This article is part of TPM Cafe, TPM’s home for opinion and news analysis. It was first published at The Conversation.

Millions of Americans will find it harder to put enough food on the table starting in March 2023, after a COVID-19 pandemic-era boost to Supplemental Nutrition Assistance Program benefits comes to an end. Congress mandated this change in budget legislation it passed in late December 2022.

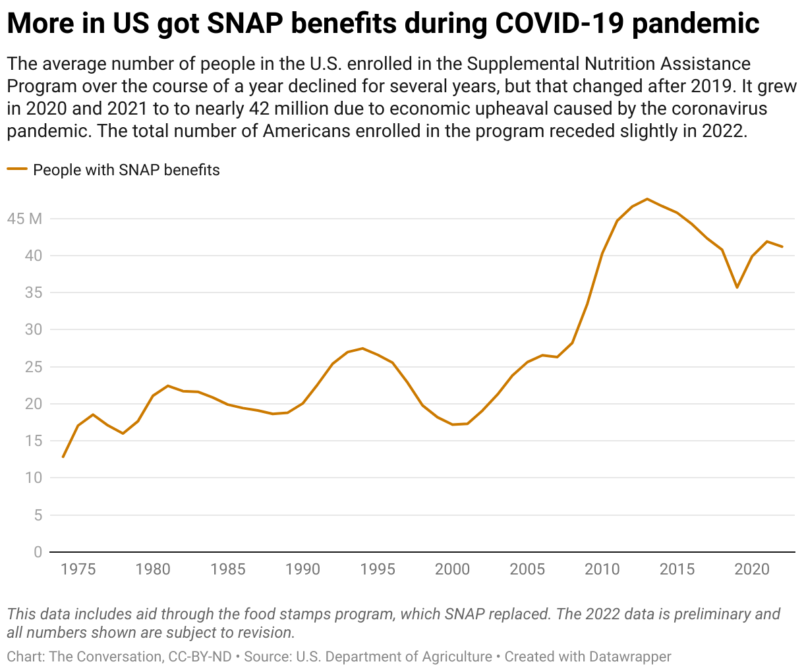

Roughly 41 million Americans are currently enrolled in this program, which the government has long used to ease hunger while boosting the economy during downturns.

Many families enrolled in the program, commonly known as SNAP but sometimes called food stamps, stand to lose an average of roughly US$90 per person a month.

While researching SNAP for an upcoming book, I’ve observed that this program has provided critical assistance to struggling families over the last three years. The extra benefits, which Americans can use to purchase food at the roughly 250,000 stores that accept them, have helped millions of people weather the pandemic’s economic fallout and high inflation rates.

SNAP benefits grew during the pandemic

In the early days of the COVID-19 pandemic, lines at food banks grew and millions lost their jobs. One way that Congress responded was with legislation that let the states, which administer this federally funded program, expand SNAP benefits during the public health emergency.

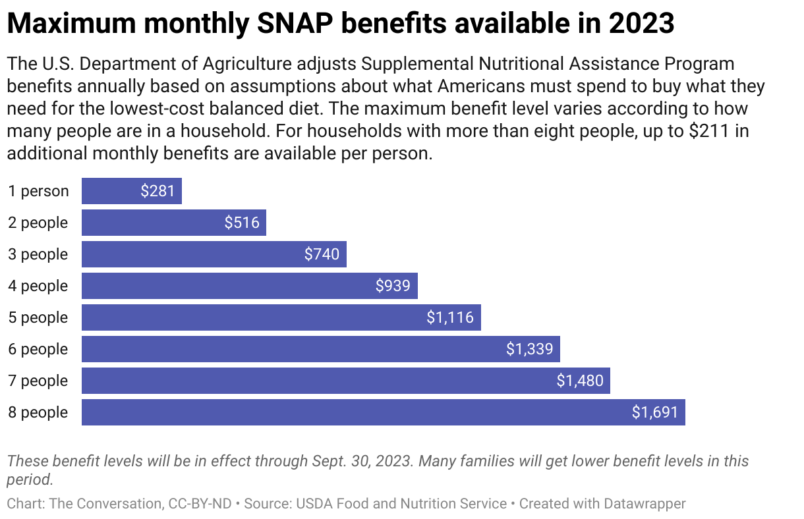

Under this temporary arrangement, all families who were eligible for SNAP could get the maximum allowable benefit amount for the size of their household. Otherwise, that maximum amount would only be available to people with no income at all. But starting in March 2023, SNAP benefits will once again be distributed everywhere on a sliding scale based on income levels.

