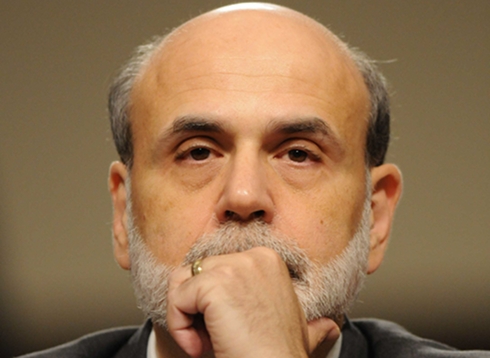

In a speech that sent stock prices tumbling, Fed Chairman Ben Bernanke announced the central bank will not take bold new steps to stimulate the economy — at least not yet. But he also ripped Congress for failing to do its part to combat unemployment with fiscal policy, and blamed brinkmanship over the debt limit for exacerbating the situation.

“Bouts of sharp volatility and risk aversion in markets have recently re-emerged in reaction to concerns about both European sovereign debts and developments related to the U.S. fiscal situation, including the recent downgrade of the U.S. long-term credit rating by one of the major rating agencies and the controversy concerning the raising of the U.S. federal debt ceiling,” Bernanke said at an annual Fed symposium in Jackson Hole, Wyoming. “The negotiations that took place over the summer disrupted financial markets and probably the economy as well, and similar events in the future could, over time, seriously jeopardize the willingness of investors around the world to hold U.S. financial assets or to make direct investments in job-creating U.S. businesses.”

Don’t do that again, he’s warning. Except that top Republicans now say taking the debt ceiling hostage will be the new normal.

Senate Minority Leader Mitch McConnell (R-KY) has called it a “hostage worth ransoming,” and expects it will be a bargaining chip on Capitol Hill for the next few years.

Bernanke also nudged Congress to juice the economy in the near-term, while enacting credible policies to reduce fiscal imbalances after the recovery’s well underway.

“Although the issue of fiscal sustainability must urgently be addressed, fiscal policymakers should not, as a consequence, disregard the fragility of the current economic recovery,” Bernanke said.

“Fortunately, the two goals of achieving fiscal sustainability–which is the result of responsible policies set in place for the longer term–and avoiding the creation of fiscal headwinds for the current recovery are not incompatible. Acting now to put in place a credible plan for reducing future deficits over the longer term, while being attentive to the implications of fiscal choices for the recovery in the near term, can help serve both objectives.

Fiscal policymakers can also promote stronger economic performance through the design of tax policies and spending programs. To the fullest extent possible, our nation’s tax and spending policies should increase incentives to work and to save, encourage investments in the skills of our workforce, stimulate private capital formation, promote research and development, and provide necessary public infrastructure. We cannot expect our economy to grow its way out of our fiscal imbalances, but a more productive economy will ease the tradeoffs that we face.”

Republicans, however, are now arguing against extending the payroll tax cut, and for requiring the government to cut spending to pay for the cost of disaster relief. The Fed’s not doing anything. Congress isn’t doing anything. A bleak picture.