Being vaccinated is now a condition of employment in all Washington state schools. And that includes public, charter and private.

Eyewitness Who Snapped First Picture Of Would-Be Bomber Gives Her Account

Sydney Bobb, a rising senior at the University of Wisconsin, Madison, snapped the first picture to publicly circulate of Floyd Ray Roseberry, the man police have identified as the would-be bomber, outside the Library of Congress.

Continue reading “Eyewitness Who Snapped First Picture Of Would-Be Bomber Gives Her Account”

Inspired by Trump

In this video from early Tuesday morning, retrieved from Facebook by TPM, Capitol bomb suspect Ray Roseberry refers to himself and those like him as the “last generation” willing to stand up for America. He then says that Trump will be reinstated as President once Joe Biden is driven from office and Democrats are imprisoned. He says Trump will then pardon everyone and he hopes for a pardon himself.

Continue reading “Inspired by Trump”

Watch The New Episode Of The Josh Marshall Podcast: A Rough Spot

A new episode of The Josh Marshall Podcast is live! This week, Josh and Kate discuss a group of House centrists trying to decouple the infrastructure bills, the start of the redistricting process and the ongoing COVID-19 pandemic of the unvaccinated.

Watch below and email us your questions for next week’s episode.

You can listen to the new episode of The Josh Marshall Podcast here.

Videos from Capitol Bomb Threat Suspect

For the last hour I’ve been watching videos created by the suspect in the Capitol bomb threat situation. He explicitly references the fall of Kabul in an August 16th video, claims Joe Biden has given US military hardware to the Taliban.

In another video from early on August 16th he says that once Biden is driven from office, Trump will become President again. He says he expects Trump, once he becomes President again, will pardon him – presumably for whatever crime he commits coming to Washington.

“It’s time to quit Biden.”

Repeatedly refers to himself and those like him as “the last generation”. He appears to have originally planned something for Labor Day. He references having people rendezvous at a local park the Friday before Labor Day before heading north to Washington, DC.

In a video from last Tuesday night, the suspect said it would be his last video until Labor Day weekend. But in a video early this morning he seems to suggest that over night he decided to move up his schedule.

More to come.

Capitol Police Announce ‘Active Bomb Threat Investigation’ Near Library Of Congress

Editor’s note: For ongoing coverage of this breaking news story, please follow TPM’s liveblog.

U.S. Capitol police announced Thursday morning that they are conducting an “active bomb threat investigation” tied to a suspicious vehicle near the Library of Congress.

When Hotter And Drier Means More—But Eventually Less—Wildfire

This article is part of TPM Cafe, TPM’s home for opinion and news analysis. It first appeared at The Conversation.

