Former Vice President Mike Pence will not appeal a federal judge’s order that he testify in special counsel Jack Smith’s investigation into former President Donald Trump’s efforts to overturn the 2020 election.

Continue reading “Pence Will Not Fight Order To Testify Against Trump In DOJ Jan 6 Probe”Trump Joins MAGA House GOPers Who Are Now Suddenly Into Defunding Fed Police

Former President Donald Trump on Wednesday joined MAGA House Republicans who are using his indictment in Manhattan to push for Congress to “defund” federal law enforcement.

Continue reading “Trump Joins MAGA House GOPers Who Are Now Suddenly Into Defunding Fed Police”Peter-Legal-Problems-Navarro Suggests Bragg Is Actually The One Who Should Be Indicted

Trump’s former trade adviser Peter Navarro has decided to weigh in on his old boss’s criminal charges, even though he himself has unfinished business in the court related to Jan. 6.

Continue reading “Peter-Legal-Problems-Navarro Suggests Bragg Is Actually The One Who Should Be Indicted”NPR Reacts To Twitter Labeling It A ‘State-Affiliated Media’ Account: It’s ‘Unacceptable’

National Public Radio denounced Twitter’s decision to label the non-profit media organization a “state-affiliated media” account, calling the move “unacceptable.”

Continue reading “NPR Reacts To Twitter Labeling It A ‘State-Affiliated Media’ Account: It’s ‘Unacceptable’”Private Planes and Luxury Yachts Aren’t Just Toys for the Ultrawealthy. They’re Also Huge Tax Breaks.

This story first appeared at ProPublica. ProPublica is a Pulitzer Prize-winning investigative newsroom. Sign up for The Big Story newsletter to receive stories like this one in your inbox.

Flying to Ireland to inhale the seaside air as you drive a golf ball into the scenic distance. Crossing the country to reach your enormous yacht, which is ready for your Hudson River pleasure cruise. Hosting a governor’s wife on your very own aircraft. These are only a few of the joys that the richest Americans have experienced in recent years through their private jets. And what made them all the sweeter is that they came with a tax write-off.

Over the past two years, ProPublica has documented the many ways that the ultrawealthy avoid taxes. The biggest or most daringmaneuvers scale in the billions of dollars, and while the tax deductibility of private jets isn’t the most important feature of U.S. tax law, the fact that billionaires’ luxury rides come with millions in tax savings says a lot about how the system really works.

There are dozens of examples of wealthy Americans taking these sorts of deductions, which are premised on the notion that the planes are used mainly for business, in the massive trove of tax records that have formed the basis for ProPublica’s “Secret IRS Files” series. The ultrawealthy, however, can easily blur business and pleasure. And when they purport to make their planes available for leasing, to fulfill one definition of using the planes for business, they tend to be more adept at generating tax deductions than revenue.

Tony Alvarez and Bryan Marsal built a successful consulting firm specializing in restructuring — advising struggling or bankrupt companies on what to sell and whom to lay off. It can be a grim business: Marsal has been known to announce to prone firms that they were now a “community of pain.” But the partners, who are also close friends, own another enterprise, the Hogs Head Golf Club (“Built by Friends, for Friends, for Fun”), on the southwest coast of Ireland. It boasts views of the nearby mountains and bay.

In 2016, before opening their new course, the pair teamed up, via an LLC they named after their golf club, to buy a 2001 Gulfstream IV jet. The next year, President Donald Trump signed his big tax cut into law. It made buying a plane even more attractive: The full price of the plane could be deducted in the first year, a perk called “bonus depreciation.” Before, depreciation was typically only partially front-loaded, with the full balance spread over five years. The law also for the first time made pre-owned planes eligible for this treatment.

As a result, when Alvarez and Marsal sprang for their second plane in 2018, this one a Gulfstream V, the entire cost was deductible. That year, the pair’s two planes netted them a tax deduction of $14 million.

Last August, their Gulfstream V took off from Westchester County Airport in New York state for Ireland. About an hour later, their Gulfstream IV left for the same destination, a small airport in County Kerry near their club. Both planes can comfortably seat over a dozen passengers, but flight records don’t show who was on board. Over the coming month and a half, the two planes crisscrossed the Atlantic several times.

Were these business trips? Possibly, yes. (ProPublica’s records do not indicate whether specific trips were taken as deductions.) If so, operating expenses — including crew, fuel and other costs — from the partners’ trips to oversee the course would be fully deductible. These deductions would come in addition to depreciation.

