This story first appeared at ProPublica. ProPublica is a Pulitzer Prize-winning investigative newsroom. Sign up for The Big Story newsletter to receive stories like this one in your inbox.

Here’s a tale of two Stephen Rosses.

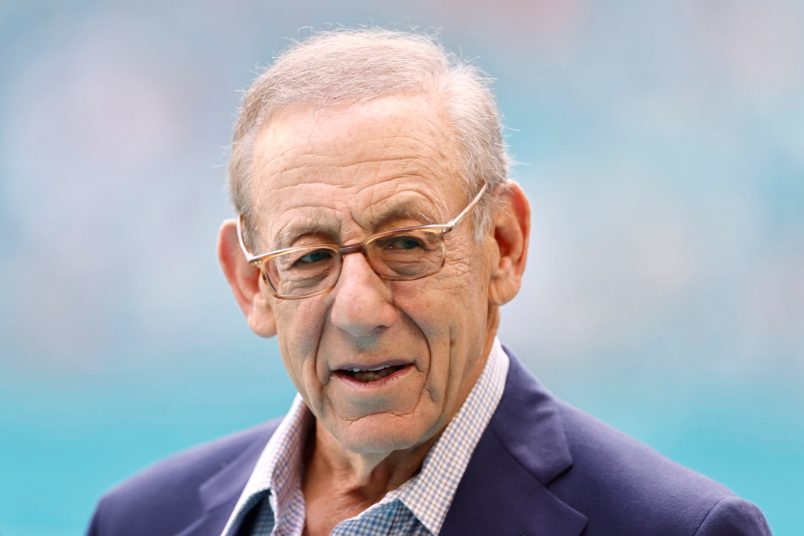

Real life Stephen Ross, who founded Related Companies, a global firm best known for developing the Time Warner Center and Hudson Yards in Manhattan, was a massive winner between 2008 and 2017. He became the second-wealthiest real estate titan in America, almost doubling his net worth over those years, according to Forbes Magazine’s annual list, by adding $3 billion to his fortune. His assets included a penthouse apartment overlooking Central Park and the Miami Dolphins football team.

Then there’s the other Stephen Ross, the big loser. That’s the one depicted on his tax returns. Though the developer brought in some $1.5 billion in income from 2008 to 2017, he reported even more — nearly $2 billion — in losses. And because he reported negative income, he didn’t pay a nickel in federal income taxes over those 10 years.

What enables this dual identity? The upside-down tax world of the ultrawealthy.

ProPublica’s analysis of more than 15 years of secret tax data for thousands of the wealthiest Americans shows that Ross is one of a special breed.

He is among a subset of the ultrarich who take advantage of owning businesses that generate enormous tax deductions that then flow through to their personal tax returns. Many of them are in commercial real estate or oil and gas, industries that have been granted unusual advantages in the American tax code, which allow the ultrawealthy to take tax losses even on profitable enterprises. Manhattan apartment towers that are soaring in value can be turned into sinkholes for tax purposes. A massively profitable natural gas pipeline company can churn out Texas-sized write-offs for its billionaire owner.

By being able to generate losses — effectively, by being the biggest losers — these Americans are the most effective income-tax avoiders among the ultrawealthy, ProPublica’s analysis of tax data found. While ProPublica has shown that some of the country’s absolute wealthiest people, including Jeff Bezos, Elon Musk and Michael Bloomberg, occasionally sidestep federal income tax entirely, this group does it year in and year out.

Take Silicon Valley real estate mogul Jay Paul, who hauled in $354 million between 2007 and 2018. According to Forbes, he vaulted into the ranks of the multibillionaires in those years. Yet Paul paid taxes in only one of those years, thanks to losses of over $700 million.

Then there’s Texas wildcatter Trevor Rees-Jones, who built Chief Oil & Gas into a major natural gas producer over the past two decades. The multibillionaire reported a total of $1.4 billion in income from 2013 to 2018, but offset that with even greater losses. He paid no federal income taxes in four of those six years.

None of the people mentioned in this article would discuss their taxes or tax-avoidance techniques with ProPublica.

