also hard to forecast, particularly long term. Researchers can get a pretty good sense of conditions one month out, but the chaotic nature of the atmosphere and weather make longer-range outlooks less reliable.

We saw that this year. The initial forecast was for a dry winter 2023 in much of the West. But in California, Arizona and New Mexico, the opposite happened.

Seasonal forecasts tend to rely heavily on whether it’s an El Niño or La Niña year, involving sea surface temperatures in the tropical Pacific that can affect the jet stream and atmospheric conditions around the world. During La Niña — the pattern we saw from 2020 until March 2023 — the Southwest tends to be drier and the Pacific Northwest wetter.

But that pattern doesn’t always set up in exactly the same way and in the same place, as we saw this year.

There is a lot more going on in the atmosphere and the oceans on a short-term scale that can dominate the La Niña pattern. This year’s series of atmospheric rivers has been one example.

This article is republished from The Conversation under a Creative Commons license. Read the original article.

A Case Study On The Epidemic Of Bothsidesism In Journalism

A lot of things happened. Here are some of the things. This is TPM’s Morning Memo.

Hahahaha … Sob

I started this WaPo story – headlined “Much of the 2024 GOP field focuses on dark, apocalyptic themes” – with hope and optimism. Awesome, the bigs are treating this as not normal, which is good, just what democracy needs!

It starts off strong, citing Trump’s “I am your retribution” speech and building up to a compelling nut ‘graph:

The trio of comments from 2024 Republican presidential hopefuls — either declared or expected — underscore the dark undertones and apocalyptic rhetoric that have pervaded much of the Republican Party in the era of Trump.

But in the very next ‘graph, immediately undercutting the story’s own premise, comes the first sign that the story is infected with the insidious journalistic trope of bothsidesism:

President Biden and Democrats often engage in their own existential messaging, warning that some Republicans — whom they deride as “extremists” — are out of step with most Americans, eager, for example, to cut programs like Medicare and Social Security.”

Wait, what? Equating the defense of Medicare and Social Security with “I am your retribution”? Putting extremists in quotes was a nice touch, too.

From there, the story’s structure deteriorates into a both-sides dipsy doo of apocalyptic things Republicans have said followed by “to be sure”-style tut-tutting over Democrats just to even things out, culminating in: “Of course, Democrats also deploy hyperbolic and dark language against their Republican foes.” Of course?!?

The peak of the bothsidesism comes when the story hands the baton to a dyed-in-the-wool Trumper who invokes … 85-year-old Jane Fonda … as representative of elected Democrats. What is this, 1972?

Cliff Sims, a former Trump White House official, pushed back on the notion that only Republicans are using overheated language. He pointed to the recent comments by actor and liberal activist Jane Fonda on ABC’s “The View,” in which she suggested the “murder” of antiabortion politicians — she later said she was using hyperbole and had made the suggestion in jest — and what he called “the never-ending drumbeat of Democrats who call Trump ‘Insert Authoritarian Phrase Here.’”

Remember this is a story ostensibly about how GOP contenders for president in 2024 are using dark and apocalyptic language, but okay sure Hanoi Jane half a century later as a counterpoint.

Democracy dies in darkness, though to be sure light has its own issues and has yet to account for its role in the arson problem.

Jack Smith’s MAL Probe Casts Wide Net

CNN:

At least two dozen people – from Mar-a-Lago resort staff to members of Donald Trump’s inner circle at the Florida estate – have been subpoenaed to testify to a federal grand jury that’s investigating the former president’s handling of classified documents, multiple sources familiar with the investigation told CNN.

Yet Another Trump Lawyer Caught Up In MAL Probe

Investigators have also sought to compel the testimony of another attorney for the former president, Jennifer Little, who has also sought to assert attorney-client privilege, as part of the investigation into the Mar-a-Lago documents, sources tell ABC News.

Do Tell!

The Georgia special grand jury heard the recording of another phone call from then-President Donald Trump pressuring a state official to overturn the 2020 election results.

