The 24th Amendment to the United States Constitution was ratified in 1964, ensuring that the right of citizens of the United States to vote “shall not be denied or abridged by the United States or any State by reason of failure to pay any poll tax or other tax.” At the time, five southern states—Virginia, Alabama, Texas, Arkansas, and Mississippi—still enforced poll tax requirements. In the years after the Civil War, states across the South instituted poll taxes, disenfranchising African Americans and poor whites across the region.

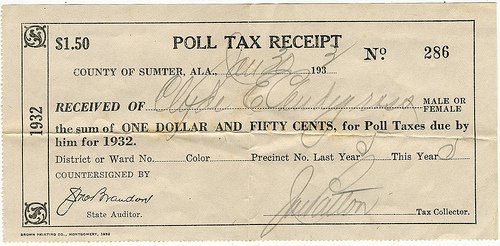

This artifact from Sumter, Alabama in 1932 acknowledges the receipt of a $1.50 poll tax or $26.09 in 2015 dollars.

In 1932, the average cost of a loaf of bread nationally was seven cents. In other words, Alabama’s poll tax was equivalent to 21 loaves of bread.

Image Available At: https://www.splcenter.org/sites/default/files/polltaxreceipt.jpg

Oh my would ®s love to bring this back…in (D) districts.

That’s an amazing piece of ephemera.

Today we have Sec. of State offices closing all across areas of the black belt in Alabama, where essentially getting a State ID will become a major setback for those that don’t drive and want to be a part of the franchise to vote. The underlining documents needed to get that State ID are made even more onerous because of these specifically targeted closings. The time spent traveling to other Sec. of State offices farther away to get a State ID, as well as county clerk offices to get documents or waivers, is the modern day equivalent of a poll tax and clearly its a way to disenfranchise an entire group of black people. Same old, same old.

“Color”.

To be technical, this is a tax on voting, which isn’t a poll tax. A poll tax remains legal, albeit horrifyingly bad policy: it’s a tax wherein the amount paid doesn’t vary from person to person, whatever his income is.

Just as conservatives can’t go around saying ‘ni@@ER, ni@@er, ni@@er’ you can’t say ‘poll tax, poll tax, poll tax’. You have to be more subtle, like voter ID’s that can only be obtained from locations that ‘those kind of people’ have a hard time getting to. It’s making sure ‘those kind of people’ take a tour through our corrections system coming out the other end stripped of voting rights. This is NOT Jim Crow, it’s James Crowe III, Esquire. It’s nascent Fascism and Nazism with a tailored suit.