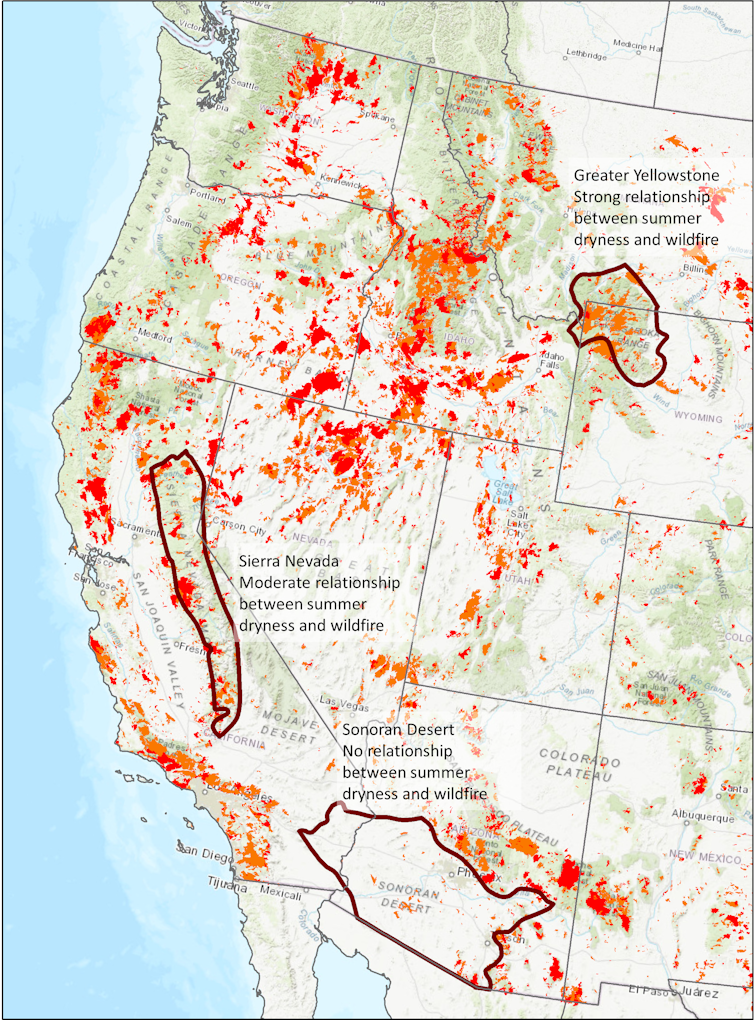

There is abundant evidence that changes in the climate, both increased temperature and reduced precipitation, are making wildfires worse in the western U.S. The relationship between climate and wildfire seems obvious and universal: hotter + drier = more and worse wildfire.

Yet the diversity of wildland areas in the western U.S. means that not all ecosystems respond in the same way to a hotter and drier climate. Understanding how and why climate change has different effects on wildfire is essential for effective management of our natural areas.

Jeremy Littell

Why do areas respond differently?

Similar to campfires, wildfires require fuel to burn: parts of trees and shrubs, the leaves, twigs and branches. Dried grasses, too, will work. The growth of this vegetation depends on water, and water availability depends on the climate.

How hot and dry the climate is in an area influences the amount of fuel that is available to burn and the strength of the relationship between wildfire and climate. Ecologists such as us calculate how closely related wildfire area burned is to how hot and dry it is during the summer, and we have found that the relationship does indeed vary.

Areas that are historically cool and wet have a lot of fuel, but the fuel has to be dry enough to burn, so the relationship in these areas between wildfire and climate is very strong. Areas that are historically warm and dry have less fuel, often not enough fuel for a large wildfire even if it is very dry.

Let’s consider one extreme. The Sonoran Desert in Arizona is persistently hot and dry, and vegetation is sparse. The dryness of the summer, what we call the “summer water deficit,” does not control the extent and severity of wildfires. Summer is almost always hot and dry enough to burn, and how much it burns depends on the amount of fuel. No matter how much hotter and drier the climate becomes, wildfire is not going to increase unless more fuel appears on the landscape. Unfortunately, exotic grasses that are adapted to wildfire are invading much of the American Southwest, including the Sonoran Desert, providing that extra fuel.

At the other extreme are mountain forests, such as Yellowstone National Park and the surrounding area, that have abundant vegetation and fuel and are cooler and wetter. There, the amount of land that burns is strongly related to the summer water deficit. Hotter and drier summers are likely to increase wildfire activity.

What about areas in between these two extremes?

Where hotter and drier can eventually mean less fire

In California, wildfires in the dry forests of the Sierra Nevada are partly controlled by summer water deficit. For a while, hotter and drier summers are likely to increase the amount of land burned each year.

We ran computer simulations of the interactions among climate, plant growth and wildfire for one area within the Sierra Nevada. In the first decade of the simulations, an initial burst of large areas burned each year. This first pulse of wildfire burned more area in a scenario with increased drought and temperature than in the historical climate, just as we are seeing in the recent extreme fire seasons in the Sierra Nevada.

Over time, however, climate change will modify how plants grow. Persistently hotter and drier climate over decades will increase the number of dead and dying trees and decrease new growth. Eventually less fuel is available to burn as the dead trees decompose and fewer live ones replace them.

