SANTA FE, N.M. (AP) — It’s being pitched as an educational lifeline for impoverished preschool-aged children and condemned as the latest example of local government overreach sweeping progressive cities from coast to coast.

Voters in New Mexico’s capital city have until Tuesday to decide whether to levy a new tax on sugary drinks that would raise the cost of a can of soda by nearly 25 cents.

The citywide tax on distributors would provide Santa Fe an estimated $7.5 million in its first year to expand early childhood education to roughly 1,000 children whose families cannot afford quality preschool and don’t qualify for state programs.

With the vote, Santa Fe is simultaneously wading into two topics that have provoked heated debates around the country — affordable preschool and the taxation of sugary drinks.

If approved, Santa Fe will join U.S. cities from Philadelphia to San Francisco that have adopted soda taxes in recent years. Billionaire Michael Bloomberg helped pass a ban on large-sized soft drinks when he was mayor of New York only to have it overturned by the courts, but he has since spent millions of dollars pushing soda taxes around the country.

Early voting has been underway since April 12 in Santa Fe, and competing political action committees have blanketed the city with advertisements through radio, TV, social media and mailbox fliers. The campaigns have spurred complaints of deception and questions about some untraceable political spending. An offer of free tacos to the first early voters by a pro-tax group was abandoned amid criticism of vote buying.

The American Beverage Association, the lobbying arm for the soft-drink industry, has contributed nearly $1 million in an attempt to defeat the measure. Pro-tax efforts have been bankrolled by Bloomberg, who has provided $1.1 million to the political committee Pre-K for Santa Fe in cash and direct campaign support.

The debate has even spilled over into interfaith forums, public rallies and fiery group discussions among local business owners.

Santa Fe Roman Catholic Archbishop John C. Wester threw his backing behind the tax, announcing that cities have no other choice than to fund preschool. The endorsement came after a Catholic rector in Santa Fe criticized the tax proposal on social media.

Mayor Javier Gonzales, a Democrat, calls the proposed tax both a moral imperative and a sound public investment, given mounting evidence that children who receive early schooling are less likely to fall behind, drop out and get mired in crime.

The proposal is being decided as working parents living just above poverty in Santa Fe struggle to pay the market rate for child care, despite the city’s $11 minimum wage.

For about half Santa Fe’s 3- and 4-year-olds, formal pre-kindergarten remains out of reach. Most of those families earn too little to benefit from proposed child care tax deductions backed by President Donald Trump and his daughter, Ivanka, who has become a leading advocate on the issue.

Efforts by New Mexico to expand early childhood education have stalled amid a state budget crisis and political resistance. The state currently allocates about $50 million a year to underwrite full- and part-time preschool for about 9,000 children but has been stymied from spending much more by faltering tax revenues.

“When there is a void that exists and when the state fails our community in meeting our responsibility to adequately fund education, I believe our city want us to step up,” Gonzales said.

Opponents of the tax have cast themselves as defenders of Santa Fe’s working poor, while sowing doubts about whether the tax can provide a sustainable source of revenue if it truly discourages consumption of sugary drinks.

“We think this targets hard-working families and small businesses,” said David Huynh, a spokesman for the political committee Better Way for Santa Fe & Pre-K. “There are definitely better ways to fund this without imposing the largest tax of its kind.”

The 2-cents-per-ounce tax would tie with Boulder, Colorado, as the nation’s most expensive. Under Santa Fe’s approach — which does not apply to artificial sweeteners or diet soda — the tax would be devoted solely to funding preschool.

City Councilor Ron Trujillo said he’s been cheered on for opposing the tax and urging city leaders to stick to fixing roads, parks and pipes.

“They feel that Santa Fe city government shouldn’t be telling them what they can drink,” he said.

Anti-tax sentiments were on prominent display as two professional canvassers recently knocked on doors in a working-class neighborhood.

One conversation ended with an abrupt question — “Is this to propose more taxes?” — and the door was quickly closed.

At another doorway, retiree Sheila Hartney offered grudging support.

“I’m not crazy about the idea with a sugar tax like this,” she said. “I like the part about early childhood education because it’s clear to me that there is an enormous need.”

Copyright 2017 The Associated Press. All rights reserved. This material may not be published, broadcast, rewritten or redistributed.

This fight has been gearing up for awhile because the pro-sugar people were running ads about this 3 years ago on New Mexico TV with pleas not to take away the children’s juice boxes and their cokes.

What they fail to talk about however, is how very prevalent diabetes is in New Mexico. Native Americans are very prone to develop diabetes and I know it’s a big problem in the Hispanic population too.

And everything in the article that was said about public education in New Mexico was an understatement - it really needs all the help it can get. New Mexico is poor and the schools are poor. The dropout rate is high.

So since regulation and legislation are balancing acts, it seems to me on balance that it’s a reasonable tax.

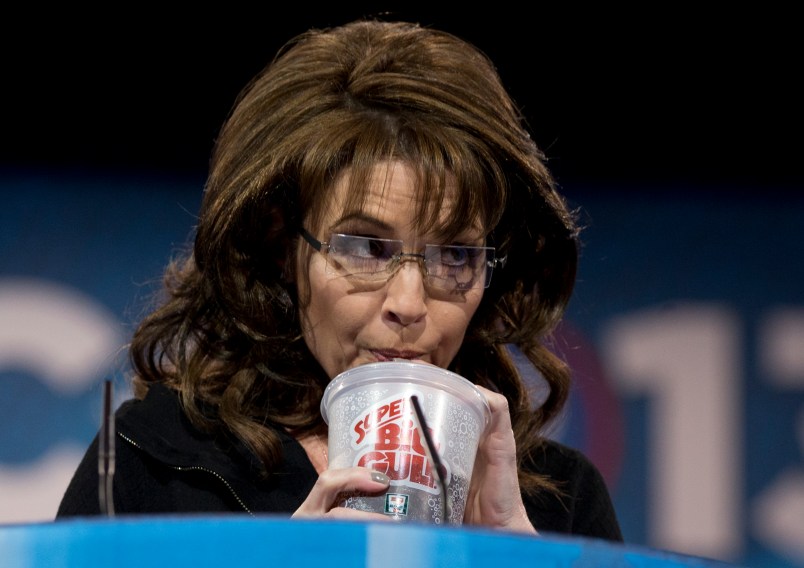

Nice pic. Bible Spice? Caribou Barbie? Snowmachine Sarah? Wasilla Hillbilla? Whore of Babble On?

Oh, right: Saccharine Sarah, you betcha, doncha know, also.

On a related note:

Fuck You, Sid McCrashcup!

It’s not an involuntary tic, it’s a feature.™