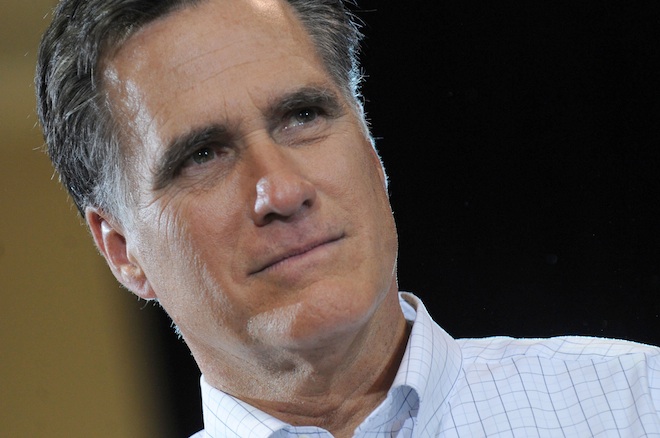

On a conference call with the media Tuesday morning several of Mitt Romney’s political and financial aides tried to suck the life out of the undying story of Romney’s tax liability, walking reporters through hundreds of pages of his family’s tax returns.

As he acknowledged several days ago, Romney pays a very low effective tax rate given his enormous income and extraordinary wealth. His effective rate is about the same as that of a wage earner making $40,000 a year, barely hanging on in the broader middle class.

For the most part, Romney’s aides deftly addressed lingering controversies about his returns. Many of these stem from the complicated nature of the strategies they use to keep his liability down, all of which constitute very new terrain for political reporters. But a couple of things stuck out.

First, Romney made nearly $13 million in 2010 and 2011 in “carried interest” — this is money that’s paid out to fund managers in return for their labor. But since that money comes out of profits made by the companies in which the firm has invested, it’s taxed at the long-term capital gains rate of 15 percent — much lower than it ought to be for what are essentially wages.

This is a well-known loophole in the tax code. And though it’s perfectly legal under current law, it will keep alive questions about equity in the tax code, and whether somebody as wealthy as Romney ought to walk through such loopholes with millions of dollars a year, when budget deficits are high, federal support programs are being slashed, and similar advantages are for all intents and purposes unavailable to most workers.

The second big unanswered question is much more technical, but potentially explosive — indeed the answer could undermine Romney’s claim that his overseas investments do not allow him to avoid or defer US taxes.

Midway through the call, a reporter asked if Romney’s individual retirement account (IRA) was structured in such a way that it managed to avoid an obscure 35 percent tax called the Unrelated Business Income Tax (UBIT). This issue was first raised by the Wall Street Journal, but the question was asked in such a way that Romney’s Brad Malt was able to dodge it.

“Governor Romney’s IRA is not structured in the Caymans; it’s not located in the Cayman’s. It’s tax deferred just like your IRA, and my IRA,” Malt said.

True as far as it goes. But as NYU tax lawyer Daniel Shaviro explained to me last week, that’s not how this particular strategy works. The key is that this obscure tax can be triggered if an IRA or other tax exempt entity borrows to make investments. But an IRA can avoid the tax altogether by investing in offshore entities that do borrow to make investments of their own. When the dividends return to the IRA, they are exempt from the unrelated business income tax.

Later in the call I asked if Romney’s IRA had investments in any offshore entities that would have been subject to the 35 percent UBIT if the investments had been made an onshore entities. The campaign has promised to get back to me with an answer to that question. We’ll let you know what they say.