The same computer simulations show that the initial pulse of wildfires removes a lot of dense vegetation, and subsequent fires become smaller compared with fires in historical climate conditions and with increased drought and temperature. Furthermore, because hotter and drier conditions can eventually lead to less fuel development, the wildfire area burned over 60 years may be smaller with increased drought and temperature than in the historical climate.

Less wildfire due to climate change may sound like good news, but how it occurs is not necessarily a desirable outcome for these forests. In the simulations, reduced wildfire is a consequence of extreme water limitation that results in reduced forest biomass. This means less tree growth and more dying trees that eventually result in a thinner and less productive forest. If the climate changes enough, the trees may even be replaced by shrubs, which have their own unique relationship between climate and wildfire.

The problem with quickly putting out every fire

Human actions, in particular putting out every fire, have changed how dry forests burn.

Some fires are started by lightning, but Indigenous peoples burned the landscape frequently, reducing fuels, so the spread and intensity of subsequent wildfires was more limited. After European colonization, the U.S. government spent more than a century actively suppressing wildfires. As a result, many forests became choked with excess fuels. Even without climate change, excess fuels increase the wildfire hazard.

The effect of that fire suppression on current wildfire hazards can also vary from region to region.

In cooler and wetter areas, climate change can have a stronger effect on wildfires than fire suppression. These are the areas with naturally abundant fuel and strong relationships between climate and wildfire. In drier systems, where fuels were historically low and had limited wildfire spread, suppression over the past century can have a stronger effect on current wildfire hazard than in wetter areas. It is important to consider climate change, regional characteristics and land management, all of which affect the fuels that are available to burn in a wildfire.

What to do about wildfire

There is no single solution to the increasing wildfire activity and declining health of forests.

The global solution would be to slow and eventually reverse climate change. More locally, combining prescribed fires, which are intentionally set in relatively mild weather conditions, with mechanical removal of small trees and ground fuels is the best way to prevent more severe wildfires.

Increasing the use of prescribed fire or allowing wildfires to burn under safe conditions can restore some forests to be more resilient – those that have excess fuel from fire suppression – and reduce the hazards that the western U.S. is seeing now. Past wildfires can limit the spread of new wildfires by reducing the amount of vegetation and fuel available to burn.

Over the past five years, wildfires in the U.S. burned an average of 7.8 million acres annually, which cost an average of US$2.4 billion per year to fight.

Managing forests in the face of the threat of larger, more severe wildfires in a warming climate presents a huge challenge to fire managers, given the costs of treatments and the millions of acres that could benefit from them. Plenty of wildland is still primed to burn, and understanding the intricate relationship among climate, fuels and wildfire can help managers prioritize areas where more fire will be beneficial and areas where different approaches may be preferred.

Maureen C Kennedy is an assistant professor of Quantitative Fire Ecology at the University of Washington.

Don McKenzie is a professor of Environmental and Forest Sciences at the University of Washington.

Jeremy Littell research ecologist for Climate Impacts at the US Geological Survey.

This article is republished from The Conversation under a Creative Commons license. Read the original article.

Hannity Can’t Seem To Decide Whether Or Not The COVID Vaccine Works (It Does)

Fox News host Sean Hannity is back to casting doubt on the efficacy of the COVID-19 vaccine after boosting it last month.

Continue reading “Hannity Can’t Seem To Decide Whether Or Not The COVID Vaccine Works (It Does)”

Another Booster Data Point

New data out of Israel appears to suggest substantial increased protection after a third shot of the Pfizer vaccine. I say ‘appears’ because like a lot of the real-time information emerging out of Israel it’s made up of current statistics rather than a study per se. And at least in the news accounts one has to read between the lines since some points are not stated explicitly.

How The Trump Tax Law Created A Loophole That Lets Top Executives Net Millions By Slashing Their Own Salaries

This story first appeared at ProPublica. ProPublica is a Pulitzer Prize-winning investigative newsroom. Sign up for The Big Story newsletter to receive stories like this one in your inbox.

In the months after President Donald Trump signed the Tax Cuts and Jobs Act in December 2017, some tax professionals grew giddy as they discovered opportunities for their clients inside a law that already slashed rates for corporations and wealthy individuals.