Trump Lawyer Using Civil Suit To Fish For Info On Criminal Probes

As Donald Trump prepares for an indictment that could come any minute now, one of his top lawyers is apparently trying to use another case to siphon information about every possible pending investigation into the former president—including ones that Trump might not even know about yet.

That covert effort was revealed this week in a previously unreported letter that the office of New York Attorney General Letitia James (OAG) submitted in state court. James and Trump’s attorneys have battled over subpoenas for weeks as her $250 million fraud suit against the Trump Organization barrels ahead.

This Is Golden

UPDATE: Jan. 6 defendant Gabriel Garcia is defending his trip to CPAC last week w/o notifying the court (a potential violation of his pretrial release conditions) by telling Judge Jackson he was preparing his defense … by talking to Matt Gaetz and Ivan Raiklin. pic.twitter.com/PMSLmcxhjn

— Kyle Cheney (@kyledcheney) March 17, 2023

U.S. District Judge Amy Berman Jackson has ordered Garcia to appear Monday in person for a hearing on whether he violated the terms of his pre-trial release by going to CPAC. In doing so, she imposed strict limits on his trip to DC for the hearing: “Defendant is only permitted to leave the district where he lives to travel directly to DC, and he may go only to his hotel, his lawyers office, and the courthouse, where he must be accompanied by his lawyer at all times.”

This Isn’t That Hard, Folks

For those of you in the back, yes, raising the retirement age is a cut to Social Security benefits.

Speaking Of Raising The Retirement Age

Amid large street demonstrations, French President Emmanuel Macron bypassed Parliament and invoked special constitutional powers on Thursday to raise the retirement age from 62 to 64.

Put Me In, Coach!

I’m loving the sleuthing the WSJ is doing on the Nord Stream sabotage, especially since it involves reporting in German yachting circles and excursions to obscure (to me) Danish ports. Tough assignment, guys:

At least some of the six people on the suspected sabotage team boarded the Andromeda in Rostock’s Hohe Düne harbor, which caters to upscale tourists and hosts international yachting events. … From there, the Andromeda traveled to the Yachthafen Hafendorf in Wiek on the island of Rügen, a far more discreet harbor off the beaten track, with no camera surveillance at night, according to René Redmann, the harbor master.

German investigators believe that it was in quiet, out-of-the-way Wiek that the suspected saboteurs loaded explosives—ferried to the port in a white van—and additional operatives onto the Andromeda, according to a German official briefed on the investigation. …

After Wiek, the Andromeda sailed to the busier Danish port of Christiansø, farther north.

Dear Readers

I’ll be handing over the reins of Morning Memo for a few days to Nicole Lafond and the rest of the TPM team. Please treat them well! Be back soon.

Do you like Morning Memo? Let us know!

Republicans Keep Pretending That This Social Security Cut Is Not Actually A Cut

“I know of no Republican or Democrat in the House or the Senate who is proposing cutting Social Security benefits,” Sen. Mitt Romney (R-UT) steamed from his perch at the Senate Budget Committee hearing Wednesday. “And it’s dishonest to keep saying it. It’s offensive and dishonest, and not realistic.”

Record scratch.

Continue reading “Republicans Keep Pretending That This Social Security Cut Is Not Actually A Cut”Wealthy Executives Make Millions Trading Competitors’ Stock With Remarkable Timing

This article first appeared at ProPublica. ProPublica is a Pulitzer Prize-winning investigative newsroom. Sign up for The Big Story newsletter to receive stories like this one in your inbox.

On Feb. 21, 2018, August Troendle, an Ohio billionaire, made a remarkably well-timed stock trade. He sold $1.1 million worth of shares of Syneos Health the day before a management shake-up caused the company’s stock to plunge 16%. It was the largest one-day drop that year for Syneos’ share price.

