This article is part of TPM Cafe, TPM’s home for opinion and news analysis.

The federal government is in the midst of rolling out a $2 trillion bailout package to try and mitigate the effects of the national coronavirus shutdown. Much of this money will go to major corporations, while working and middle-class Americans may see at most a few thousand dollars. Very little has been done to take care of gig workers, freelancers and consultants who have seen contracts cancelled, or drastically reduced, and customers evaporate. Perhaps it could have been better spent bailing out student debtors.

Many of the companies that will be beneficiaries of the bailout seem to be operating with an intent to fleece taxpayers. Hilton Hotel Corporation, for instance, engaged in a $2 billion stock buyback on March 3, at which point it was more than apparent that they would experience a slump in business. The coal industry has sought to use the bailout to wriggle out of a $220 million tax intended to benefit former coal miners with black lung disease. And the airlines have begged poverty despite spending 96% of free cash flow on stock buybacks over the past decade, according to Bloomberg, compared to an average of 50% for the S&P 500. And these same airlines are estimated to have a full six months of liquidity with which they could continue to pay salaries.

And if that’s not frustrating enough, get this: executive pay for bailout beneficiaries is capped at only $3 million plus 50% of whatever they made above $3 million in 2019. This means that theoretically the American Airlines CEO, who earned $12 million 2018 (the 2019 numbers are not available yet), could still earn $7.5 million in 2020 even as his company benefits from taxpayer funds.

Since the cut to corporate tax rates in 2018, big business has benefited to the tune of some $1.5 trillion under the Trump administration. In a nutshell, big business has already been getting a free ride and is not deserving of this bailout. Much of the government spending in the coronavirus bailout seems to be less aligned with helping the American people financially during a trying time or improving coronavirus survival rates, than with underwriting years of irresponsible corporate behavior.

Perhaps there was a better use of $2 trillion than corporate welfare. If the purpose is to inject money into the economy and give Americans a financial cushion to help get them through the coming months, a better move may have been to cancel some or all of the $1.4 trillion in student loan debt that is owned to the federal government. This would still have left $600 billion for other purposes while instantly reducing the expenses of millions of Americans and freeing their money for other uses, such as paying rent and supporting struggling local restaurants and their workers. Even a partial student loan forgiveness could have paid dividends for recipients for years to come.

And it’s not as if we don’t know how to do this, either. Sen. Elizabeth Warren (D-MA) already has a plan for this, which she campaigned on. The fact that even partial student debt relief was not included in the coronavirus bailout is a travesty. This is money that is owed to the federal government, and it can choose to collect on it or not. Instead of writing paltry checks as part of a bread and circuses policy — $1200 does not go far in New York City, which is the epicenter of the coronavirus crisis — this could have been an opportunity to goose the economy while also creating lasting, high impact improvements in the financial lives of millions of Americans.