At a May 2018 conference of financial advisers, one wealth planner told the room that a key provision of the new law “leaves a gaping hole in the tax code.” As he put it, “The goal by the end of the presentation today is to make you guys the bus drivers, or the truck drivers, to drive right through that hole with your clients.”

Among the tax-saving opportunities offered by the law: Taxes on profits from certain types of businesses were cut dramatically, while the rate on salaries those businesses paid was reduced only slightly.

That created an alluring opportunity. People who were both owners and employees of a company could make the same amount of money but change how they label it, by lowering their salaries and in turn increasing the company’s profits, which they shared in. That would reduce their tax bill by moving money from a high-tax category to a lower one: Wages are taxed at a top rate of 37% plus an additional 3.8% Medicare levy, while profits, under the new law, are taxed at a top rate of 29.6% (with no Medicare tax). Proponents of this provision claimed it would foster increased investment in American businesses (economists say it’s too early to determine whether that’s true). But even before the bill passed, prominent tax academics warned, in an article titled “The Games They Will Play,” that the tax break would be abused.

Their fears appear to have materialized. Secret IRS data shows multiple instances in which salaries for top executives and owners suddenly and inexplicably dropped in the first year after the Trump tax cut, reducing their tax bills even as their companies appeared to thrive. The mysterious pay cuts played out across industries, from logistics companies to real estate firms to makers of bathtubs, and among executives of varying degrees of prominence. The salary for one construction firm executive dropped from more than $4 million in 2017 to $105,000 in 2018.

The wages for car accessory manufacturer David MacNeil, whose WeatherTech floor mats are featured in a Super Bowl ad each year, fell from $68 million in 2017 to $47 million in 2018.

The salary of Jeffrey Records, CEO of Oklahoma City-based MidFirst Bank, plummeted from $8.6 million to $1.8 million.

And the wages of Dick Uihlein, the Republican megadonor and chairman of shipping supplies behemoth Uline, sank from $5.1 million to $2.1 million.

It’s impossible to say how much money was reclassified as a result of the new law, but consider this: The loophole already existed, in much smaller form, before the Trump tax overhaul. A government report in 2009 estimated the U.S. Treasury was losing billions to this strategy. Back then, an owner could save the Medicare tax by counting a dollar as profits rather than salary. But after the Trump law, the tax savings roughly tripled, to about 11%.

The revelations about the wage maneuvers come from a trove of IRS records obtained by ProPublica covering thousands of the wealthiest Americans. Previous articles in “The Secret IRS Files” series have detailed how the wealthy avoid paying taxes legally, including a story last week exploring the massive benefits the Trump tax overhaul provided billionaires.

The sudden shifts in compensation revealed in the tax returns of wealthy business owners show how they may be gaming federal law to further slash their taxes. They also highlight how, unlike most Americans, whose taxes are automatically taken out of each paycheck, wealthy business owners have a menu of avoidance techniques afforded to them by the tax code.

The tax benefits of shifting wages to profits can be significant. MacNeil, for example, saved an estimated $8 million in the first two years, according to a ProPublica analysis of the IRS records.

MacNeil defended his wage drop and said he used the tax savings to create more jobs: “You want me investing in my country — my fellow Americans? Get out of my pocket.”

ProPublica analyzed years of wage and profit data and found that for each of the companies named in this story, company profits rose even as wages were cut.

Unlike publicly traded corporations, private companies are not required to publicly report profits, salaries for top executives or their rationales for compensation decisions. But experts who spoke to ProPublica said that, if audited, these executives would have to justify why the value of their labor plunged in a given year. The secret tax data does not answer that question.

Taking an unreasonably low salary in order to avoid taxes is illegal. But the IRS’ definition of “reasonable” is vague, and the vast majority of business owners will likely never have to justify the salary cuts. Only a tiny fraction of such companies have their salaries examined by the IRS. Karen Burke, a tax law professor at the University of Florida, said, “For a business owner, there’s every incentive to do this and every reason to believe you’ll get away with it.”