A spokesperson for Ross declined to accept questions. In a statement, he said, “Stephen Ross has always followed the tax law. His returns — which were illegally obtained and descriptions of which were released by ProPublica — are reflective of and in accordance with federal tax policy. It should terrify every American that their information is not safe with the government and that media will act illegally in disseminating it. We will have no further correspondence with you as we believe this is an illegal act.” (As ProPublica has explained, the organization believes its actions are legal and protected by the Constitution.)

A spokesman for Rees-Jones declined to comment. Paul did not respond to repeated requests for comment.

The techniques used by these billionaires to generate losses are generally legal. Loopholes for fossil-fuel businesses date back practically to the income tax’s birth in the early 20th century. Carve-outs for real estate and oil and gas have withstood sporadic efforts at reform by Congress in part because there has been widespread support for investment in housing and energy.

The commercial real estate and fossil fuel breaks have enabled some of the wealthiest Americans to escape federal income taxes for long stretches of time. Sometimes they amass such large losses that they cannot use all of them in a given year. When that happens, they fill up reservoirs of deductions that they then draw down bit by bit to wipe away taxes in future years. Before ProPublica’s analysis of its trove of tax data, the extent of this type of avoidance among the nation’s wealthiest was not known.

Typical working Americans do not generate these kinds of business losses and thus can’t use them to offset income or reduce income tax.

As long as there have been income taxes, there have been schemes to manufacture illusory losses that reduce taxes, and there have likewise been counterefforts by Congress and the IRS to rein them in. But ProPublica’s findings show these measures to prevent deduction abuses “aren’t doing what they are supposed to do,” said Daniel Shaviro, the Wayne Perry Professor of Taxation at New York University Law School. “The system isn’t working right.”

For decades, One Columbus Place, a 51-story apartment complex in midtown Manhattan, has looked like an excellent investment. Located a block off the southwest corner of Central Park, it’s adjacent to the Columbus Circle mall for shopping at Coach or Swarovski or for dining at the Michelin three-star restaurant Per Se.

Its 729 rental units have churned out millions of dollars in rental income every year for its owners, among them Stephen Ross. Mortgage records show its value has skyrocketed, jumping from $250 million in the early 2000s to almost $550 million in 2016.

Yet, for more than a decade, this prime piece of New York real estate was a surefire money-loser for tax purposes. Since Ross acquired a share in the property in 2007, he has recorded $32 million in tax losses from his stake in a partnership that owns it, his tax records show.

Tax losses from properties owned through a host of such partnerships are central to Ross’ ability, and that of other real estate moguls, to continue to grow their wealth while reporting negative income year after year to the IRS.

Their down-is-up, up-is-down tax life comes in large part from provisions in the code that amplify developers’ ability to exploit write-offs from what’s known as depreciation, or the presumed decline in the value of assets over time. Some of these rules apply only to the real estate business, letting developers take outsize deductions today to reduce their taxable income while delaying their tax bill for decades — and potentially forever.

Depreciation itself is a widely accepted concept. In most businesses, the depreciation write-offs come from assets, like machinery, that reliably lose their value over time; eventually, a machine becomes outmoded or breaks down.

When it comes to real estate, a common justification for depreciation relies on the idea that space in older buildings will tend to command lower rents than space in newer ones, eventually making it worthwhile for an owner to knock down a building and construct a new one. So, if a building initially cost investors $100 million, the tax code allows them, over a period of years, to deduct that $100 million.

But rather than losing value, real estate properties often rise in value over time, much like One Columbus Place has done for Ross and his business partners. (That value includes the cost of the land, which doesn’t generate depreciation write-offs.)

These depreciation write-offs, along with deductions for interest and other expenses, have helped many of the nation’s wealthiest real estate developers largely avoid income taxes in recent years, even as their empires have grown more valuable.

Former President Donald Trump, for whom Ross hosted a $100,000-a-plate fundraiser in 2019, is perhaps the best-known example of commercial real estate’s tax beneficiaries. As The New York Times reported last year, Trump paid $750 in federal income taxes in 2016 and 2017, and nothing at all in 10 of the years between 2001 and 2015. According to ProPublica’s data, Trump took in $2.3 billion from 2008 to 2017, but his massive losses were more than enough to wipe that out and keep his overall income below zero every year. In 2008, Trump reported a negative income of over $650 million, one of the largest single-year losses in the tax trove obtained by ProPublica.

