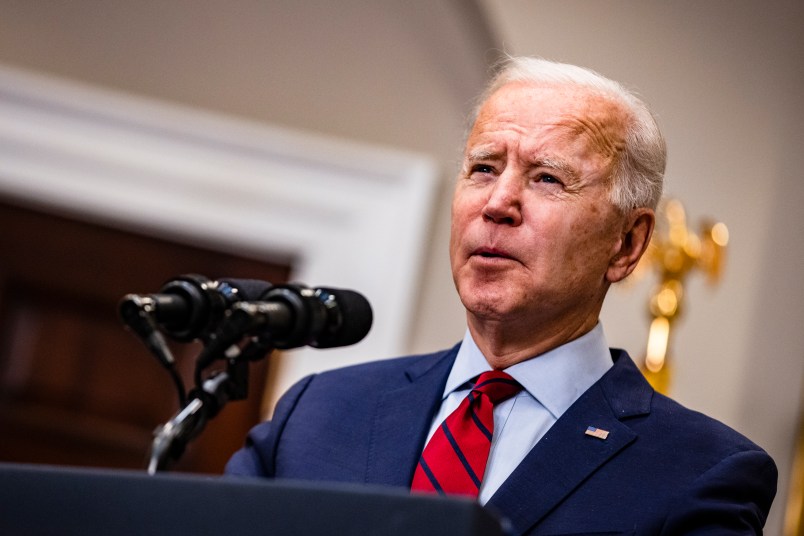

The Biden administration is preparing to give us a first look at its potential infrastructure bill.

The White House has begun to offer details about what the bill — the next major piece of legislation after the American Rescue Plan — that the Biden administration will pursue.

And while the specifics on Democrats’ strategy for passing the legislation through the Senate remains in flux, new reports from the New York Times and Washington Post provide a sense of what the White House hopes to prioritize.

In short, the infrastructure package could contain quite a lot.

Here’s a summary of what those two reports suggest is currently on the table.

Two parts

The legislation will likely be split into at least two parts, both newspapers report.

One half of the legislation would focus on a massive injection of infrastructure spending into the economy: hundreds of billions of dollars that may turn out to be based largely on the infrastructure investment plan on which Biden campaigned.

The other would deliver changes to the country’s social safety net, like universal pre-K, free community college, and an extension of the child tax credit.

But some Biden officials hope that splitting the two pieces of legislation could open up a path for the the infrastructure portion to clear the threshold established by the inevitable Republican filibuster, which, at the moment, creates a 60-vote standard for the legislation to pass.

Eternal infrastructure week

Officials are considering including the following in the infrastructure portion of the bill, the Washington Post reports:

- $400 billion to combat climate change

- $60 billion for eco-friendly transit

- $200 billion for housing infrastructure upgrades

- $100 billion to increase the housing supply for those with lower incomes

That’s an incomplete list, but it speaks to at least part of the White House’s ambition: to undertake massive investments in infrastructure that will double as a piece of legislation aimed at climate change.

This is the segment of the legislation that some White House officials reportedly believe could attract Republican buy-in. The New York Times reports that the bill could end up marrying investments in advanced manufacturing with efforts to reduce carbon emissions.

Democrats are mulling over how they might structure tax increases that could finance the legislation.

Some tax breaks that were passed in Trump’s 2017 tax cut are also set to expire this week, which could be a way to garner support from the right.

One proposal would see the top threshold for marginal income tax rates — currently set at $500,000 for individuals and $600,000 for couples — be lowered to $400,000. Biden promised during the campaign that no American making less than $400,000 annually would see their taxes go up.

But it’s an approach that — in spite of potential focuses on stated GOP priorities like 5G telecom upgrades and rural broadband — could founder on obstructionism from Senate Majority Leader Mitch McConnell (R-KY), who has already suggested that potential tax increases to finance the bill are a non-starter.

Welfare expansion

Democrats are reportedly eyeing reconciliation as the means to pass the second half of the package.

That would focus on social policy goals of the Biden administration, including:

- Universal pre-K

- Free community college

- Extension of the child tax credit and ACA subsidies

- National paid leave program

Administration officials remain less decided on how to finance the two pieces of legislation, the papers report — a potential stumbling block for major legislation moving through the reconciliation process.

One proposal would reportedly allow Medicare to negotiate drug prices with pharmaceutical companies, which could shave down the bill’s price tag.

Biden also said during the campaign that he would push to raise the corporate tax rate up to 28 percent from 21 percent, where it has stood since the Trump tax cuts were passed in 2017.

This remains both the least clear but also, for passage, potentially the most consequential portion of the plan.

If they’re smart they’ll steer way way way clear of the word “welfare.” Is this a TPM term for the article or are the Dems that dumb. Either way, let’s not load Mitch’s gun belt with the silver “welfare” bullet, ok?

They could call them “Socialist Freebies”. Better?

… from the pit of radical, leftist, pedophile hell.

Or maybe entitlements?

Not good enough