The company was one Troendle knew well. He is the CEO of Medpace, one of Syneos’ chief competitors in a niche industry. Both Syneos and Medpace handle clinical trials for biopharma companies, and that year they had jointly launched a trade association for companies in the field.

The day after selling the Syneos shares in February 2018, Troendle bought again — at least $3.9 million worth. The value of his Syneos stake then rose 75% in the year that followed.

In February 2019, Troendle sold much of that position, netting $2.3 million in profit. Two days later, Syneos disclosed that the Securities and Exchange Commission was investigating its accounting practices. The news sent the company’s shares tumbling. Troendle’s sale avoided a 25% loss, the stock’s largest decline in such a short period during either that or the previous year. (Troendle declined to comment.)

The Medpace executive is among dozens of top executives who have traded shares of either competitors or other companies with close connections to their own. A Gulf of Mexico oil executive invested in one partner company the day before it announced good news about some of its wells. A paper-industry executive made a 37% return in less than a week by buying shares of a competitor just before it was acquired by another company. And a toy magnate traded hundreds of millions of dollars in stock and options of his main rival, conducting transactions on at least 295 days. He made an 11% return over a recent five-year period, even as the rival’s shares fell by 57%.

These transactions are captured in a vast IRS dataset of stock trades made by the country’s wealthiest people, part of a trove of tax data leaked to ProPublica. ProPublica analyzed millions of those trades, isolated those by corporate executives trading in companies related to their own, then identified transactions that were anomalous — either because of the size of the bets or because individuals were trading a particular stock for the first time or using high-risk, high-return options for the first time.

The records give no indication as to why executives made particular trades or what information they possessed; they may have simply been relying on years of broad industry knowledge to make astute bets at fortuitous moments. Still, the records show many instances where the executives bought and sold with exquisite timing.

Such trading records have never been publicly available. Even the SEC itself doesn’t have such a comprehensive database. The records provide an unprecedented glimpse into how the titans of American industry make themselves even wealthier in the stock market.

U.S. securities law bars “insider trading” — buying or selling stocks based on access to nonpublic information not available to other investors — under certain circumstances. Historically, insider trading prosecutions and SEC enforcement have both focused on corporate employees, and those close to them, trading in the stock of their own companies.

But executives at companies can also have extensive access to nonpublic information about rivals, partners or vendors through their business. Buying or selling stock based on that knowledge can run afoul of insider-trading law, according to experts. ProPublica described multiple trades, without mentioning names, to Robert Zink, a former chief of the Justice Department’s criminal fraud section, who responded that if he were still at the Justice Department, “of course we would look at it.” He added that the key to ProPublica’s findings is “the trading doesn’t appear to be a one- or two-time thing. It’s happening a lot.”

Harvey Pitt, former chair of the SEC, said it was unwise for corporate officials to bet on the fortunes of competing companies.

“Executives should not be trading in the stocks of their competitors,” Pitt said. “Why go looking for trouble? It’s perfectly possible to invest in the stock market without investing in companies you have actual nonpublic information about or that you might be argued to have nonpublic information about.”

There’s at least one sign that the SEC has gotten interested in this sort of trading. In 2021, the agency brought an insider-trading case against an executive at a biopharmaceutical company who learned his own company was about to get acquired, then bought options in a competitor, whose share price also rose on the news. (The case is still pending; the defendant has denied improper conduct.) It’s not clear if that action is a harbinger of increased enforcement by the SEC, which declined to comment about its enforcement priorities.

Insider trading is a simple concept and simultaneously difficult to prove, because it hinges on blurry definitions and court rulings that have favored defendants and weakened enforcement. Matters are even murkier when it comes to executives buying and selling shares of rivals and partners. This can be perfectly legal.

But even when legal, such trades can allow executives to win when their companies lose, according to securities experts. Executives are often handsomely compensated with their own company’s stock, which gives them a direct reward for maximizing profits and raising their company’s stock price. Owning shares of competitors’ stock potentially gives them a reason to root for their rivals to succeed, said Alan Jagolinzer, a professor of financial accounting at the University of Cambridge’s business school.