New York-area real estate developer Charles Kushner, the father of Trump’s son-in-law, Jared Kushner, also avoided federal income taxes for long stretches of time. Though he reported making some $330 million between 2008 and 2018, Charles Kushner paid income taxes only twice in that decade ($1.8 million in total) thanks to deductions. (Kushner went to prison in 2005 after being convicted of tax fraud and other charges. Trump pardoned him last year.)

A spokesperson for Trump did not respond to questions about his taxes. (The Trump Organization’s chief legal officer told The New York Times last year that Trump “has paid tens of millions of dollars in personal taxes to the federal government” over the past decade, an apparent reference to taxes other than income tax.) Representatives for Kushner did not respond to repeated requests for comment.

Even relative to fellow real estate developers, though, Stephen Ross is exceptional. He didn’t start out in commercial real estate. He began his career as a tax attorney.

Ross, 81, grew up on the outskirts of Detroit, the son of an inventor with little business savvy. After getting a business degree from the University of Michigan, Ross decided to go to law school to avoid the Vietnam war draft. He then extended his education, earning a master’s degree in tax law at New York University.

He saw the tax code as a puzzle to solve. “Most people, when you say you’re a tax lawyer, they think you’re filling out forms for the IRS,” Ross once told a group of NYU students. “But I look at it as probably the most creative aspect of law because you’re given a set of facts and you’re saying, ‘How do you really reduce or eliminate the tax consequences from those facts?’”

After graduating, Ross went to work, first at the accounting firm Coopers & Lybrand, and later at a Wall Street investment bank, which fired him. Then, with a $10,000 loan from his mother, Ross went into business for himself, selling tax shelters.

In its early years, Ross’ Related Companies solicited investments in affordable-housing projects from affluent professionals like doctors and dentists with the promise that the deals would generate deductions they could use on their taxes to offset the income from their day jobs.

By the mid-1970s, such shelters had become big business on Wall Street. The losses frequently subsidized economically dubious investments in a range of industries. It wasn’t uncommon for firms to offer investors the chance to get $2 or $3 worth of tax savings for every $1 they put in.

As the decade wore on, regulators increasingly took notice. The IRS started programs to scrutinize loss-making businesses. Ross and some of his real estate partnerships were audited, according to a company prospectus, and in some cases, the IRS determined that the firm had been too aggressive in taking write-offs from the projects.

Lawmakers began to crack down, too. In 1976, Congress limited the tax losses investors could take if they borrowed money to invest in industries like oil and gas or motion pictures. But the change didn’t apply to the real estate industry, which successfully argued that without such tax shelters, investors wouldn’t back new low-income housing.

In 1986, Congress sought to rein in tax shelters once more as part of a major tax overhaul. This time the changes included rules to prevent affluent people from using the kind of investments Ross had been offering. The rules shrank who could offset their other income using business losses to only those who had important roles in the business, such as those who spent a certain number of hours on it; so-called passive investors were out of luck.

Several tough years followed for Ross and others in the industry, but the real estate lobby mounted a pressure campaign that yielded results in 1993, when Congress allowed real estate professionals once again to use losses generated from their rental properties to wipe out taxable income from things like wages.

After being pounded by the real estate crash of the early 1990s, the Related Companies reorganized itself with an infusion of cash from new investors. Related made use of new federal housing tax credits, as well as local tax breaks and tax-exempt public financing offered by New York City to propel development of affordable housing units. The firm also continued to branch out into more traditional office and luxury apartment deals.

In 2003, the $1.7 billion development of Time Warner Center catapulted Ross indisputably into the upper echelon of New York developers. Then the most expensive real estate project in the history of the city, the two shining glass towers beside Columbus Circle also helped elevate Ross into the the Forbes 400 for the first time in 2006.

Despite his growing fortune, Ross often owed no federal income tax. In the 22 years from 1996 to 2017, he paid no federal income taxes 12 times. His largest tax bill came in 2006, when he owed $12.6 million after reporting just over $100 million in income.

In the years since, Ross has used a combination of business losses, tax credits and other deductions to sidestep such bills. In 2016, for example, Ross reported $306 million in income, including $219 million in capital gains, $51 million in interest income and $5 million in wages from his role at Related Companies. But he was able to offset that income entirely with losses, including by claiming $271 million in losses through his business activities that year and by tapping his reserve of losses from prior years.