Michael Kosnitzky, co-chair of the private client and family office group at the law firm Pillsbury Winthrop, said his wealthy clients often own a business, such as an art gallery, in the same area where they own a vacation home. If the main purpose of a flight there is to attend to that business, jet owners must take care to make that as clear as possible. “I advise my clients to go to their secondary business location first” upon landing, he said, as a way to help build the case.

Accounting for how a jet is used can get complicated. If nonbusiness guests, such as family, ride along on a business flight, it’s treated as a fringe benefit, which is taxable. (The benefit is typically attributed to the jet owner, experts said.) But that wrinkle isn’t too bad: The IRS formula used to calculate the benefit drastically undervalues the cost of riding on a private jet and is closer to the price of a first-class commercial ticket.

Last Christmas, flight records show the two Gulfstreams again leaving together, this time to St. Vincent and the Grenadines in the Caribbean. While Alvarez and Marsal’s consulting firm boasts an office in the Cayman Islands, there isn’t one on these particular islands (which are about 1,400 miles from the Caymans), making it appear this was a family trip. Operating costs from “entertainment” flights like these are not deductible under tax law. But indulging in some pleasure doesn’t necessarily imperil the key tax prize of bonus depreciation: As long as, over the course of a year, the jet is used over 50% of the time for business, the owner gets to keep that perk.

A spokesperson for Alvarez and Marsal’s firm did not respond to a request for comment.

Mori Hosseini made his fortune as a Florida homebuilder and has owned a plane since at least 2006. When Trump’s tax bill began to gain momentum in Congress in the fall of 2017, he decided it was time for a new jet.

The $19.5 million he paid for his nine-seat Bombardier Challenger 350 appeared as a deduction on his 2017 taxes, leading to almost $8 million in tax savings right off the bat. But there were more deductions to come. Even the interest on the loan he’d taken out to buy the plane was deductible, and his 2018 taxes show a $600,000 expense.

Soon, Hosseini, a longtime Republican donor and close adviser to Florida Gov. Ron DeSantis, was helping the governor and his family travel in style. In 2019, DeSantis’ wife, Casey, flew on the jet from Tallahassee to Jacksonville to attend a fundraiser held by a defense contractor. It was just one of several times that the DeSantises or the campaign have used the jet over the past few years, according to campaign finance records. Such flights are generally allowed under Florida law as long as they are disclosed as in-kind contributions. Hosseini did not respond to questions from ProPublica.

On his taxes, Hosseini says the LLC that holds his plane is in the business of “aircraft leasing.” It’s a very common move among jet owners. When they are not using the plane, they rent out the plane for charter flights, usually via an independent leasing company. Not only does this defray the costs of ownership, but it has tax benefits, too. It helps them establish that they bought the aircraft for a business purpose, the business of chartering.

In theory, taxpayers aren’t allowed to deduct losses from something that has no hope of being a profitable business. In practice, though, some billionaire-owned operations that look like expensive hobbies, such as racing horses in the Kentucky Derby, rack up business deductions by the tens of millions of dollars.

ProPublica examined the tax records of over 30 wealthy Americans who owned planes, and one thing was very clear: Profits in the airplane chartering business for this set, judging from their taxes, were extremely rare. Hosseini’s records show two years of profit over an eleven-year period.

Or take George Argyros, a California billionaire real estate developer who once owned the Seattle Mariners. A major GOP donor, he also was the U.S. ambassador to Spain from 2001 to 2004. Argyros, 86, has leased out his aircraft through his own chartering company for decades. From 2002 through 2019, his tax records show, his company pulled a profit just twice. Overall, he deducted over $50 million in net losses over the years.

In June 2021, Argyros’ Gulfstream landed at the small airport near Newburgh in New York’s Hudson Valley, having flown cross-country from California. Nearby, his $83 million, 248-foot yacht the Huntress awaited. Over the coming weeks, the ship would be seen cruising up and down the Hudson River, astounding locals who gawked at its six decks, helipad and hot tub.

A representative for Argyros declined to comment.

Yachts are dealt with differently from airplanes in tax law. They are considered entertainment facilities, so you can’t claim deductions on the premise that you used it for business travel.