And by making millions through trading on nonpublic information, executives could contribute to the perception that the stock market is rigged to benefit the privileged. Well-placed executives enjoy access to information within their industry that isn’t available to ordinary investors. The perception that industry insiders use that knowledge for personal gain could undermine the public’s confidence that the markets are fair.

In the wake of the stock market crash of 1929, Americans learned that wealthy corporate executives had taken advantage of their positions to reap profits on their personal investments. In response, Congress created the SEC and passed reforms aimed at leveling the playing field for investors. Those reforms required top executives of public companies, who swim in an ocean of nonpublic information, to disclose any trades they make in their own company’s stock.

This disclosure requirement, however, has never applied to trades that executives make in shares of partner companies and competitors. Congress also didn’t explicitly ban, or even define, insider trading. Instead, it generally outlawed securities fraud, and left it to regulators and judges to hash out the specifics.

Still, the basic concept of insider trading is well-established. Any employee (or contractor who works for them, such as lawyers or investment bankers) who knows about, say, a coming announcement of a bad quarter, a new blockbuster product or an upcoming takeover is generally prohibited from buying or selling shares in that company.

To bring a case, federal authorities have to prove two main elements. First, they must show that the trader had what’s known as “material nonpublic information”: a significant fact, not yet publicly known, that would affect the company’s share price. And second, that the employee who traded on that information, or provided the tip to the person who did, had a duty not to disclose it or use it for personal benefit.

These elements can be hard to pin down. The CEO of a public company can argue their well-timed trade of a competitor’s shares was informed by a deep knowledge of the industry, not a nonpublic tip. The owner of a private firm may argue that they can use nonpublic information from their own company to trade the stock of competitors because they have no duty not to use the information for personal benefit.

Many employers add their own restrictions. Law firms and investment managers often require employees to clear any securities trades ahead of time. Some companies have policies that forbid trading while in possession of nonpublic information about competitors, clients or partners. Medpace, the publicly traded company that Troendle has led while profiting from trades in several competitors, acknowledges the likelihood that employees will learn nonpublic information about firms other than their own and warns that employees “who obtain material non-public information about another company in the course of their duties are prohibited from trading in the stock or securities of the other company.”

No other executives in ProPublica’s database appear to have traded in shares of rival companies on the scale that Isaac Larian did. The CEO of MGA Entertainment, whose Bratz fashion dolls competed with Mattel’s Barbie dolls, Larian traded hundreds of millions of dollars worth of his rival’s securities between 2005 and 2019. (Records show Larian also traded, often profitably, in shares of Hasbro, another close competitor.)

Over a recent five-year span, Larian earned about $28 million in profit on Mattel trades. That equates to an 11% return on his investment, which sounds like a modest outcome until you consider that Mattel’s stock crashed by 57% during the same period.

MGA and Mattel are fierce competitors. Larian has poached Mattel employees, and he frequently lashes out at the company on social media and cable news. He uses mocking nicknames to describe Mattel executives in public, referring to former general counsel Bob Normile as Bob “Abnormal,” and refers to the company as the “evil empire.”

Mattel and MGA have sued and countersued each other. Larian’s rival filed suit in 2004, claiming MGA had stolen the idea for Bratz, its first giant success. The litigation dragged on for years, with MGA ultimately claiming victory after an appeal.

And through it all, Larian was buying and selling shares of Mattel. For example, on June 5, 2008, he sold $3 million of Mattel stock. That same day, he was in court fighting the company in the Bratz lawsuit — and he had just obtained evidence that could hurt Mattel. He had received an anonymous letter alleging Mattel was spying on Larian and his family. It was a potentially game-changing piece of evidence in a lawsuit in which Larian’s MGA was being accused of unsavory business practices.

The judge ordered the letter sealed, but its existence became public later that day, when it was revealed in the press. The next day, Mattel stock fell 2.6%. Having sold the day before, Larian avoided the loss on those shares.

