WASHINGTON (AP) — Senate Republicans are stepping quickly to meet competing demands of holdout GOP senators for a tax overhaul package expected to add $1 trillion to the nation’s deficit over 10 years.

The Republicans eye a crucial final vote Friday on the $1.4 trillion Senate bill carrying the hopes of President Donald Trump and the Republican Party to preserve their majorities in next year’s elections.

Amid a whirl of meetings and dramatic votes Thursday evening, the Senate GOP leaders rewrote the bill behind closed doors. They weighed scaling back the tax cuts in the legislation to secure crucial support.

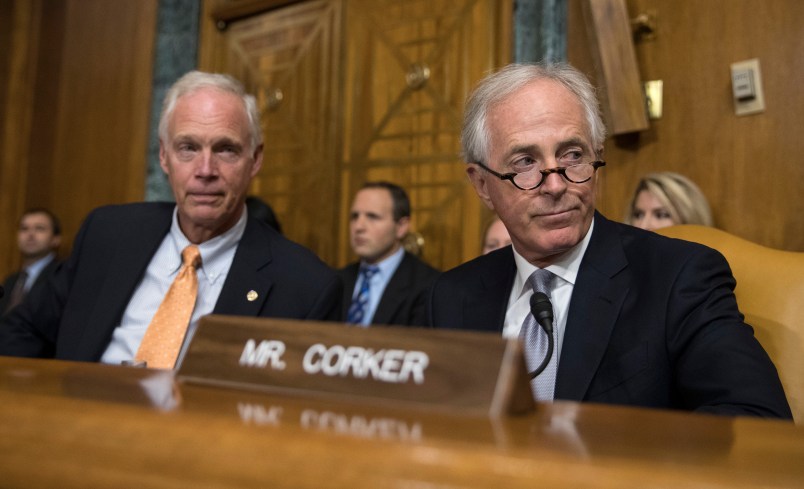

The leaders were making major changes up to the last minute, including one that would roll back some of the tax cuts after six years to appease deficit hawks — notably Sens. Bob Corker of Tennessee and Jeff Flake of Arizona.

Another faction to be reckoned with: senators supporting millions of businesses whose owners report the firm’s profits on their individual tax returns. The vast majority of U.S. businesses, big and small, are taxed this way. Sen. Steve Daines, R-Mont., backed the tax legislation Wednesday after securing an increase in the deduction for business income from 17.4 percent to 20 percent.

But Sen. Ron Johnson, R-Wis., said Thursday that he is still withholding support for the bill because he’d like the deduction boosted to 25 percent.

The scramble to alter the bill came after the Senate’s parliamentarian ruled that automatic “triggers” designed to guard against big deficits would violate Senate rules. GOP leaders’ main concern was winning over the hawks worried about adding more red ink to the mounting $20 trillion deficit.

Senate Majority Leader Mitch McConnell, R-Ky., had expressed confidence early in the day, but he has little margin for error with a 52-48 Republican majority. He can afford to lose only two votes while counting on Vice President Mike Pence to break the tie.

Sen. John Cornyn of Texas, the No. 2 Republican in the Senate, said the bill will have “alternative, frankly, tax increases we don’t want to do” to address deficit concerns.

Flake said the “trigger” tax increases would raise about $350 billion over 10 years, though he didn’t specify which taxes would go up.

In a dramatic turn, Democrats forced a vote on whether to return the measure to the Senate Finance Committee so it could be rewritten to ensure smaller deficits. After holding out for nearly an hour during the vote, Corker, Flake and Johnson eventually joined fellow Republicans to scuttle the Democratic proposal.

Corker has pushed to add automatic tax increases in future years if the package doesn’t raise as much revenue as projected.

With the provision seemingly dead, Corker said senators would change the bill to roll back some of the tax cuts in future years, regardless of whether tax revenues meet expectations. Flake said the tax increases would take affect after six years.

The overall legislation would bring the first overhaul of the U.S. tax code in 31 years. It would slash the corporate tax rate, offer more modest cuts for families and individuals and eliminate several popular deductions.

Unlike the tax bill passed by the House two weeks ago, the Senate measure would end the requirement in President Barack Obama’s health care law that people pay a tax penalty if they don’t buy health insurance.

The tax cuts for individuals in the Senate plan would expire in 2026 while the corporate tax cuts would be permanent.

Both the House and Senate bills would nearly double the standard deduction to around $12,000 for individuals and about $24,000 for married couples.

After Senate passage, lawmakers will try to reconcile the Senate bill with the House version in hopes of delivering a first major legislative accomplishment to Trump by Christmas.

A new analysis by the nonpartisan Joint Committee on Taxation found that the Senate bill would add $1 trillion to the deficit over a decade.

The bill would increase economic growth, generating an additional $458 billion in tax revenue, according to the analysis. That’s far short of the $2 trillion promised by Treasury Secretary Steven Mnuchin.

Two Republican senators, John McCain of Arizona and Lisa Murkowski of Alaska, announced their support for the tax package Thursday, giving it a major boost. The two had voted against the GOP bill to dismantle the Obama health care law this past summer.

Senators were still grappling with several issues, including a provision to add a deduction for local property taxes. The current Senate bill completely eliminates the federal deduction for state and local taxes, a popular benefit in the Democratic-leaning states of New York, New Jersey, California and Illinois as well as many wealthy suburbs nationwide.

Sen. Susan Collins, R-Maine, proposed an amendment to let homeowners deduct up to $10,000 in local property taxes on their federal returns. It’s similar to a provision in the House-passed bill. Without the deduction, Collins said, it would be “very problematic for me” to vote for the bill.

___

Associated Press writers Alan Fram and Andrew Taylor contributed to this report.

We are so boned. It seems the only facet of this thing that is not up for discussion is the permanent part of the corporate tax cuts.

Try a 25% corporate rate, and a nice middle-class cut and pay for it by closing loopholes for the rich. That would give you maybe 48 more votes.

And probably lose you 52 votes, including the VP’s.

Middle-class tax cut. Dreamer.

Sweeten the pot with a tax on baby formula in cities and subsidies for coal powered wind turbines. That will bring them around.