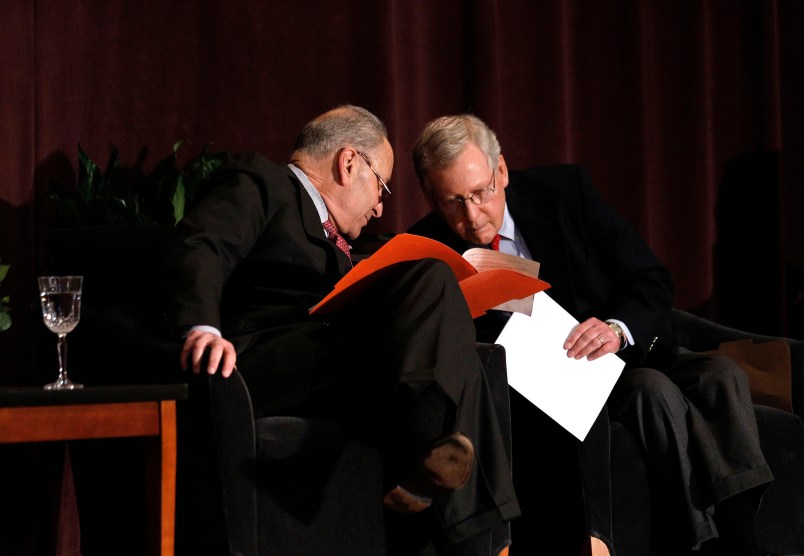

While many are simply desperate for any financial relief in this moment, this, in my opinion, was not the way to do it. The fact that this bill passed the Senate with overwhelming bipartisan support speaks not only to the dysfunction in Washington, but to the fundamentally bankrupt values of most members of both parties. The first goal in Congress seems to be lining corporate pockets, not taking care of the citizens who always seem to foot the bill.

Correction: The original version of this piece misstated the cap on executive compensation for bailout beneficiaries. Executive compensation is actually capped at $3 million plus 50 percent of what the executive made beyond $3 million the year prior. TPM regrets this error.

Benjamin Reeves is a freelance financial journalist and screenwriter based in New York. He writes the daily newsletter “Highly Transmissible.” Reeves previously was the senior special projects editor at “Worth” magazine, worked in communications at Columbia Business School and was a foreign correspondent in Latin America.

Call me a neoliberal shill, but facts matter if we want to argue about things.

The 500 billion corporate bailout fund is for loans, not direct cash payments. The corporations will have to pay it back, just as they had to pay back TARP funds, which were all paid back with significant interest. So comparing that fund to eliminating debt is apples to oranges.

The point of this package, loathe though any Republican and too many Democrats would be to admit such a thing, is to prevent a catastrophic plummet in aggregate demand that causes the kind of depression we had in the early 30’s where aggregate demand stabilizes at a level far below the full employment capacity of the economy. Because student debt is amortized over many years, resulting in comparatively small payments each month, cancelling part of people’s student debt wouldn’t, if you’ll pardon my French, do jack fucking shit to plug the crater.

Average student loan payment is $400 a month, so it would only take 3 months for the student loan payments to be equivalent to the stimulus checks, which will take approximately that much time to reach the last people. On top of that, these are younger people with these loans who on average will be making less money than the average American, so they are more likely to spend any extra money they have. Therefore, nullifying student debt is likely to have a greater keynsian multiplier than merely sending $1200 to every American (whose income is <99k), and it will spread the effect out over a longer period (see: years) which will be necessary to maintain economic growth, as opposed to just a one-shot measure.

Some bigger issues I can think of re: paying off the student debt would be that you’re basically punishing people who were frugal, got jobs, and didn’t take on student debt vs those who got their maximum possible loans to fund their arts education. And also what about the people who are taking more loans currently or planning on taking loans for their education, would they also not see a dime beyond paying off their current debt? And would you be giving more incentive towards loan providers to try to sell more loans under the premise that the government might just pay that all off for you, so feel free to take as much debt as you want? Slippery slopes.

The best answer of course is that we should adopt many of the socialist programs to reduce the cost of education at public universities to $0, provide essential living assistance to those pursuing higher education, and providing mechanisms to alleviate student loan debt, including allowing for bankruptcy for those who can’t pay their student debt, restructuring debt payoff to be based on percentage of annual income over time (like pay 4% of your income a year for the next 20 years and all your debt is gone, even if you had a million dollars in debt and work as a barista, etc).

But that sort of stuff is unrelated to the immediate desire for economic stimulus, which I’m not sure I feel the same way as say the 3 million Americans who just filed for unemployment.

At that point you’re also targeting extra stimulus towards those whose families were wealthy enough to send them to college. The actual working class wouldn’t get shit, it’s basically a giveaway to the middle and upper middle classes. There are better ways to do stimulus.

There are also fewer people with student debt than would be receiving these stimulus payments, so it would have a reduced immediate-term impact from that as well.

Actually, there was a provision in the Senate version of the bill to suspend student loan payments for six months, I assume it made it through the house, non? Interest is still accruing, but If your goal is to get $400/month into the hands of former students, it seems that this has been done.