By 2015, the two companies were in litigation once again. At that point, MGA was alleging that Mattel was stealing its ideas for new toys. In April, Larian emailed Mattel’s CEO after the two met, suggesting that Mattel’s share price would rise if the two companies came to an out-of-court agreement. “I believe the street will reward the Mattel stock positively once this is settled and the legal fees go away,” Larian wrote in the email.

But Larian never settled. And he appears to have invested millions in bets against Mattel during the month the companies were discussing a settlement. The trades are not described as short sales in the IRS data. But when Mattel’s share price fell, Larian’s broker reported profits, a scenario two securities experts said suggested the trades were either short trades or stock options that Larian took out in anticipation the stock would tumble.

Larian has publicly acknowledged shorting Mattel stock. “I made a LOT more money shorting Mattel stock than they did running a $4.5 billion toy company,” Larian boasted in one LinkedIn post in 2020. (In other instances, he has also posted about holding a long position in Mattel. “I’m a major shareholder,” Larian said on LinkedIn in 2017.)

Larian’s trades sometimes corresponded with the rollout of new MGA products that could cut into Mattel’s market share and thus might lower Mattel’s stock price. In the month before MGA unveiled a new line of Bratz dolls in July 2015, Larian appears to have invested (here, too, the evidence is not conclusive) about $3 million betting against Mattel.

At other times, Larian traded Mattel stock before the company announced news, which industry experts said he may have been in a position to learn about as CEO of a rival. Toy companies all deal with the same vendors and retail stores and compete with each other for prime shelf space. It’s not uncommon to gain intelligence on how well a competitor is doing. And according to interviews with eight people who have worked for him, Larian is a boss with an endless appetite for information about his company and its competitors, constantly grilling subordinates on minutiae about the industry.

On July 26, 2017, Larian sold $1.4 million worth of Mattel shares. The next day, Mattel announced its earnings for the previous quarter, with declining sales for Barbie and some of the toymaker’s other doll lines, including Monster High and American Girl, all of which MGA had competed with. Mattel’s stock fell nearly 8% by the end of the next day, the beginning of a 23% slide over the next month. Larian avoided those losses.

ProPublica described Larian’s trading history — without identifying him or the companies involved — to multiple securities experts. They said the pattern was potentially troubling and deserved regulatory and legal scrutiny. But they also noted numerous caveats and ways in which the law offers latitude for this sort of trading.

Generally, the experts said, these types of trades are more perilous for executives at either public companies or private firms with investors. Executives at such companies typically have a clear duty to refrain from using company information for their own personal benefit, according to experts.

But if an executive owns all of his company, trading ahead of his own actions, such as the announcement of a new product line, or based on his own sales data, would likely not be legally problematic. (Larian’s tax data suggests he owns about 80% of the company, but it’s not clear whether another person or a different Larian entity owns the rest.) “U.S. law does not generally prohibit trading on information that you own,” said Joshua Mitts, a Columbia University law professor who has studied insider trading laws.

However, using confidential information from outside one’s own company, such as if an executive traded after learning something about a competitor from a retailer, experts say, could raise legal questions, as could trading after learning a nonpublic fact that was expected to remain confidential during litigation or settlement talks. “The SEC would certainly look at this,” Mitts said.

Pitt, the former SEC chair, echoed those concerns. “This conduct contains the seeds of some very potentially pernicious activity,” he said. “This is very risky.”

Larian declined requests for an interview and also declined multiple requests to answer a list of detailed questions for this article. His lawyer, Sanford Michelman, told ProPublica that any suggestion that Larian violated the law is “false and defamatory.” He asserted that they were not aware of any evidence suggesting that Larian possessed material, nonpublic information that Larian knew was obtained in breach of a duty. Michelman also accused ProPublica of making “false assumptions and allegations” but did not identify any specific errors in ProPublica’s reporting.

