WASHINGTON (AP) — A key part of House Republicans’ plan to overhaul the way corporations pay taxes is on life support, leaving lawmakers scrambling to save one of President Donald Trump’s biggest priorities and increasing the chances the GOP will simply pass a tax cut instead of overhauling the tax code.

A proposed tax on imports is central to the GOP plan to lower the overall corporate tax rate. It would generate about $1 trillion over the next decade to finance the lower rates without adding to the deficit. It would also provide strong incentives for U.S.-based companies to keep their operations in the United States and perhaps persuade companies to move overseas operations to the U.S.

But the tax faces strong opposition from retailers, automakers and the oil industry, and a growing number of congressional Republicans have come out against it. They worry that it will increase the cost of imports, raising consumer prices.

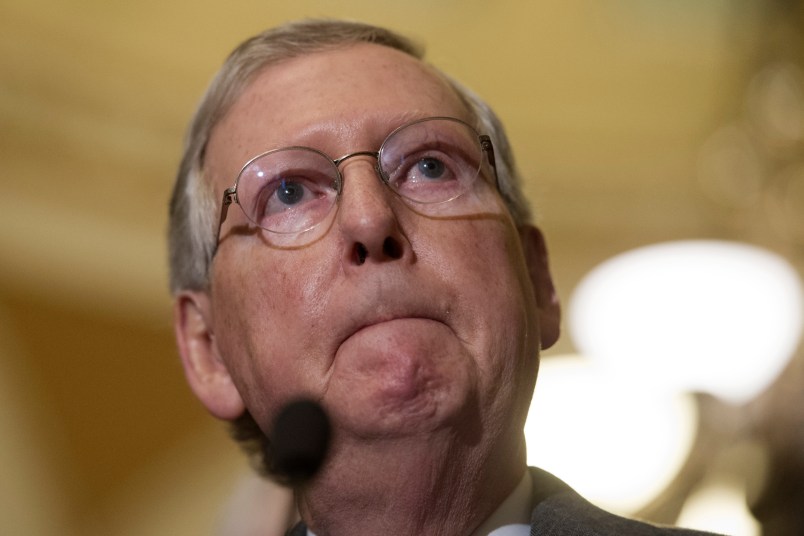

Majority Leader Mitch McConnell, R-Ky., says there probably aren’t enough votes to pass the import tax in the Senate — not a single Republican senator has publicly endorsed it. And a powerful group of House conservatives says it’s time to dump the idea.

“The sooner we acknowledge that and get on with a plan that actually works and actually can build consensus, the better off we will be,” said Rep. Mark Meadows, R-N.C., chairman of the conservative Freedom Caucus.

Even one of the biggest backers of the new tax says he is open to other ideas.

Rep. Kevin Brady, R-Texas, has pushed the tax as chairman of the powerful House Ways and Means Committee. He still says it’s the best way to promote economic growth and domestic jobs, but he has softened his stance on alternatives.

“I’m still confident that we’re going to stay at the table until we solve that problem, which is how do we stop U.S. jobs from continuing to leave the United States,” Brady said. “We’re going to remain open to the best ideas on how we do that.”

On Tuesday, Brady proposed gradually phasing in the tax over five years to give corporations time to adjust.

It wasn’t received well by opponents.

“Forcing consumers to pay more so that some profitable companies can operate tax-free is no better of an idea in five years than it is today,” said Brian Dodge of the Retail Industry Leaders Association.

But if the import tax is dead, then what?

“I would never declare anything dead until there was a fully formed alternative,” said Rohit Kumar, a former tax counsel to McConnell who now heads PwC’s Washington tax office. “I think that’s one of the big challenges that Republicans are struggling with right now.”

Thirty-one years after the last tax overhaul, there is widespread agreement that the current system is too complicated and picks winners and losers, compelling companies to make decisions based on tax implications instead of sound business reasons.

The goal — for now — is to simplify the tax code and make it more efficient in a way that does not add to the federal government’s mounting debt. That means some would pay more and some would pay less, a heavy political lift among politicians who have deep political and practical disagreements.

Lawmakers also are trying to overhaul taxes on individuals, which raises another set of big challenges.

“It’s easier to get a coalition to cut taxes,” said Mark Mazur, a former Treasury official under President Barack Obama. “And if the conversation is, ‘how long do they last and how deep are the tax cuts,’ each party knows how to do that conversation. It’s not like you’re asking for a huge lift.”

The new import tax, which is called a border adjustment tax, would radically change the way corporations are taxed. Under current law, corporations pay a top tax rate of 35 percent on their profits. But the tax code is filled with so many exemptions, deductions and credits that most corporations pay a much lower rate.

Under the proposed system, American companies that produce and sell their products in the U.S. would pay a new 20 percent tax on the profits from these sales. However, if a company exports a product, the profits from that sale would not be taxed by the U.S.

Foreign companies that import goods to the U.S. would also have to pay the tax, and they would not be able to deduct the cost of the imported good as a business expense.

Republicans in Congress and at the White House have been meeting behind closed doors for weeks to come up with viable alternatives. Democrats have been largely excluded from the talks, leaving Republicans with little room for error.

“I still think that Republicans, out of pure political necessity, if nothing else, are likely to find a way to get some sort of tax bill to the president’s desk for his signature,” Kumar said.

Whether it’s genuine tax reform or simply a tax cut “is still very much in question right now,” he added.

___

Associated Press writer Erica Werner contributed to this report.

___

Follow Stephen Ohlemacher on Twitter at http://twitter.com/stephenatap

This is slightly off the tax plan topic but touches on price of imports. I am not an economist and so I can only offer my observations about imports vs domestic products.

Example 1: Recently I bought a pair of sunglasses online for less than $3. They are exactly what I wanted (John Lennon style, blue tinted mirror lenses, yep!) and they were sent directly to me from China. Got them in less than two weeks. I had been looking for a similar pair for a long time in local stores to no avail, (even the styles I didn’t want were no cheaper than $15). How any company can manufacture and ship product that cheaply and make a profit is beyond me, but I know a domestic company couldn’t do it.

Example 2: I have seen heavy iron manhole covers that were marked “made in India”. How is it possible to manufacture and ship such bulky items all the way from India at a better price than they can be made domestically?

I do know tariffs can lead to trade wars etc. but something seems out of whack here. No wonder our manufacturing is suffering. What gives?

Ah yes. What they want is to give the big breaks and not have anybody pay for them till down the road, when nobody will remember exactly who’s responsible.

This way, the prices would go up at the big box stores and their right winger peeps would finally wake up to something real and punish them.

I don’t see what their problem is. Decreasing corporate taxes will increase corporate profits which in turn will increase dividends and stock prices for the benefit of the investor class. Passing the cost on to the plebeians would have no political effect, an incontestable fact proven by the number of people who reflexively and dependably vote “R” against their own best interests.

Turtle man supports any bill that sticks it to the middle class!

Not just the middle class. As @26degreesrising pointed out the prices would go up at the big box stores which sticks it to the working poor who don’t make enough to pay any state or federal income tax. A tax plan that benefits the “job creators” and investor class at the expense of everybody else is a classic GOP win/win.