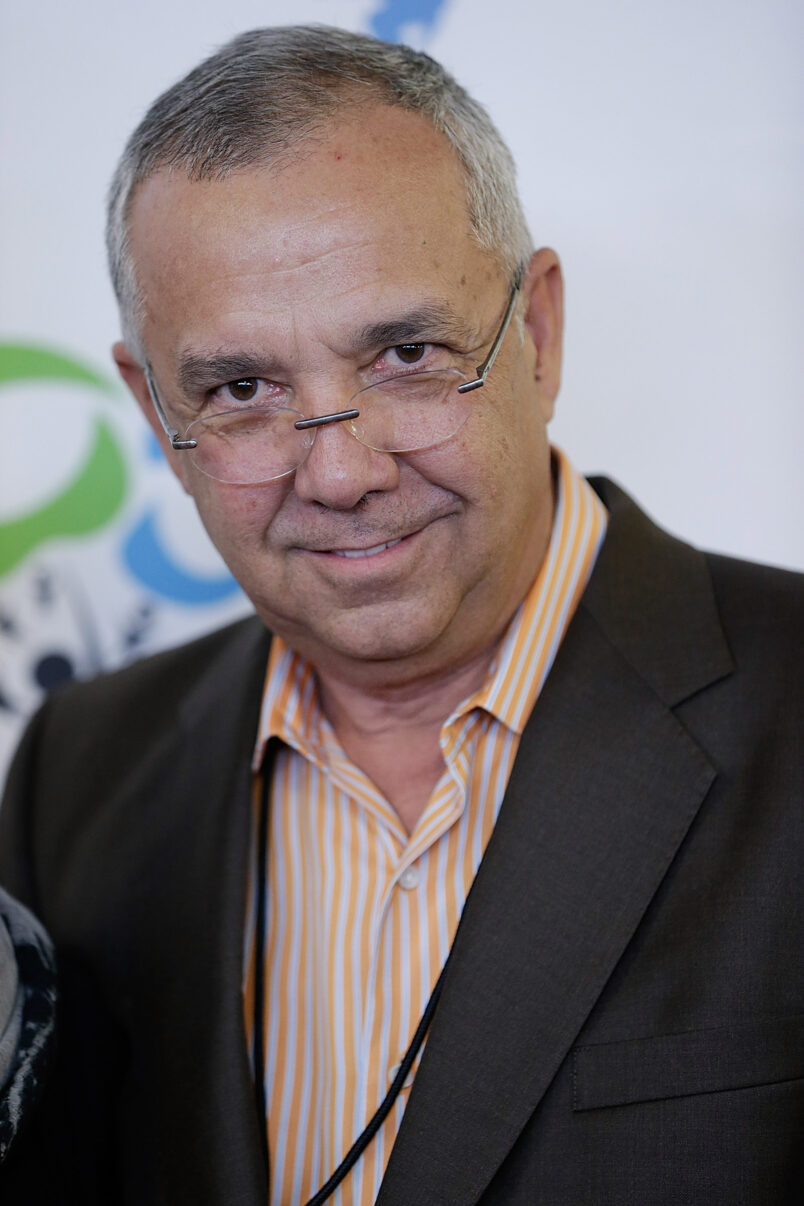

But that doesn’t mean there’s no tax savings to be had. Mike Fernandez is a capable businessman, having made a fortune starting and investing in health care companies. But the Florida-based investor seems to have abysmal luck with one of his businesses: leasing out his 180-foot yacht, the Lady Michelle, when he’s not using it. On his 2017 and 2018 tax returns, he claimed a total of $11.3 million in expenses connected with the Lady Michelle from depreciation, repairs, wages and other costs. Meanwhile, his revenue over the two years totaled $178,000. Fernandez did not respond to questions from ProPublica.

Should the IRS audit one of these businesses — itself unlikely over the past decade, due to the gutting of the agency’s budget — the IRS faces a high hurdle: proving that not only was the business not profitable, but that the business owner was not really trying to profit. The case of personal jets adds an additional difficulty for an auditor. The ultrawealthy can often argue that, even if chartering did not result in profits, they also used the plane to help conduct their main business.

Robert Bigelow made his fortune in real estate and owns Budget Suites of America, an extended-stay apartment chain. His passions, however, reach to the skies and beyond. For decades, he’s poured resources into investigating UFO sightings and paranormal phenomena. Two years ago, he announced $1 million in grants from his Bigelow Institute for Consciousness Studies for research “into contact and communication with post-mortem or discarnate consciousness.”