Often executives can know even more about their business partners than they do about their competitors. ProPublica’s data shows that some executives have bought stock in their partners with superb timing.

Gerald Boelte is the chairman and founder of LLOG Exploration, one of the largest privately owned oil production companies in the U.S. After the Deepwater Horizon spill spewed millions of gallons of oil into the Gulf of Mexico in 2010, some companies gave up on drilling there. But Boelte stayed, buying up new leases.

One of Boelte’s oil production partners was Stone Energy, at the time a publicly traded company; both LLOG and Stone were based in Louisiana. In 2013, the two companies drilled a deepwater well together in the gulf. And in June 2015, they struck oil together on a well in another part of the gulf known as Viosca Knoll.

That same summer, a separate project Stone was working on in another part of the gulf south of Louisiana, the Cardona wells, looked to be turning into a success. In an earnings report on Aug. 5, 2015, Stone announced that the value of its reserves had increased, along with revealing promising new details of the Cardona field. In the days that followed, Stone’s stock surged.

That was good news for Boelte. The day before Stone’s earnings were announced, he began purchasing $527,000 in the company’s stock. His tax data suggests it was the first and only time he bought the company’s stock during the years for which ProPublica has data. By the time he sold the shares two months later, Boelte claimed $343,000 in profit, a 65% return.

Aside from being Stone’s partner, there’s another reason Boelte could have received insights about how the company was doing before the public did. After seeing positive signs in its Cardona project, Stone sold LLOG its stake in the Viosca Knoll well the two companies had been working on together. Stone planned to use the sale proceeds to continue developing its own projects, such as the Cardona wells. The two sides concluded the sale in October, according to company filings, but typically such negotiations take months, an expert said. That suggests Boelte might have known about Stone shifting resources before he bought shares.

In a detailed statement, Boelte said, “I do not and have never traded on any material, non-public information of competitors, business partners or others.” He went on: “I did not draw any conclusion about Stone Energy’s intentions for other specific investments one way or another, and I had no discussions with Stone Energy regarding their intentions with respect to other investments by Stone Energy.” His purchase of the shares, he said, was motivated by his expectation that crude prices were about to rise; based on that, he invested in “several energy securities, including Stone Energy.”

Boelte said he quickly sold half of the Stone shares, and held on to the remainder until 2021 (which is beyond the period covered by ProPublica’s data), and that overall he lost money on the trades. “Any implication that I was investing based upon advance knowledge,” Boelte said, “is therefore clearly false.”

The board of Checkpoint Systems had been quietly considering its “strategic” options for more than a year. The New Jersey-based company, which makes anti-theft tags and other inventory tracking devices for stores, was suffering as its clients closed brick-and-mortar locations. By late 2015 and early 2016, Checkpoint’s board had made a list of potential acquirers, and the company’s bankers began contacting them.

Talks heated up with one potential buyer, CCL Industries, and Checkpoint gave the company access to its confidential business and financial documents. In January 2016, CCL told Checkpoint that it was going to ask its board for approval to make the acquisition. CCL would offer $10.15 per share, a significant premium.

As this was happening, on Jan. 14, Jim Sankey, the CEO of InVue, one of Checkpoint’s competitors, bought $285,000 in shares of the company. He was just getting started. Over the course of the next month, Sankey bought more shares, $3.2 million in all. (ProPublica’s tax records show no indication that he had traded shares of Checkpoint before.)

A month later, news broke that Checkpoint was getting acquired. Sankey made $2.3 million in profit from his investment, a cherry on top of the $25 million he made from his own company that year.

In an interview, Sankey said that he did not know Checkpoint was going to be acquired, and that his company was not among those approached by Checkpoint about a possible sale or partnership. Sankey said he bought shares because the price had been falling. Years earlier, in 2007, he had overseen a roughly $150 million sale of one of his anti-theft product lines to Checkpoint. He knew that division’s operating income at the time of the sale, and that it hadn’t lost clients since. Based on that calculation, he believed the stock was undervalued. “I built the business,” said Sankey, who remains CEO of privately held InVue. “And I knew they couldn’t screw it up.”

