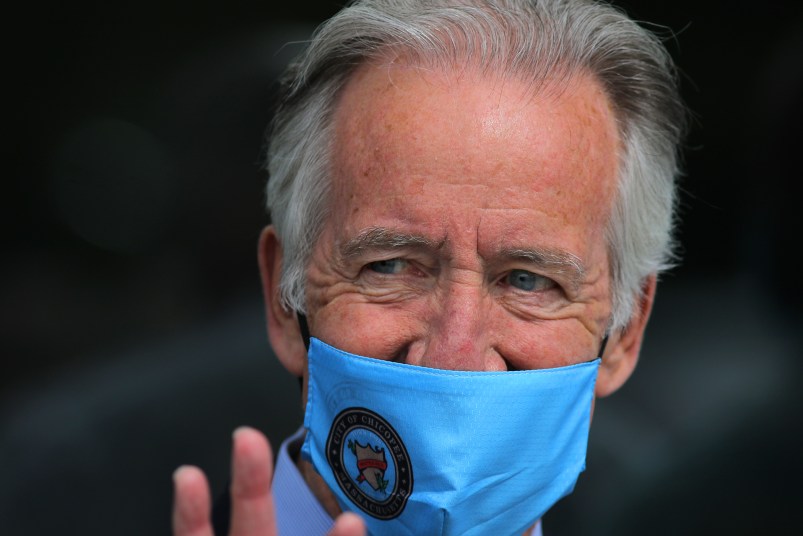

Rep. Richard Neal (D-MA), chairman of the House Ways and Means Committee, took aim at President Trump late Sunday shortly after the New York Times dropped its bombshell report on Trump’s decades-long history of tax avoidance.

In a statement released Sunday night, Neal wrote that the Times’ report “shines a stark light on the vastly different experience people with power and influence have” compared to the average American taxpayer when dealing with the IRS.

Neal then slammed Trump for having “gamed the tax code to his advantage” and accused the President of using legal fights as a tool to delay or avoid paying the taxes he owes.

Neal pointed to the Times’ reporting that the President has been roiled in a “lengthy audit battle with the IRS” that could potentially result in him owing the federal government $100 million, before arguing that Trump is “the boss of the agency he considers an adversary.”

Neal urged that the IRS’s presidential audit program remain independent, and that the Times’ report “underscores the importance” of the Ways and Means Committee’s ongoing lawsuit to access Trump’s tax returns.

“I remain confident that the law is on the Committee’s side, and that our request meets the standard the Supreme Court set with its July 2020 rulings,” Neal wrote. “Our case is very strong, and we will ultimately prevail.”

During a press conference at the White House on Sunday shortly after the Times released its report on his tax avoidance, the President dismissed the report as “fake news” and griped that the IRS treats him “very badly” while acknowledging that he’s been under IRS audit for “a long time.”

Guess the Trump Crime Family can no longer fall back on the specious legal argument that the House Ways and Means Committee’s subpoena of the tax records is merely a “fishing expedition”.

The IRS goes after single Mom’s waitress tips. But wealthy types get a lawyer. Why should anyone pay taxes?

Having hundreds of millions in loans outstanding that he apparently has paid no principal down on sounds like a national security issue to me.

“gamed the tax code to his advantage”

I think this is putting it mildly. I’m more inclined to believe this is criminal tax evasion.