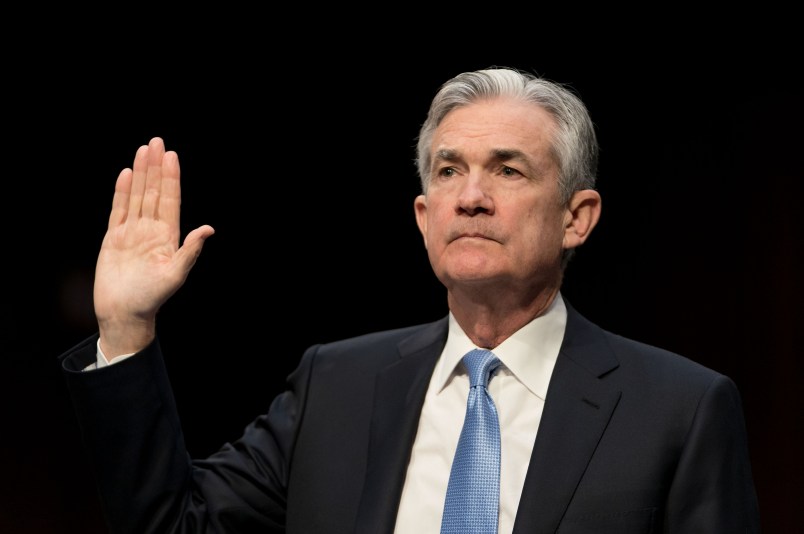

WASHINGTON (AP) — The Senate has approved President Donald Trump’s selection of Jerome Powell to be the next chairman of the Federal Reserve beginning next month.

Senators voted 85-12 to confirm Powell to lead the nation’s central bank, a post that is considered the most powerful economic position in government.

Powell will succeed Janet Yellen, the first woman to lead the Fed, when her term ends Feb. 3. Trump decided against offering Yellen a second four-year term as chair despite widespread praise for her performance since succeeding Ben Bernanke.

Powell, 64, has served for 5½ years on the Fed’s board. A lawyer and investment manager by training, he will be the first Fed leader in 40 years without an advanced degree in economics. Many expect him to follow Yellen’s cautious approach to interest rates.

Powell, viewed as a centrist, enjoyed support from Republicans and Democrats.

Sen. Sherrod Brown, the top Democrat on the Senate Banking Committee, praised Powell’s tenure on the Fed board.

“His track record over the past six years shows he is a thoughtful policymaker,” Brown said.

During the presidential race, Trump was critical of the role the Fed played in implementing the Dodd-Frank Act, the 2010 law that tightened banking regulations after the 2008 financial crisis. Trump and many Republicans in Congress contended that the stricter regulations were too burdensome for financial institutions and were a key reason why economic growth since the Great Recession ended in 2009 had been lackluster.

Powell has signaled that he favors ways to make bank regulations less onerous, especially for smaller community banks.

Trump will be able to essentially remake the Fed’s board during his first two years in office. He has already filled the key post of vice chairman for regulation with Randal Quarles. The president has also nominated Marvin Goodfriend, a conservative economist, for another vacancy on the board.

In addition, he can fill three more vacancies on the seven-member board, including the key spot of Fed vice chairman, which has been vacant since Stanley Fischer left in October.

All told, the vacancies will have given Trump the ability to fill six of the seven board positions with his own choices. Lael Brainard will remain the lone board member not to have been chosen by Trump.

Powell, known as a collegial consensus-builder, could help serve as a steadying force for the U.S. economy as well as a unifying figure among the central bank’s policymakers. As a Fed governor, Powell has never dissented from a central bank decision.

Educated at Princeton University with a law degree from Georgetown, Powell, known as Jay, spent many years in investment management — at Dillon Read and then at the Carlyle Group. His work there made him one of the wealthiest figures to serve on the Fed board: His most recent financial disclosure form places his wealth at between $19.7 million and $55 million. And based on how government disclosures are drafted, his wealth may actually be closer to $100 million.

I’m sure that will work out just swell.

Let me guess, he’s a serial bankruptcy adulterer indictee?

It could be worse – a lot worse actually given the abominable record of this administration – but Powell is still an Inflation Derper so we can expect some bad policy moves from the Fed after he takes over.

So , Dickhead will not have to pick the lock to get any money for his off shore bank accounts .

Powell is a lawyer, and by all accounts a nice guy. However, some very serious changes are taking place in the macroeconomic sphere, and you probably want to have one of those greek-letter equation guys there when the going gets tough. A couple reasons. First, the US is finally trying to exit QE. Under this policy, central banks became the biggest holders of bonds in the world, typically a fifth of all government debt. QT is all about unwinding that bond position. Second, legislators and governments have not come up with new economic paradigms. Most politicians still think “growth” is the answer, even if that possibility for advanced economies has been retreating for four decades. Growth has been almost eerie in the period since the 2008 global financial crisis. Ironically, the US has resorted to a good, old-fashioned devaluation of its currency and the possibility of higher inflation down the road. Thus, the follower central bank has become the economic policy leader without the vision as to where the economy should be steered. It’s great to have forward momentum, but having a direction is sort of the point.