David MacNeil enjoys being the boss. A table reserved for him at the cafeteria of his sprawling production plant has a placard that warns: “Don’t even think about sitting here.” He compliments one of his 1,700 employees about the company pickup truck he’s driving, then adds, “It’s mine.” As he walks among the whirring machines pumping out his custom car mats, he revels in the fact that he built a flourishing manufacturing empire without offshoring, creating hundreds of jobs.

“This is why they give us a tax break,” he said, “so we can make shit happen.”

After ProPublica contacted him, MacNeil invited two reporters for a daylong tour of his factory complex in Bolingbrook, Illinois. A former car salesman, he founded WeatherTech, a top U.S. manufacturer of car accessories, in 1989 and now regularly generates $100 million in annual profit. MacNeil owns a super-yacht, a private jet, a Florida equestrian estate and a collection of antique cars.

He describes himself as “the kind of man America needs, a man that believes in the great American worker.” As he led the tour of his plant, he took his phone out to read emails from employees praising his generosity and showed photos of himself removing trash from the ocean in his free time.

MacNeil backed Trump, donating $1 million to his inauguration and hundreds of thousands to Republican candidates and causes. Trump’s tax law would have cut the magnate’s taxes no matter what. But the IRS records indicate MacNeil may have taken steps to further boost those savings.

For 16 years, the records show, MacNeil’s wages climbed every year: from $1.1 million in 2008 to $10.1 million in 2012 and almost $68 million in 2017. But in 2018, that trend suddenly reversed. He cut his salary to $47 million. Then in 2019, he slashed it even more aggressively, bringing it down to $17 million — 75% lower than two years earlier.

MacNeil’s CEO title hadn’t changed. He hadn’t stepped back. “I bust my ass seven days a week,” he said.

As MacNeil’s salary fell, the company’s profits, which are taxed at a lower rate, surged. In 2018, after four years in which profits hovered around $100 million a year, they suddenly jumped to $121 million. The $21 million increase mirrored the amount that MacNeil lowered his wages that year.

With his (higher-taxed) wages dropping and his (lower-taxed) profits rising, MacNeil avoided an estimated $8 million in taxes.

MacNeil first said he was unaware that his wages had been cut 75% until ProPublica asked him about it. “I had no idea,” he said, asserting the decision was made by his accountants. Later, MacNeil told ProPublica that his wage decrease stemmed from his decision to begin reinvesting almost all of his profits back into the company, leaving him less cash to pay himself in wages.

Experts told ProPublica that increased capital investments by an owner could help justify lower wages, if they result in the owner having less cash left over.

Still, the tax data shows MacNeil’s profits soaring during the years his wages dropped. The data does not indicate how much money MacNeil put back into the business. Asked to provide specific figures outlining his annual cash flow and reinvestment, MacNeil declined.

MacNeil also cited the vagueness of the IRS’ definition of “reasonable compensation.” Most important, he said, the estimated $8 million in taxes he avoided by dropping his wages allowed him to buy an $8 million machine that would generate many multiples of that in tax revenue in the years to come, because it would make his business more profitable.

In a series of text messages in the days that followed, MacNeil continued to defend himself, telling a ProPublica reporter that he didn’t understand “the real world” and “it’s time to grow up and get a real job.”

“Break it up anyway you want, you saw there was a half billion dollars in investment with your own eyes,” he wrote. “We’ve paid hundreds and hundreds of millions of dollars in taxes since 2012. How much have you paid? Chump change for sure. Enjoy!”

MacNeil’s company, like all of the ones discussed in this article, is organized as a pass-through, a tax structure that is quite common but not popularly understood.

To understand pass-throughs, it’s first useful to know how their corporate cousin, the C corporation, is taxed. Most large publicly traded companies, the ExxonMobils and Nikes of the world, are C corporations. When these companies end the year, they must pay the IRS corporate income tax on any profits they have earned. Shareholders receive money, and then owe taxes, only if they decide to sell their holding at a gain or if the companies issue a dividend.