ProPublica’s records don’t offer a complete picture of the sources of each taxpayer’s losses, but they do provide some insight. That year, for example, in addition to losses from One Columbus Place, Ross recorded a loss of $31 million from a partnership associated with the Miami Dolphins. As ProPublica previously reported, professional sports teams provide a stream of tax losses for their wealthy owners. Ross also had a loss of $16.9 million from RSE Ventures, his investment company, which has owned stakes in restaurants, a chickpea pasta maker and a drone racing league.

After taking all of his losses, his records show that he would have owed a small amount of alternative minimum tax, which is designed to ensure that taxpayers with high income and huge deductions pay at least some taxes. But Ross was able to eliminate that bill, too, by using tax credits, which he’d also built up a store of over the years. That left him with a federal income tax bill of zero dollars for the year.

Since the early 2000s, when he had significant taxable income, Ross has turned to a conventional technique for creating tax deductions: charitable donations. He has made a series of multimillion-dollar contributions to his alma mater, the University of Michigan, which have earned him naming rights to its business school and some of its sports facilities. In 2003, a partnership owned by Ross and his business partners donated part of a stake in a southern California property to the school, taking a $33 million tax deduction in exchange. But when the university sold the stake two years later, it got only $1.9 million for it.

In 2008, the IRS rejected the claimed tax deduction. In court, the agency argued that the transaction was “a sham for tax purposes” and that Ross and his partners had grossly overvalued the gift. After almost a decade of legal wrangling, a federal judge sided with the IRS, disallowing the deduction, including Ross’ personal share of $5.4 million. The judge also upheld millions of dollars in penalties that the IRS imposed on the partnership for engaging in the maneuver. Both the tax attorney and the accountant who advised Ross on the deal pleaded guilty to tax evasion in an unrelated case. (In a 2017 article on the case, a spokesperson said Ross “was surprised and extremely disappointed by the actions of the two individuals, who have pled guilty, and has severed all dealings with them.”)

Ross’ core business, real estate, remains almost unmatched as a way to avoid taxes.

For most investors, losses are limited by how much money they stand to lose if the enterprise goes belly up, or how much money they have “at risk.” But not real estate investors. They can deduct the depreciation of a property from their taxable income even if the money they used to buy the place was borrowed from a bank and the property is the only asset on the line for the loan. If they buy a building worth $50 million, putting $10 million down and borrowing the rest, they can still deduct $50 million from their personal taxes over time, even though they’ve put much less of their own money into the project.

Savings related to depreciation and similar write-offs are supposed to be temporary; when you sell the assets, you owe taxes not only on your profits from the sale, but on whatever depreciation you’ve taken on the property as well. In tax lingo, this is known as “depreciation recapture.”

But two big gifts in the tax code, working together, can allow real estate moguls to push off those taxes forever.

First, commercial real estate investors can avoid paying taxes on their gains by rolling sale proceeds into similar investments within six months. This provision of the tax code, called the “like-kind exchange,” goes back to the years following the end of World War I and used to apply to other kinds of property owners. Now it’s available only to real estate investors, a provision that’s expected to cost the U.S. Treasury $40 billion in revenue over the next 10 years. Real estate moguls can “swap till they drop,” as the industry saying has it.

Then, there are even more tax benefits that can be used when they do meet their demise — at least to benefit their heirs. For starters, all the gains in the value of the moguls’ properties are wiped out for tax purposes (a process known by the wonky phrase “step-up in basis”). The tax slate is similarly wiped clean when it comes to the depreciation write-offs that were taken on the properties. The heirs don’t have to pay depreciation recapture taxes.

Real estate heirs then get another quirky benefit: They can depreciate the same buildings all over again as if they’d just bought them, using the piggy bank of write-offs to shield their own income from taxes.

As for Ross, after filing his taxes for 2017, he still had a storehouse of tax losses that ProPublica estimates exceeded $440 million. It was entirely possible that he’d never pay federal income taxes again.

If you’re looking to get richer while telling the tax man you’re getting poorer, it’s hard to beat real estate development. But the oil and gas industry provides stiff competition.

Privileged as the lifeblood of the economy, the energy sector has long been lavished with tax breaks. Provisions dating to the 1910s allow drillers to immediately write off a large portion of their investments, essentially subsidizing oil and gas exploration.

