The fateful question came from a tax lawyer, in a room filled with dozens of them. It came at the end of a Friday morning panel, on the second day of the American Bar Association tax section’s big annual meeting at the Grand Hyatt hotel in Washington D.C. The moderator had announced that it would be the panel’s last question.

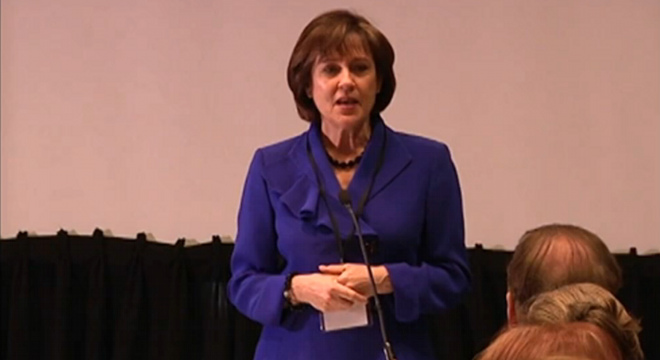

“Lois, a few months ago there were some concerns about the IRS’s review of 501(c)(4) organizations, of applications from tea party organizations,” Celia Roady, a veteran tax lawyer, asked Lois Lerner, head of the IRS’ tax-exempt organizations division, a few minutes after Lerner finished giving prepared remarks. “I was just wondering if you could provide an update.”

The name of the panel was “News From The IRS And Treasury.” But few, if any, of those present could have anticipated the kind of news Lerner would make with her response to Roady’s question.

Lerner began by describing the increase in 501(c)(4) applications the IRS received between 2010 and 2012. IRS employees in Cincinnati, Lerner said, had reacted by centralizing the applications for efficiency and consistency, something the IRS did “whenever we see an uptick in a new kind of application or something we haven’t seen before.” But in this case, Lerner said, the centralization had not been carried out properly.

“Instead of referring to the cases as advocacy cases, they actually used case names on this list,” Lerner said, according to a transcript of the meeting. “They used names like Tea Party or Patriots and they selected cases simply because the applications had those names in the title. That was wrong, that was absolutely incorrect, insensitive, and inappropriate — that’s not how we go about selecting cases for further review.”

Lerner went on to also acknowledge that the IRS had sent some of these organizations questions that were “far too broad,” in some cases even asking for contributor names. Within minutes, her words had made headlines. Within hours, White House Press Secretary Jary Carney was taking questions about the IRS’ actions. Within days, President Obama was expressing concern, and Attorney General Eric Holder had announced an investigation into the matter.

But back at the Grand Hyatt on Friday, Lerner’s words were met with surprise and bafflement. The fact that the Treasury Inspector General for Tax Administration had a report on the issue just days from release was not yet widely known. Audience members couldn’t understand why Lerner had chosen that panel as the venue in which to make her admission. While Lerner’s remarks have since been referred to as a “slip” by lawmakers and media reports, several people in the audience on Friday said they saw Lerner refer to notes when answering the question, as if she’d prepared the response in advance. The whole thing was so strange, some even speculated that the question itself had been a plant.

“We all just sort of looked at each other and couldn’t quite understand,” Ellen Aprill, a professor at Loyola Law School who was in the audience, told TPM on Monday. “It seemed so odd that it was such a detailed response to the question rather than part of her prepared remarks.”

Paul Streckfus, the editor of EO Tax Journal, an online publication for exempt organization tax practitioners, told TPM he had been “dozing off” when Roady had asked the question, but had “jumped almost out of my seat” when he realized what Lerner was saying. (Streckfus recorded the panel and provided the transcript of Roady’s question to TPM.) Once Lerner had finished, Streckfus rushed up along with another reporter to question Lerner further, but she begged off.

“I’m sorry, I can’t answer any questions, I’ve got to go,” Streckfus said Lerner told him.

Philip Hackney, an assistant professor of law at Louisiana State University and a former senior technician reviewer in the the IRS’ Office of Chief Counsel, said he had been “blown away” by Lerner’s response.

“She’s a seasoned government employee,” Hackney told TPM. “I’ve spoken at those things before, and generally this isn’t the way you do it. It’s really strange.”

According to Hackney, an American Bar Association tax section meeting isn’t where you would expect a government official to stumble. Attendees appreciate their access to government officials, and don’t make a habit of hardball questions.

“It’s not unlike a reporter’s relationship with government officials, which is, they respect that government officials don’t want to be put in embarrassing positions, and so they’re highly unlikely to ask any kind of embarrassing questions,” Hackney said. “So it’s a total dance that these guys place with the government, the government plays with them. And everybody knows the rules of the game, generally.”

It’s not unheard of for questions to be planted at events like Friday’s, but no one TPM talked to believed that Roady’s question had set up in advance. Both Aprill and Streckfus said they had asked Roady directly about the issue. Roady denied any arrangement.

“I know that some people in the audience thought it was set up, but I talked to Celia [Roady],” Aprill said. “It was not a set up. And I believe Celia. I’ve known Celia for years.”

Roady, a partner in the D.C. office of Morgan Lewis and a member of the the IRS’ Advisory Committee on Tax-Exempt and Government Entities, did not respond to a request for comment from TPM.

As for Lerner, perhaps she had been trying to get out in front of the Inspector General’s report, people said. But there were still questions about how an official as respected as Lerner could have made such a miscalculation.

“At that point [after Roady asked Lerner the question], she should have said, ‘I understand the report’s coming out in a few days, as soon as it’s out I’ll be glad to respond to that question, but now is not the time,'” Streckfus said. “So I think she did make a terrible mistake. I think she would even agree that it was just a terrible mistake on her part. It’s like being a quarterback and throwing an interception. You think, ‘Man, I wish I could have that one back.’ And, unfortunately in her case, once it got out there, all hell broke loose.”