In news buried by the Goldman fraud charges, the Inspector General for the SEC issued a blistering 159-page report Friday concluding that the agency’s Fort Worth office knew that Texas businessman Allen Stanford was operating a Ponzi scheme in 1997 — but didn’t make a serious effort to pursue the matter for eight years, until 2005.

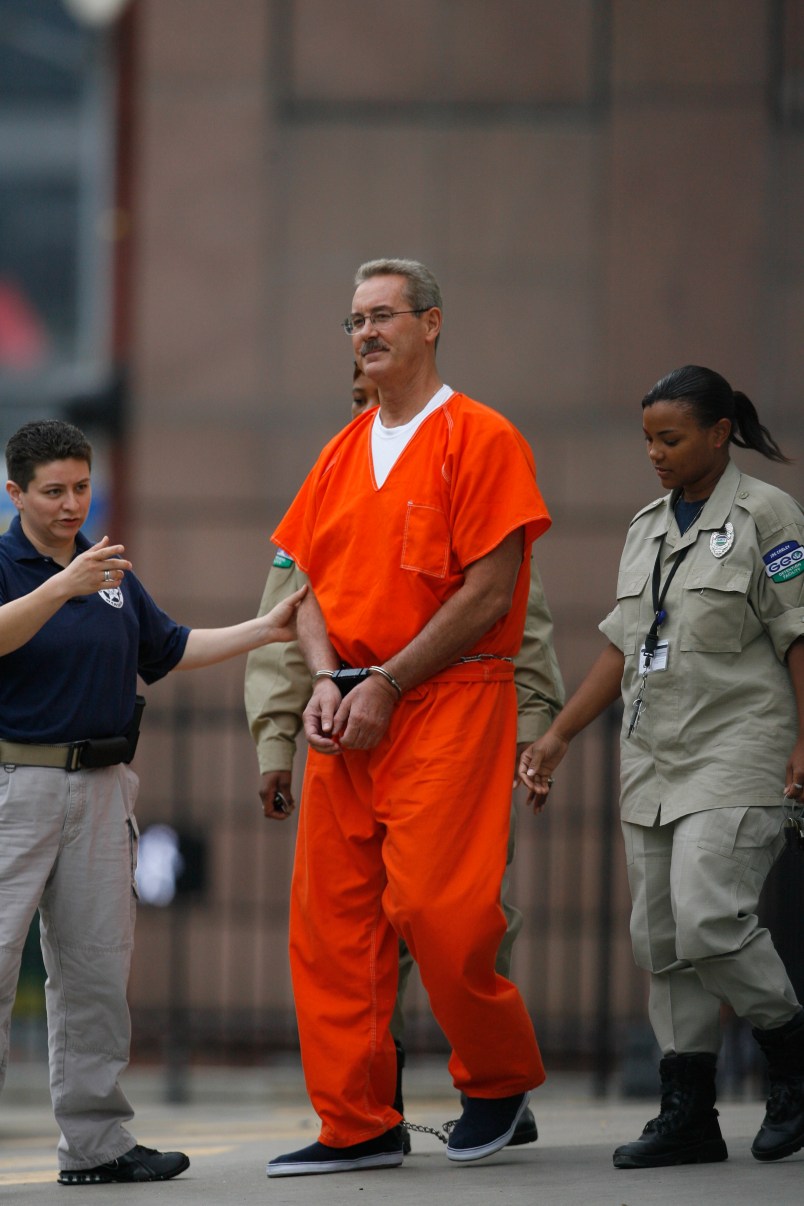

Stanford, a flamboyant Texas billionaire, is currently in jail facing charges of operating a $7 billion Ponzi scheme.

The inspector general’s report paints the enforcement section of the Fort Worth office as the main culprit. The IG concludes:

“[T]he SEC’s Fort Worth office was aware since 1997 that Robert Allen Stanford was likely operating a Ponzi scheme, having come to that conclusion a mere two years after Stanford Group Company (‘SGC’), Stanford’s investment adviser, registered with the SEC in 1995. We found that over the next 8 years, the SEC’s Fort Worth Examination group conducted four examinations of Stanford’s operations, finding in each examination that the CDs could not have been ‘legitimate,’ and that it was ‘highly unlikely’ that the returns Stanford claimed to generate could have been achieved with the purported conservative investment approach.

Fort Worth examiners dutifully conducted examinations of Stanford in 1997, 1998, 2002 and 2004, concluding in each case that Stanford’s CDs were likely a Ponzi scheme or a similar fraudulent scheme. The only significant difference in the Examination group’s findings over the years was that the potential fraud grew exponentially, from $250 million to $1.5 billion.”

Despite all of that, “no meaningful effort was made by Enforcement to investigate the potential fraud or to bring an action to attempt to stop it until late 2005,” according to the report.

Why not? The report continues:

We found that senior Fort Worth officials perceived that they were being judged on the numbers of cases they brought, so-called “stats,” and communicated to the Enforcement staff that novel or complex cases were disfavored. As a result, cases like Stanford, which were not considered “quick-hit” or “slam-dunk” cases, were not encouraged.

The OIG investigation also found that the former head of Enforcement in Fort Worth, who played a significant role in multiple decisions over the years to quash investigations of Stanford, sought to represent Stanford on three separate occasions after he left the Commission, and in fact represented Stanford briefly in 2006 before he was informed by the SEC Ethics Office that it was improper to do so.

There are other sections of the report — one is titled “After Stanford Refused To Produce Documents, No Further Investigative Steps Were Taken” — that point to remarkably lax posture from the Fort Worth enforcement division. Read the whole report here (.pdf).

Late Update: We dug into the case of the SEC enforcement official who quashed various investigations of Stanford, before going on to do work for him in private practice.