His main focus, however, has been space. He founded Bigelow Aerospace, a company focused on building expandable space habitats. The company has had some successes, winning a contract from NASA for a module for use on the International Space Station. But what it has not had is profits. Bigelow put more than $350 million into the company, “my own real black hole,” as he’s put it.

In the two decades prior to 2018, even as Forbes and The Wall Street Journal variously estimated his net worth as $700 million and $900 million, Bigelow posted negative incomes on his taxes most years, as large losses from his aerospace company wiped out his other income. His personal jet, held by Cosmos Air LLC, also played a role. From 2005 to 2018, he deducted a total of $51 million related to use of his plane. ProPublica could not find evidence that Bigelow charters his aircraft, nor did Bigelow respond to ProPublica’s requests for comment.

Of course, the deductions could also be justified on the basis that the aircraft is necessary to tend to Bigelow’s various businesses. The plane is a luxury expense, in other words, essential to help him run up millions more in tax deductions — one black hole orbiting another.

The Law Isn’t Brittle for Following It

We’ve now had the day of spectacle and legal experts have had a chance to provide their first analyses of the case brought against former President Trump. On the substance the case isn’t difficult to understand: In the final weeks of the 2016 campaign, Trump orchestrated a hush money scheme to keep a series of affairs and assignations out of the press and in so doing broke a series of laws. The legal arguments behind the case are more complicated, involving both federal and state laws, and a specific argument about how different violations of the law interact with each other to create a broader pattern of criminal conduct.

Continue reading “The Law Isn’t Brittle for Following It”Dan Kelly Throws Emotional Tantrum After Losing Wisconsin Supreme Court Race

Dan Kelly, the former Wisconsin Supreme Court justice who lost a second race for the bench Tuesday night, delivered less of a concession speech and more of a lengthy, emotional whine.

Continue reading “Dan Kelly Throws Emotional Tantrum After Losing Wisconsin Supreme Court Race”Donald Trump Suffers Major Setback In Jan. 6 Investigation

A lot of things happened. Here are some of the things. This is TPM’s Morning Memo.

What A Moment

Yesterday’s events had me recalling the indelible scene at the end of All The President’s Men, with Nixon being sworn in to a second term while Woodward and Bernstein clack away on their typewriters with the stories that will lead to his resignation some 18 months later.

With all eyes glued to the circus atmosphere outside the courthouse in Manhattan ahead of Donald Trump’s early afternoon arraignment on state charges in the Stormy Daniels hush money case, a separate midday sealed court ruling in Washington, D.C., served as reminder of the multiple layers of legal jeopardy the former president faces.

The DC Circuit Court of Appeals declined Trump’s reported request to intervene on an emergency basis and block the imminent grand jury testimony of several former Trump administration officials in Special Counsel Jack Smith’s Jan. 6 investigation.

Trump is apparently appealing a March 15 order from U.S. District Judge Beryl Howell, at the time the chief judge in DC, that rejected his executive privilege arguments to block his former aides’ testimony. Trump’s lawyers were reportedly in court Monday trying to convince U.S. District Judge James Boasberg, Howell’s successor as chief judge (who oversees grand jury proceedings like this one) to stay the order while they appealed. Apparently they lost that argument, resulting in the emergency appeal.

The appeals court ruling came after a flurry of late night filings Monday, all under seal so we have very little visibility into the actual arguments or which aides it involved. So all of the reporting around this development is necessarily hedged and uncertain.

But based on reporting, primarily from CNN and ABC News, the grand jury testimony at issue appears to involve former Trump chief of staff Mark Meadows, Trump White House advisers Stephen Miller and Dan Scavino, former Director of National Intelligence John Ratcliffe, and former national security adviser Robert O’Brien, and former Homeland Security acting secretary Ken Cuccinelli. Some or all of those witnesses may have already testified before the grand jury but invoked executive privilege to refuse to answer certain questions.

The three-judge panel that denied the emergency motion included Obama appointees Patricia Millett and Robert Wilkins and Trump appointee Greg Katsas. Early reporting indicates Trump will not appeal this ruling to the Supreme Court.

It appears that Trump’s broader appeal is still pending – the appeals court only denied his emergency motion – but in a sign of how quickly things are moving, Cuccinelli was brought back before the grand jury Tuesday afternoon after the appeals court decision, CNN reported. So the practical effect may be that Trump has lost his most plausible executive privilege claims.