One special gift from U.S. taxpayers to oil drillers is called depletion. The idea is grounded in common sense: As oil (or gas or coal) is taken out of the ground, there’s less left to collect later. That bit-by-bit depletion — analogous to depreciation — becomes a tax write-off. Each year, oil investors get to deduct a set percentage of the revenue from the property.

But investors can keep on deducting that set amount indefinitely, even after they’ve recouped their investment, a benefit that had its critics almost from the beginning. The idea was “based on no sound economic principle,” groused the Joint Committee on Taxation in 1926. Yet only in the 1970s was the depletion provision meaningfully curtailed, and then mainly for the largest oil producers. Congress left it in place for independent operators like wildcatters, long venerated as a cross between plucky entrepreneurs and cowboys.

Today the ranks of billionaires are filled with these independent operators. They get the best of both worlds: legacy tax breaks from the days when oil exploration was a crapshoot and current technology that makes the business much less speculative.

These tax breaks have long outlived their initial purpose of encouraging drilling, said Joseph Aldy, a professor of the practice of public policy at the John F. Kennedy School of Government at Harvard University. Now “we’re just giving money to rich people.”

Billionaires in the industry collect enough deductions to dwarf even vast incomes. Of the 18 billionaires ProPublica previously identified as having received COVID-19 stimulus checks last year — they were eligible because their huge tax write-offs resulted in reported incomes that fell below the middle-class cutoffs for receiving payments — six made their fortunes in the oil and gas industry.

One was Trevor Rees-Jones, who rode the shale fracking boom to build a fortune of over $4 billion while shrinking his federal income taxes to nothing.

His tax returns show huge income, over a billion dollars in total from 2013 to 2018, but even more enormous deductions. In 2013, for instance, Rees-Jones’ company, Chief Oil & Gas, made a major move, acquiring 40 natural gas wells in Pennsylvania’s Marcellus Shale for $500 million. Hundreds of millions in write-offs for that acquisition flowed to Rees-Jones’ taxes.

A spokesman for Rees-Jones declined to comment.

Another Texan, Kelcy Warren of the pipeline giant Energy Transfer, shows how the industry’s tax breaks, when blended with others that are more broadly available, can turn a wildly profitable company into a tax write-off for its owner, even as he reaps billions of dollars in income.

Warren, who co-founded Energy Transfer in the 1990s, is worth about $3.5 billion, according to Forbes. He built the company on a plan of aggressive expansion, through both acquisitions and building pipelines. “You must grow until you die,” he has said.

Warren’s aggressive strategy has allowed him to amass billions of dollars in income, only a small portion of which is taxed. (Representatives for Warren did not respond to requests for comment.)

Energy Transfer is publicly traded, but it’s structured as a special kind of partnership, called a master limited partnership. Only public companies in oil and gas, as well as a few other industries, can take this form.

Partnerships work differently than corporations. A corporation is a separate entity from its investors: The corporation pays taxes on its profits, and the investors pay taxes on the dividends they receive. By contrast, partnerships, including master limited partnerships, don’t generally pay taxes. Only the investors (the partners) pay taxes on their share of the partnership’s profits.

But when Energy Transfer sends regular cash distributions to its partners, these payments are, in most cases, considered a “return of capital” rather than a profit. They come tax free.

Warren’s stake in Energy Transfer — he is the primary general partner and holds hundreds of millions of units of the publicly traded limited partnership — has long entitled him to receive hundreds of millions of dollars in distributions every year, which have helped fund an outsize lifestyle. In addition to a 23,000-square-foot home in Dallas, which boasts a 200-seat theater, a bowling alley and a baseball field, he also has a fleet of private planes, an entire Honduran island, and an 11,000-acre ranch near Austin that has giraffes, javelinas and Asian oxen.

From 2010 to 2018, Warren was entitled to receive more than $1.5 billion in cash distributions, according to ProPublica’s analysis of company filings. During that time, Warren also disclosed an additional $500 million in income from other sources on his tax returns.

But in six of the nine years, he told the IRS he’d lost more money than he’d made. In four of them, he paid nothing.

