Did you know that a whistleblower has come forward with evidence that Trump administration officials are interfering with the mandatory audits federal law requires for all Presidents and Vice Presidents? I didn’t either! Or at least I didn’t until I was talking to TPM’s Josh Kovensky and he mentioned it to me in passing. And yes, this is really true! (Josh wrote the story up here back on August 27th. Definitely read his analysis for a deeper look at the details.) On July 29th a federal employee came forward to the House Ways and Means Committee with “credible allegations” of possible misconduct tied to the mandatory audits of the President’s and Vice President’s taxes.

Why isn’t this a bigger deal?

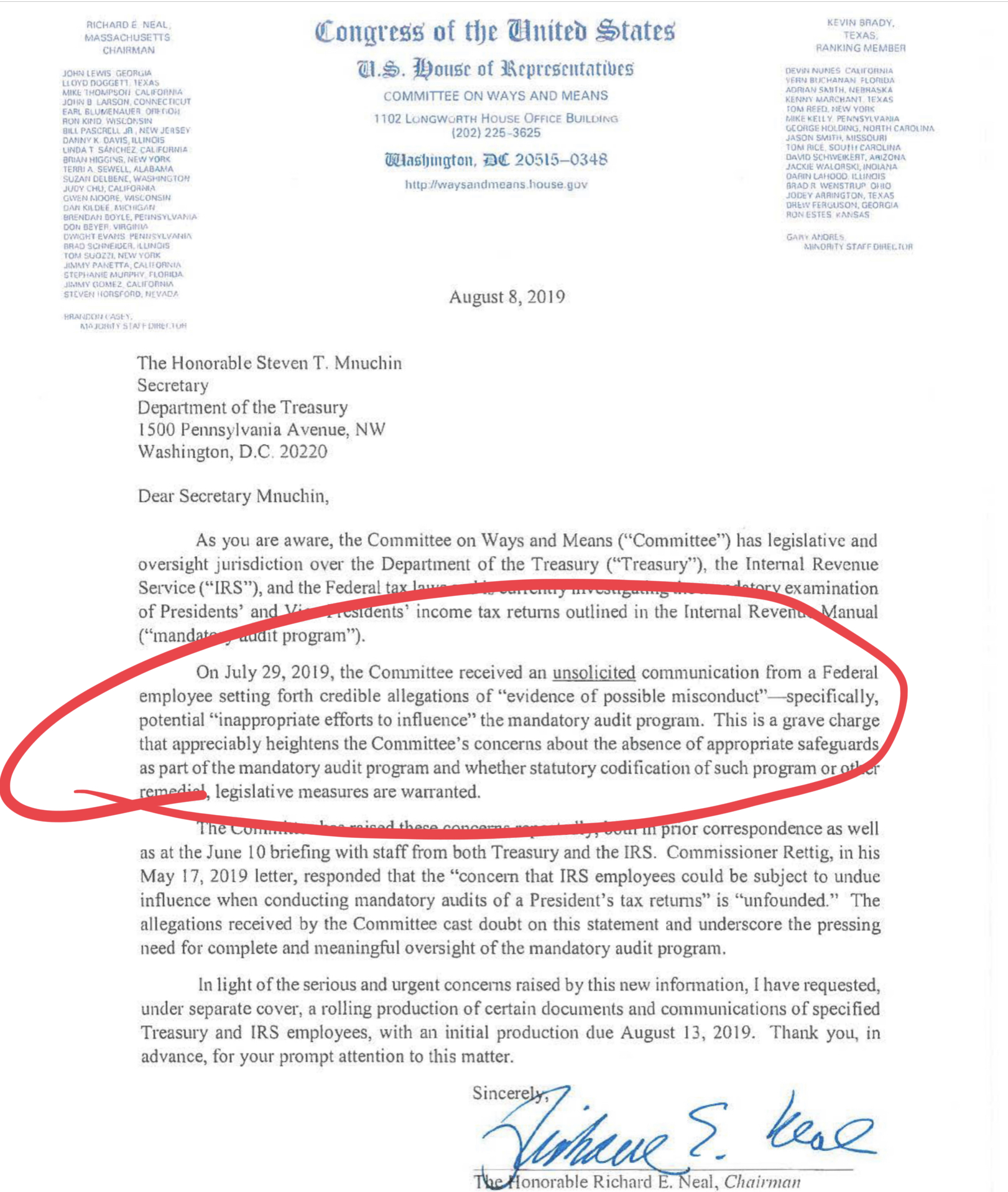

First, a few points. It’s not that no one has talked about this. There were a few small write-ups of this fact in D.C. publications after Chairman Richard Neal (D-MA) raised the issue with Treasury Secretary Steven Mnuchin. Neal wrote to Mnuchin about the whistleblower in a letter dated August 8th. But it didn’t become public until August 20th when it was included in a legal filing tied to the on-going tax returns litigation.

It’s fair to say that if there hasn’t been enough attention to this Neal is as much at fault as reporters. That August 8th letter only comes at the matter in a roundabout way. One of the arguments Neal’s committee is using in its demand for the President’s tax returns is that they need to see whether the law that mandates Presidential audits is being correctly administered. The IRS/Treasury response has been that there’s nothing to worry about on that front (the concerns are “unfounded”), so you don’t need the tax returns. In the August 8th letter, Neal says, well we do think we have reason to worry and in fact now we have this whistleblower who says there’s funny business going on right now.

As you can see, the whole issue is rolled up into Neal’s strategy for getting the President’s tax returns. Federal law says Neal can just ask for the returns and the IRS has to produce them. Period. The President has told his appointees not to follow that law. So now it’s in court. Neal’s strategy has been not so much to rely on the plain text of the law but to argue his legislative purpose for requesting them. Basically, I need them because we need to check on these laws or pass new laws.

But haven’t we kind of lost the plot here? There’s a whistleblower who says Trump’s appointees are interfering with the mandatory audit of the President’s tax returns. That’s a big deal quite apart from how it affects the tax returns lawsuit!

It is important to note that sometimes a whistleblower is just a disgruntled employee. Or maybe they’re acting in good faith but there’s really no there there. But there’s a reason we have whistleblower laws. Because generally speaking when someone risks their job to come forward with information about wrongdoing there’s actually some wrongdoing. Or at least something that requires scrutiny.

Beyond this though, it is entirely de rigueur for the opposition party to be screaming from the rafters constantly when a whistleblower comes forward about an issue of such massive public controversy. Democrats shouldn’t be in the business of mimicking the nonsense of the Benghazi or Dan Burton eras. But it goes without saying that if the shoe we’re on the other foot probably 60% of Fox News would be about this. And generally, this seems par for the course for what we might most generously call Neal’s ‘apolitical’ approach to oversight.

You can see the letter here.

But really, WTF? Why aren’t we hearing more about this?