What An Amazing Scandal!

Step back for a moment and marvel at what an amazing scandal the Stormy Daniels hush money scheme is.

Come on! In any other era, this would be awesome!

Only because of the passage of time and the subsequent TWO impeachments and failed coup does this scandal seem tepid. But judge it by pre-2017 standards and it’s amazing! The toxic stew of sex AND money AND power AND coverup. What more could you want?

You have the country’s leading tabloid mag conspiring with the GOP nominee for president to bury negative stories about him, including an apparently debunked claim from his doorman that he fathered a child out of wedlock, a disputed claim of a one-night stand with a porn star that cost him $130,000, and a contested claim that he had an affair with a Playboy playmate.

It’s 100% bonkers on its face!

Is You Takin’ Notes On A Criminal Fuckin’ Conspiracy?

My favorite reveals from yesterday were how lame and ineffectual the coverup was.

They were writing checks. Checks! It’s all traceable. It’s all evidence now in the criminal case.

At one point, we learned yesterday, Trump Org CFO Allen Weisselberg allegedly jotted down the particulars of the agreement to reimburse Michael Cohen for his hush money payment to Daniels on Trump’s behalf.

HE WROTE IT DOWN!

Prosecutors appear to have the document with those notes, according to the statement of facts filed in the case: “The TO CFO [Weisselberg] memorialized these calculations in handwritten notes on the copy of the bank statement that Lawyer A [Cohen] had provided.”

You know what Stringer Bell would say about this.

Golf Clap

Trump Rails Against All The Prosecutors Investigating Him

TPM’s Hunter Walker watched Donald Trump’s Mar-a-Lago speech last night for you.

What Are The Odds?

Donald Trump’s next in-person appearance in the Manhattan criminal case isn’t scheduled to happen until December (with trial sometime early next year). I find it almost impossible to imagine that he doesn’t get hauled in before then to account for threatening remarks and incitements to violence, forcing the the judge to consider a gag order in the case.

Ironic!

Around the same time former President Trump was pleading not guilty in Manhattan in the Stormy Daniels hush money case, the Ninth Circuit Court of Appeals ordered Daniels to pay nearly $122,000 in legal fees to Trump’s attorneys in her failed libel suit.

Janet Protasiewicz Wins In Wisconsion

A huge win for abortion rights with national implications in the most closely watched race of 2023.

Also this:

‘We’ll Cut Your Throats. We’ll Put A Bullet In Your Head.’

A Maryland man allegedly left a voicemail at the DC office of Human Rights Campaign, a major LGBT advocacy group, threatening to “slaughter” them in apparent retaliation for the Covenant School shooting in Nashville, where the shooter was a transgender person. The man was arrested by the FBI and is facing federal charges.

‘I Agree That They’re Overalls’

A sample of TPMer Josh Kovensky’s reporting from outside the Manhattan courthouse before Trump’s arraignment:

Do you like Morning Memo? Let us know!

Trump Responds To Indictment By Railing Against All The Prosecutors Investigating Him

Former President Trump responded to being indicted on Tuesday with an angry speech in which he painted a dark vision of the country and unloaded a litany of conspiracy theories, some familiar and some novel. Cheered on by MAGA movement celebrities, he railed against President Joe Biden and criticized, at length and with specifics, the various prosecutors investigating him.

Continue reading “Trump Responds To Indictment By Railing Against All The Prosecutors Investigating Him”Protasiewicz Wins Wisconsin Court Race

And that’s a wrap. The AP has called the Wisconsin Supreme Court race. At TPM we wait for two media calls to consider a race settled. But tonight in the Editors’ Blog let’s put a fork in this one. (Celebrate by becoming a member during our annual TPM membership drive!!!!) From the beginning of the count, the de facto Republican Kelly has been running behind the numbers he needed in basically every part of the state. This one won’t even end up being that close. There will be a liberal majority on the Wisconsin Supreme Court. Scott Walker and his crew basically wired this state so Republicans were always in control. This may be the beginning of the end of that dominance. Not that Republicans can’t win of course. It’s basically a 50/50 state. But it was wired in such a way that Republicans still controlled things even when most Wisconsinites voted against them. Without control of the Supreme Court, the Wisconsin GOP’s crazy-level extreme gerrymandering may come apart.