Some states began to drop the extra benefits in the spring of 2021. But 32 states and the District of Columbia were still offering the extra help in February 2023.

A study from the Urban Institute, a think tank, estimated that the extra benefits kept 4.2 million people out of poverty at the end of 2021 and had reduced overall poverty in states still offering the benefits by 9.6% and child poverty by 14%.

Although the unemployment rate has recently fallen to the lowest level since 1969, the extra SNAP benefits have continued to help low-income families deal with soaring prices that increased the cost of food consumed at home by 11.3% in the 12 months ending in January 2023.

With more people enrolled in the program today than before the COVID-19 pandemic, and the distribution of extra benefits, SNAP spending reached a record $114 billion in the 12 months that ended in September 2022.

Looming hunger cliff

Many experts on food insecurity have long argued that SNAP benefits have historically been too low.

The Biden administration has already tried to boost them by adjusting the “Thrifty Food Plan” — the standard the U.S. Department of Agriculture uses to set SNAP benefits based on the cost of a budget-conscious and nutritionally adequate diet.

As a result, benefits rose an average of $36 a month, a 21% increase, in October 2021. That increase more than offset the expiration of a temporary seven-month boost in benefits that Congress had approved earlier that year.

SNAP benefits automatically adjust every October based on the increase in food prices in July as compared with the previous year. In 2022, they increased 12.5%. But when prices are rising quickly, as is currently the case, SNAP benefits can lose a lot of ground in the months before the next adjustment.

Many advocates for a stronger safety net say that SNAP benefits are too low to meet the needs of low-income people. They are warning of a looming hunger cliff — meaning a sharp increase in the number of people who don’t get enough nutritious food to eat — in March 2023, when the extra help ends.

At that point, the lowest-income families will lose $95 in benefits a month. But some SNAP participants, such as many elderly and disabled people who live alone and on fixed incomes and who only qualify for the minimum amount of help, will see their benefits plummet from $281 to $23 a month.

Most people on SNAP who get Social Security benefits will see their SNAP benefits fall. That’s because of the 8.7% cost of living increase in Social Security benefits implemented in January 2023, which increases their income and lowers the amount of nutritional assistance they can receive. And some of these Americans may even have enough income that they no longer qualify for SNAP at all.

For an average family of four on SNAP, benefits will fall from the maximum of $939 to $718, according to an estimate by the Center for Budget and Policy Priorities, an anti-poverty research group.

Food banks, already under stress because of higher food costs and falling donations, are bracing for higher demand. Food banks in some states that ended the emergency boost in benefits early have seen a 30% increase in need.

More people on SNAP also reported skipping meals in the states that dropped extra benefits than those that did not.

Lawmakers poised to resume a longtime fight

Several Democrats have proposed legislation to increase SNAP benefits over the long term. But many Republicans want to reduce spending on SNAP and put more limits on who can get the program’s benefits.

Debate centers around whether unemployed adults deemed capable of working should be able to get SNAP. This argument, almost as old as the program itself, was largely set aside during the pandemic.

Legislation enacted in early 2020 suspended a requirement that limited benefits for adults under 50 who meet the government’s definition of able-bodied and have no dependents. They can receive no more than three months of SNAP benefits every three years — unless they work or participate in a work-training program at least 20 hours a week.

This time limit will come back when the public health emergency ends in May 2023.

But many critics of SNAP have argued the work requirements were never effectively enforced. A few Republicans want to make tightening restrictions on SNAP benefits a condition for raising the debt ceiling. At this point, it isn’t clear if they will succeed.

Debate over SNAP reforms is likely to come up when Congress considers the program as part of broad food and agriculture legislation known as the farm bill. Congress must act to renew the program before October 2023.

But with the House narrowly controlled by Republicans and the Senate controlled by a slim Democratic majority, I believe it will be hard to make big changes to the Supplemental Nutrition Assistance Program.

This article is republished from The Conversation under a Creative Commons license. Read the original article.