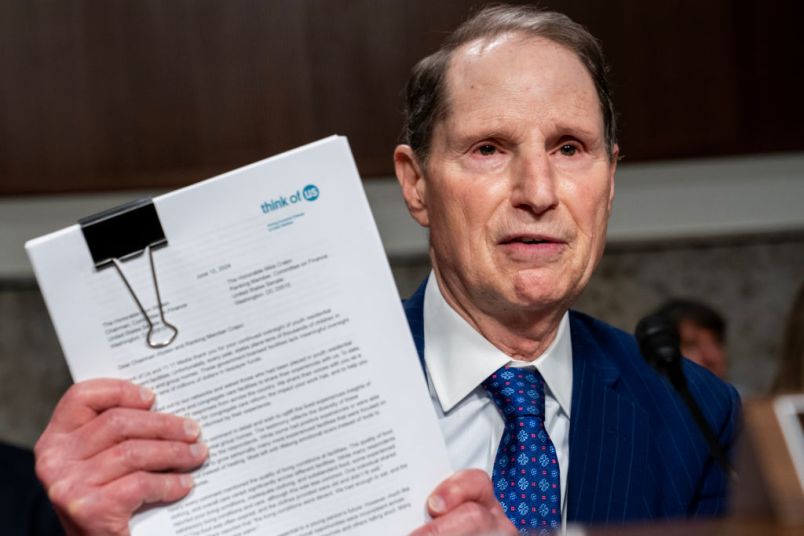

Sen. Ron Wyden (D-OR) is gearing up for a fight.

Republicans are pushing to eliminate Direct File, a Biden administration program that offers a way for some Americans to file their taxes without paying for preparation services. To Wyden, the effort to eliminate the program is an attempt to “intentionally sabotage basic public services.”

“To me, paying your taxes ought to be free and easy — and the biggest benefit of direct file is it’s free,” Wyden, the chair of the Senate Finance Committee, told TPM.

Wyden, who has pushed major tax reform legislation with Republican colleagues in the past, has been a longtime advocate of the free filing approach, which would bring the U.S. closer to the way in which taxes are collected in Australia and much of Europe.

“The tax software companies just want to pick your pocket every year and too many Republicans are taking their side,” Wyden said. “And it didn’t used to be this way. I had the only two major bipartisan bills since ‘86 and both of them had a version of Direct File.

President Joe Biden’s Inflation Reduction Act, which was signed into law in August 2022, included funding for a Direct File pilot program, a policy that had long been sought by progressive tax policy wonks. The pilot program was first launched in 12 states last year, most of which had no state income tax. It was designed to offer a free, alternative tax filing option for low- and middle-income taxpayers who opted for standard deductions. According to the IRS, about 140,000 people participated in the pilot and saved over $5.6 million in filing costs. It was expanded to all 50 states for the coming filing season.

The Biden White House has often touted the initiative, and Treasury Secretary Janet Yellen described it as something she was “especially proud of.”

However, in the wake of Trump’s election last month, the program has come under threat. On Dec. 10, a group of 29 congressional Republicans sent a letter to Trump that urged him to “take immediate action, including but not limited to a day-one executive order, to end the Internal Revenue Service’s (IRS) unauthorized and wasteful Direct File pilot program.” The letter framed the initiative as a dramatic and even dangerous change to the tax system.

“Under the guise of offering a convenient ‘free-to-file’ alternative preparation service, the IRS asserts itself as the tax assessor, collector, preparer, and enforcer — all in one — when the program is used. This is deeply concerning and a clear conflict of interest,” the letter said. “The IRS has little incentive to ensure hardworking Americans do not pay more than they owe in taxes and may instead benefit from families and small businesses paying greater amounts than they are required by law. Furthermore, it is highly inappropriate for the IRS to serve as a tax preparer for taxpayers while also being the final enforcer of tax violations.”

There are several questionable elements in this analysis of the program. As the letter notes just a few sentences after initially suggesting it makes the IRS “enforcer” of taxes, that is already a role the agency plays. Direct File also doesn’t turn the IRS into a tax preparer. Rather, it allows individuals to prepare their own taxes using the program instead of paying a company. It is also a strictly opt-in initiative that is not designed for anyone looking to make more than the standard deduction.