Most businesses in the U.S. are not C corporations, but pass-throughs. They include everything from a small corner deli to a hedge fund to a multinational construction company. Most are privately held. When one of these businesses makes a profit, they do not pay the corporate tax. Instead, that money “passes through” directly to the owner and is reflected on the owners’ personal tax returns. It is therefore taxed only once, and individual income tax rates apply.

One popular type of pass-through is called an S corporation, named after the section in the tax code. They were created in the Eisenhower era as an option for small businesses who wanted to face only a single layer of tax. Since then, many large companies have structured themselves as S corporations for the tax benefits they can bring.

The IRS requires that S corporations pay reasonable salaries — they “should not attempt to avoid paying employment taxes by having their officers treat their compensation as cash distributions” — but the agency has been vague about what those words mean. Factors cited for what makes a salary reasonable include the individual’s training and experience, job responsibilities and what comparable businesses pay for similar roles.

To offer more clarity, the IRS has publicly cited court cases it fought against business owners. In one, from 2001, a Pennsylvania veterinarian took all of his compensation as business income, paying himself no wages even though he spent more than 30 hours a week doing surgeries and other tasks. The veterinarian lost and was forced to pay back taxes.

In another case, an Iowa accountant was paid a salary of $24,000 a year, while taking profits of about $200,000. The accountant, David Watson, specialized in advising clients on tax issues involving pass-through companies. The court ruled against Watson, forcing him to pay back taxes and penalties, after it found that the market rate for his services at the time would have been over $90,000.

The issue has at times become a more public flashpoint. Former Democratic presidential nominee John Edwards was criticized for taking a small salary from the law practice he owned, and former Republican House Speaker Newt Gingrich took heat for doing the same from companies he created that profit from his speeches and other appearances. More recently, The Wall Street Journal reported that Joe Biden exploited the tactic in the years before he became president with his book and speech income. Gingrich, Edwards and Biden have all defended their handling of their tax affairs.

A 2009 report from the Government Accountability Office estimated that in 2003 and 2004, about 13% of S corporations paid artificially low wages, resulting in about $3 billion in lost tax revenue. IRS officials complained to investigators that making the case that a salary is artificially low can be difficult and time consuming. From 2006 to 2008, the IRS examined only 0.5% of S corporations, and in less than a fourth of those cases was compensation looked at. By 2019, the audit rate for S corporations had fallen even lower, to 0.2%.

As the Trump tax cut was being hammered out, lobbyists for industry groups and specific companies pushed to make sure they were eligible. Engineering, real estate and manufacturing were granted the deduction. Lawyers and companies performing “financial services,” for example, were not.

Despite that, banks lobbied successfully to be eligible for the deduction. One of the banks that pushed for that eligibility was MidFirst. That year, even as the CEO’s salary dropped from $8.6 million to $1.8 million, his share of the profits jumped more than $16 million. In 2019, Records’ salary rebounded to $6.5 million, but it remained lower than it had been in the year before the Trump tax law.

Representatives for Records declined to answer questions for this article.

Dick and Liz Uihlein also appear to have benefited. The co-founders of Uline gave millions to support Sen. Ron Johnson, the Wisconsin Republican who became the champion of the pass-through provision in the Trump tax overhaul.

Before the law passed, the salaries for the Uihleins had fluctuated. But in 2018 they dropped dramatically, from a total of $10.5 million to $4.2 million. Their wages had not been that low in more than a decade.

The business reasons for the pay cut are not clear from the available records, and a spokesman for the Uihleins declined to answer questions from ProPublica. Dick remained chairman, and Liz was president. Liz Uihlein said publicly in 2020 that the couple was still heavily involved in running the company.

Their business was booming in the year their wages fell. Profits rose from about $721 million in 2017 to $937 million in 2018, ProPublica’s analysis of the company’s tax data shows. The company remained North America’s leading distributor of shipping and packaging supplies. “Business is great,” Uline’s Chief Human Resources Officer Gil De Las Alas told the Kenosha News in November 2018. “We just keep growing, growing, growing.”