Sankey said that investigators, he believes from the SEC, interviewed the two brokers he had instructed to buy Checkpoint shares. The investigators, he said, dropped the matter after his brokers relayed his explanation for why he bought shares. He had no proof, Sankey said, but “they took my word.”

For Barry Wish, on one occasion, losing a contract to a competitor came with a significant benefit. In the 1980s, Wish co-founded Ocwen, a mortgage-servicing company, then helped steer the West Palm Beach, Florida-based firm for decades on its board. Mortgage servicers essentially act as brokers between lenders and homeowners, handling billing, modifying loans for borrowers and carrying out foreclosures.

In the years after the housing crash, Ocwen and its competitors grew rapidly, as big banks auctioned off the loans they were administering amid costly new regulations.

One of the prize tranches — $215 billion in home mortgages from Bank of America — was won by Wish’s rival, Nationstar, in January 2013. The day the company’s deal with Bank of America was announced, its stock shot up almost 17%, its biggest one-day gain since the company had gone public almost a year earlier. According to reporting at the time, Wish’s firm had been jockeying with Nationstar for the deal.

But losing wasn’t a total loss for Wish.

Less than three weeks earlier, he had bought $600,000 of Nationstar shares. The day the deal became public, Wish sold his shares, earning himself a $157,000 profit.

In a phone call with ProPublica, Wish said he didn’t recall buying Nationstar shares. Asked if he ever traded competitors’ stock, he said, “No, not at all.” When told his tax data showed he had, Wish said, “You might see it, but I don’t have any recollection,” before hanging up.

Steven Grossman is another executive who was fortunate enough to buy stock in a company just before it was acquired. Grossman’s grandfather founded Southern Container Corp., a corrugated packaging and containerboard manufacturer based on Long Island. It was one of the largest private companies of its kind, with more than half a billion dollars in annual sales until Grossman sold it in 2008 for about $1 billion. He stayed on after the sale, remaining on the payroll of the new owner, Rock-Tenn, until 2013.

ProPublica’s data shows that during his years in the industry, Grossman was also frequently trading the stock of companies he competed with. He sold no company’s stock in higher volumes than that of Temple-Inland, a Texas-based corrugated packaging firm.

Many of Grossman’s trades were well-timed, but few were as timely as his June 2011 purchases. On June 2, he bought $223,000 of Temple-Inland shares. Then, on June 6, he bought an additional $428,000.

On the very day of Grossman’s second and larger purchase, after trading closed, another paper company announced it was trying to acquire Temple-Inland. Executives had secretly been negotiating the takeover for weeks.

When the market opened the next day, Temple-Inland’s stock skyrocketed in what was its biggest one-day increase in more than a decade. Grossman quickly cashed out, making a 37% return in less than a week.

In an interview, Grossman denied trading stock altogether. When told that IRS data documented his trading activity, and asked about Temple-Inland in particular, Grossman said, “I haven’t traded stock since then.” The IRS data shows he continued to trade. Grossman said that after he sold his company in 2008, he never worked for the buyer, Rock-Tenn. But his tax data shows he was on Rock-Tenn’s payroll through 2013. “They paid me but never used my services,” Grossman said. He asserted that he did not know about the acquisition talks involving Temple-Inland when he bought shares. Asked what prompted him to buy that day, Grossman replied, “That was 10 years ago.” With that, he hung up.

Methodology

Data background and limitations

When an investor sells stocks, bonds or other securities through a broker, the firm is generally required to issue a tax form called a 1099-B, which details several pieces of information about the transaction, including a description of the asset sold, the proceeds from the sale and the date the sale occurred. The brokerage provides a copy of the 1099-B both to the investor and to the IRS. ProPublica’s universe of trades was drawn from tens of millions of these records, part of a larger set of records that formed the basis of ProPublica’s series “The Secret IRS Files.”