Wyden described the exaggerated claims in the letter and the idea that government funds should not be used to help taxpayers spend less on filing as “regurgitating” talking points from the tax prep industry, which has publicly opposed the program.

“They don’t have a winning case,” he said. “It is hard to be against approaches that are simple and free and are an alternative to paying a few hundred bucks to file your taxes.”

Commercial tax preparation companies have made billions of dollars over the years by charging people to use their software. Wyden describes them as “rent seeking.”

“We’re the only western industrialized nation as far as I can tell that has sort of dissed this whole concept for years and years,” Wyden said of free filing.

According to OpenSecrets, a nonpartisan nonprofit research group focused on money in politics, the tax prep industry has spent, as of last year, $90 million fighting direct file initiatives. Their advocates have made the case that government funds should not be spent on new filing initiatives and promoted the idea that people — even those only taking the standard deduction — need these companies’ help to maximize savings. Consumer advocates and legal experts have rejected these claims and described the industry as predatory, particularly when it comes to low income taxpayers.

Wyden blames this “staggering” lobbying effort for the Republican opposition to the Direct File program.

“To put that amount of money, in terms of distorting what this issue is all about — it’s just further evidence that this is an easy cash cow for them and that they’ve had years of milking it,” said Wyden.

So far, Trump has not offered a public answer to the letter calling on him to end the program. The Trump transition did not respond to a request for comment from TPM.

The situation offers clear parallels for some of the broader dynamics as Biden’s administration transitions to Trump’s. Biden passed the Inflation Reduction Act in a difficult congressional climate that limited in many ways how much of his agenda — initially unveiled in the form of 2021’s Build Back Better legislation — could get through. During his aborted campaign for re-election, he and his team aggressively defended that agenda. Now, after voters seemed nonplussed by the impact of Biden’s legislative wins, Trump is set to take office and could roll many of them back. Against this backdrop, Wyden’s fight to keep the program alive offers a preview of how Democratic battles might look in the coming Trump era.

“This is a perfect example of a fight that’s worth making. People understand that this is a basic service. They’ve been offered something that is free, easy and simple as opposed to spending significant amounts of time and digging seriously into your wallet to pay for business as usual,” Wyden said. “So, we’re going to go out there and say. ‘This is exactly what good government initiatives and policies ought to be like, so let’s not be too surprised when Trump and the Republicans want to tear it down.’”

Wyden said he has not yet tried to speak with Trump. However, he plans to make this case in public and during the confirmation processes for the incoming administration.

“We’re going to be pushing back all the time, day in and day out. We’ll bring it up in nomination hearings. I’ll bring it up on the floor,” Wyden said. “The Republicans want to ram a tax bill through the Congress — I’m going to make sure this is a big issue. This is not going to be an issue that moves quietly some night late in the evening.”

First, off to the Y check in later

Republicans hate big government but adore rent-seeking middlemen who profit off of “privatization” and “efficiency”: tax prep services, private banks handling student loans, drug testing companies and employment agencies made mandatory for government assistance, etc. Forget a hand in your pocket, it’s a goddamn vacuum cleaner nozzle.

“Under the guise of offering a convenient ‘free-to-file’ alternative preparation service, the IRS asserts itself as the tax assessor, collector, preparer, and enforcer — all in one — when the program is used. This is deeply concerning and a clear conflict of interest,” the letter said. “The IRS has little incentive to ensure hardworking Americans do not pay more than they owe in taxes and may instead benefit from families and small businesses paying greater amounts than they are required by law.

In my personal experience this is complete bullshit. On two separate occasions the last few years, my paid tax preparers made errors not in my favor; those errors were discovered by Massachusetts DOR and the IRS, who issued refund checks.

For decades the republicans have been hamstringing the IRS, in order to protect their wealthy puppet masters. Now they are going to bat for H&R fucking Block.

The Republican Party advances populist policies!! No!! Wait!!

As far as I can tell, tax software is a way for the companies to charge a filing fee while gaining access to your data in the hope of further service or loan business, that’s why the software itself is kept rather cheap.