Warren was able to wipe out his income tax liabilities because Energy Transfer provided him with huge deductions, not only from depletion and other tax breaks specific to oil and gas, but also from the way his company is allowed to account for depreciation.

After Energy Transfer builds a new pipeline, its value becomes an asset, one that will degrade over time, and thus produces depreciation deductions. All of that is standard. What’s unusual is that the tax code has long allowed Energy Transfer and its peers to treat the pipeline as if it lost more than half its value immediately. This “bonus depreciation” can wipe out billions in profits; indeed, in 2018, Energy Transfer reported $3.4 billion in profits in its annual public filing while simultaneously delivering big tax losses to its partners.

Lawmakers from both parties have supported bonus depreciation on the theory that the tax break, which is available across many industries, boosts spending on new equipment and juices the economy. But Trump and Republicans took the idea to its extreme in 2017 with two key changes that benefited aggressive companies like Energy Transfer in particular.

Under the new tax law, the “bonus” rose from 50% to 100%. In other words, for tax purposes, a shiny new pipeline becomes worthless upon completion. Second, the new law contained an even greater perk: It extended to the purchase of used equipment. This means that when a big company like Energy Transfer buys the assets of a smaller one, the value of all the smaller company’s equipment can be written off immediately.

Warren’s tax data reflects the benefits of this to individual owners. He entered 2018 already having built up an $82 million store of losses, and by the end of the year, he had increased it to over $130 million, ProPublica estimates.

Warren is a major Republican donor, having given $18 million to federal and state Republicans since 2015. Most of that went to supporting Trump, who was once an Energy Transfer investor.

Warren’s closeness to the Trump administration seemed to pay off. Days after taking office in 2017, Trump ordered the Army to reconsider a decision to block Energy Transfer’s Dakota Access Pipeline, whose planned path under a reservoir and near the Standing Rock Sioux Reservation had sparked strong opposition. Two weeks later, the pipeline was approved. Energy Transfer boasted record profits in the years that followed.

The company’s biggest quarter ever came last year. The reason? A $2.4 billion windfall from the worst winter storm to hit Texas in decades. Hundreds of Texans died. Utilities scrambled and prices for natural gas soared. San Antonio’s largest utility later accused Energy Transfer of “egregious” price gouging and sued to recoup some payments. The city’s mayor called Energy Transfer’s actions “the most massive wealth transfer in Texas history.” No company profited more, reported Bloomberg. (A spokesperson for Energy Transfer responded that the company had merely sold gas “at prevailing market prices.”)

It was a characteristic victory for Warren, who once said, “The most wealth I’ve ever made is during the dark times.”

Nobody knows just how many of the ultrawealthy are able to completely wipe out their income tax bills using business losses. The IRS publishes all sorts of reports analyzing the traits of taxpayers at different income levels, but its analysis typically starts with people who report $0 or more in income, thus excluding anyone who reported negative income.

But while the scope of the problem isn’t known, policymakers are well aware of techniques taxpayers use to game the system. Congress periodically seeks to tighten tax loopholes (often when it has ambitious spending initiatives it needs to pay for). For his part, President Joe Biden put forward plans this spring that would have axed a variety of oil and gas tax breaks, including percentage depletion. Master limited partnerships, the corporate form that Energy Transfer uses, were on the chopping block. In real estate, the special like-kind exchange carve-out was slated for elimination. The plans would have killed even the step-up in basis, the crucial provision that enables titans in both industries to reap huge deductions without worrying about a future income tax bill.

But as in the past, lobbyists for these industries rallied to preserve their privileged status, and these proposals were dropped.

A novel reform proposal still survives. Recent versions of Biden’s Build Back Better plan have contained a provision that would prevent wealthy taxpayers from using outsize losses from their businesses to wipe out other income in the future.

However, even if this proposal makes it into law, older losses that predate the legislation would still have a privileged status, immune to the new limitations. The biggest losers, it appears, will once again emerge unscathed.

If any of you all are surprised by this, I have a bridge for sale that you are welcomed to take a huge, tax-sheltered loss on…

Most laymen fail to grasp that the amount of money is secondary to the power it brings.

“Avoided” ??

Oh, you mean “Evaded.”

You mean there are perks for the rich in an oligarchical society?

Most wealthy types live off lines of credit. No income no tax. Of course getting tip money from wait staffs keeps the IRS busy.