ProPublica’s database does not include a complete picture of all trades made by or for investors. Investments made through a separate legal entity like a partnership, for example, are not included. Additionally, 1099-B forms are produced when an asset is sold, not when it is purchased. Many records, however, did list the date the securities were acquired, so ProPublica’s reporters were often able to see a portion of an investor’s purchasing activity. Securities that were purchased but not sold until recently are not included in the data.

The dataset spans roughly two decades. Trades from more recent years generally include more information because disclosure requirements have increased over the years. That additional detail allowed ProPublica to better determine how successful the individuals in our data were in the stock market. For stock bought before 2011, brokers were required to report the date it was sold and the total proceeds it generated but not the price paid.

These disclosure changes also affected how certain types of trades appear in the data. That includes short sales, in which an investor borrows shares of a stock, sells the borrowed shares, then “closes” the transaction by buying an equal number of shares to replace the borrowed stock at what they hope is a lower price. The IRS previously required that brokers issue a 1099-B disclosing only when someone entered into a short sale and how big the position was, but not when they closed the short. For shorts initiated after the disclosure changes in 2011, the agency required brokers to submit information about the short being closed, listing both the date it was closed and the overall profit, but no longer required the date the short was entered into. By 2014, options trades were also required to be reported in more detail.

Sometimes it was straightforward to identify short sales and options — for example, a field on the 1099-B form described them as such. However, according to experts, the forms are nonintuitive and brokers frequently fill them out incorrectly. To determine whether the anomalous cases were indeed short sales, ProPublica presented them to experts and the subjects themselves to ascertain the nature of those trades.

How we analyzed the records

To gauge how a stock’s price changed after an investor purchased or sold shares on a given date, ProPublica obtained a dataset outlining the price history for stocks traded on the New York Stock Exchange, the Nasdaq or the American Stock Exchange. We combined that data with the records of the trades documented in our IRS records. Reporters then compared the closing price of a stock on the day a trade occurred to the closing price after a number of different intervals of trading days (5, 10, 20, 60 or 120 days). Closing prices were used because brokers aren’t required to report the share price at the moment the trade was made. This approach mirrors a common method used by academic researchers who study insider trading.

By calculating a stock’s change in price after various time intervals, we could identify trades made close to significant movements in a company’s share price. But because the prices of some securities are much more volatile than others, it was important to determine how anomalous those swings were.

We compared the return from each individual trade to the full distribution of returns for that stock: For example, a one-day return of 20% was compared to all other one-day returns for that stock over a certain period of time. We found several instances in which the days executives traded in their competitors’ stock were more opportune — if not the most opportune — over certain windows of time. One executive, for example, sold more than $1 million worth of shares in a competitor’s stock the day before the company had its largest one-day price drop that year.

ProPublica also examined what ties, if any, individuals had to the companies they were trading, using interviews, news reports, SEC filings, tax records, court records, social media and other avenues.

Where Things Stand: Most Americans Are Chill With McCarthy Giving Tucker Jan 6 Tapes!!, Far-Right Media Declares

Let me just start out with the facts: The Economist/YouGov published the results of a poll this week that surveyed 1,500 U.S. adults between March 10–14 on a number of different topics, mostly about people’s feelings on the state of the country.

A few of the questions touched on House Speaker Kevin McCarthy (R-CA), asking respondents about how favorably they saw him generally and his performance as speaker of the House. Two questions asked about the issue of McCarthy giving Fox News’ Tucker Carlson and his production team exclusive access to all the internal Jan. 6 Capitol security footage for him to use to spread propaganda on his propaganda show. The survey asked if those polled had heard about the issue and if they approved or disapproved of it. The split in approval versus disapproval was relatively close.

Continue reading “Where Things Stand: Most Americans Are Chill With McCarthy Giving Tucker Jan 6 Tapes!!, Far-Right Media Declares”