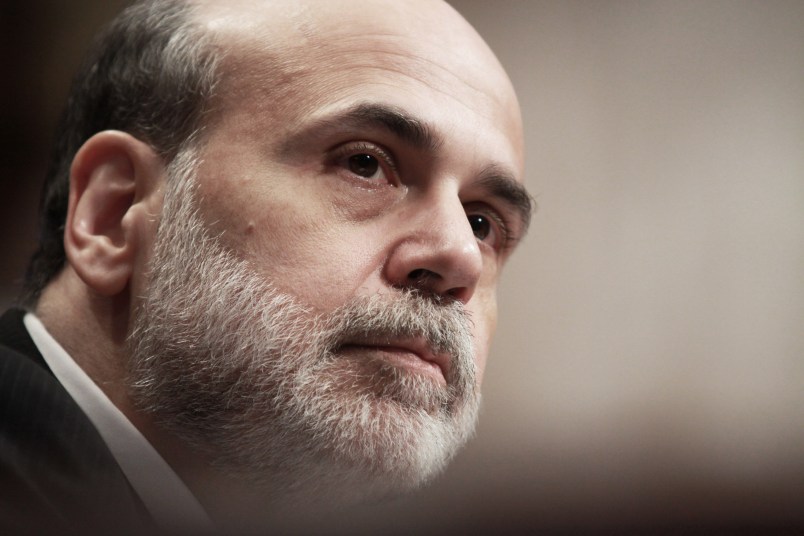

Today, MoveOn.org sent out an email urging its members to tell their Senators to vote against reconfirming Federal Reserve Chair Ben Bernanke. Read the full email after the jump.

With the struggling economy topping the list of concerns for most Americans, it’s clear that we need new economic leadership in Washington

Instead, President Obama has renominated Federal Reserve Chair Ben Bernanke, a holdover from the Bush administration, for another term.

Bernanke presided over the biggest Wall Street bailout in history, making trillions of dollars in loans to big banks with no oversight.1 But after taking extreme measures to save the banks, Bernanke has shown no interest in helping regular folks who can’t find jobs, even though ensuring “full employment” is explicitly part of his mandate.

[…]

Bernanke has had numerous opportunities to tell Congress and the American people specifically how he’ll change the Fed policies that contributed to the financial meltdown and how he’ll work to clean up the mess it created. Instead, all he’s offered are platitudes and inaction.

When asked what the Fed would do differently next time, Bernanke called for “better and smarter” regulation, without any explanation of what that means. He’s also pushed for giving regulators more power over financial firms–but he won’t acknowledge that regulators didn’t use the powers they already had this time. And he won’t admit that the Fed completely missed the real-estate bubble, even though many outside economists were warning of the danger it posed.

Bernanke has also opposed a cornerstone of the administration’s financial reform package: the Consumer Financial Protection Agency. He wants to keep responsibility for consumer protection where it is now: under his authority at the Fed. That idea is ludicrous–it was the Fed that refused to protect consumers from the shady subprime mortgage lenders and ripoff credit card deals that imperiled our economy.

Finally, and perhaps most troublingly, Bernanke has completely ignored his responsibility to help fight massive unemployment. He acknowledged to Congress that there are steps the Fed could take that would “stimulate spending and output” to help our economy start growing again. But he’s not interested in taking them.

With views like this, it’s clear that Bernanke is more interested in continuing business as usual than helping those who are struggling. We just can’t afford to have someone like that setting economic policy.