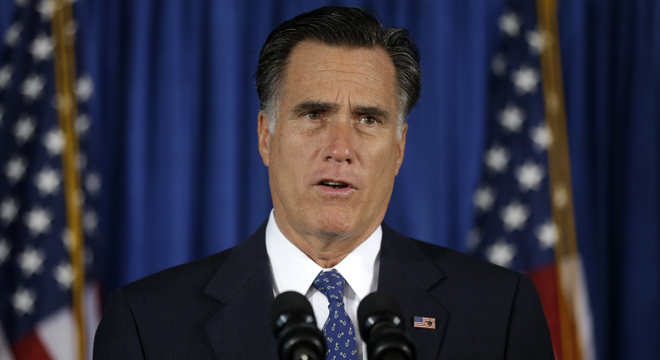

While conservative activists are circling their wagons around Mitt Romney and encouraging him to stand by his claim that the 47 percent of Americans who don’t pay federal income taxes are essentially mooching off the government, prominent policy voices on the right are dismayed by his comments — both because they’re inaccurate, and because they cut against fundamental conservative causes.

Romney argued that the 47 percent — of which three-fifths pay payroll taxes and one-fifth are seniors — represent President Obama’s core base. “The story is complicated, and it doesn’t line up well with the dependency story Romney seemed to have in mind,” wrote Reiham Salam at National Review. “As an explanation for electoral trends, though, this theory doesn’t hold up,” wrote Ramesh Ponnuru at Bloomberg View, pointing out that many low-income Americans vote Republican.

Many conservatives support programs like the Earned Income Tax Credit — which contributes to the phenomenon Romney derided — because it advances the goal of replacing welfare programs with work incentive programs. Anti-tax activists separately note that Republican presidents since Ronald Reagan have worked to grow the ranks of Americans who don’t pay federal income taxes.

“Since when has it been the job of Republicans and conservatives to make sure everyone has IRS obligations?” wrote Jim Antle at the Daily Caller. He accused Romney of “[i]gnoring the rising payroll tax burden of the last few decades while dismissing many of those who have borne it as deadbeats.”

Antle’s blog post was approvingly tweeted by Ryan Ellis, the top lobbyist for anti-tax crusader Grover Norquist. He was joined by Salam and Ponnuru in noting — and defending — three decades of Republican-driven policies that built the current tax system via tax cuts and credits. They also argued that the 53-47 analysis papers over economic mobility.

“Conservatives have even less reason for worrying about people who don’t pay federal income taxes,” wrote Ponnuru. “A major reason that the number of those people has grown is that a Republican-controlled Congress created, and the Bush administration expanded, a tax credit for parents.”

The development exposes a gulf between movement conservatives, who have embraced the view that nearly half of Americans are Democratic voters in thrall to a liberal welfare state, and their policy-minded fellow travelers who know the view is false.

“One thing that frustrates me,” wrote Salam, “is that many Republicans who’ve embraced the ‘takers’ interpretation of the fact that 46% of tax units didn’t pay federal income taxes forget why Republican policymakers of the past created policies like the EITC and the child tax credit in the first place…. We need conservative politicians who are willing to explain why low-income and middle-income parents should be removed from the tax rolls during the years they are making the biggest investments in their children, and who are willing to make the case for the EITC program as an alternative to worklessness and lifelong dependency.”

For Matt Welch of the libertarian magazine Reason, the problem is that Romney’s message contradicts the pitch Republicans made to voters at the GOP convention.

“This is economic determinism at its worst, going against the very message the Republican Party was trying to sell to the world during its quadrennial national convention last month,” he wrote. “Over and over again, we heard speakers there talk about how their immigrant grandparents came to this country, worked hard, built ‘that,’ never asked for a handout, and as a result their descendants have enjoyed the American Dream of ever-upward mobility. What the 53/47 dividing line says, to the direct contrary, is that income status is a permanent political condition, defrocking all Americans of agency and independent thought…. There are to my mind many more important things to consider in this presidential race than Mitt Romney’s reductive parroting of plausible-but-wrong GOP tropes. But the reason this controversy will have legs is ultimately because many Republicans think Romney’s comments were just fine. They are about to learn what the rest of the country thinks about that.”