This article was originally published at ProPublica, a Pulitzer Prize-winning investigative newsroom.

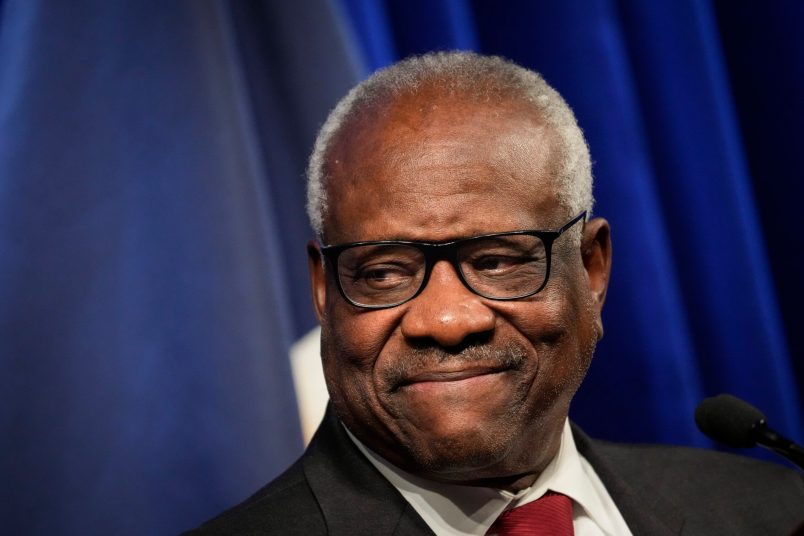

Supreme Court Justice Clarence Thomas’ decadeslong friendship with real estate tycoon Harlan Crow and Samuel Alito’s luxury travel with billionaire Paul Singer have raised questions about influence and ethics at the nation’s highest court.

For months, Supreme Court Justice Clarence Thomas and his allies have defended Thomas’ practice of not disclosing free luxury travel by saying the trips fell under a carve-out to the federal disclosure law for government officials.

But by not publicly reporting his trips to the Bohemian Grove and to a 2018 Koch network event, Thomas appears to have violated the disclosure law, even by his own permissive interpretation of it, ethics law experts said. The details of the trips, which ProPublica first reported last month, could prove important evidence in any formal investigation of Thomas’ conduct.

Thomas’ defense has centered on what’s known as the personal hospitality exemption, part of a federal law passed after Watergate that requires Supreme Court justices and many other officials to publicly report most gifts.

Under the exemption, gifts of “food, lodging, or entertainment received as personal hospitality” don’t have to be disclosed. The law provides a technical definition of “personal hospitality.” It only applies to gifts received from someone at that person’s home or “on property or facilities” that they or their family own. A judge would generally not need to disclose a weekend at a friend’s house; they would need to report if someone paid for them to stay at the Ritz-Carlton.

Numerous ethics law experts have said that gifts of transportation, such as private jet flights, must be disclosed under the law because they are not “food, lodging, or entertainment.”

Thomas has laid out a different view of the disclosure requirements. In his financial disclosure released in late August, Thomas asserted that the personal hospitality exemption extended to transportation. Justice Samuel Alito has made the same argument in an op-ed where he elaborated on his reasoning: private jets would count as “facilities” under the law’s definition of personal hospitality. In this view of the disclosure requirements, a key question would be whether the person providing a private jet flight actually owned the jet. So, for example, Thomas would not need to report flights on his friend Harlan Crow’s private plane because Crow owns it.

Thomas and Alito’s position is incorrect, many experts said, because it simply ignores the statute’s language: that the personal hospitality exemption only applies to food, lodging, or entertainment.

But there’s an additional reason the newly revealed trips should have been disclosed.

ProPublica recently reported that in 2018, Thomas traveled on a Gulfstream G200 private jet to Palm Springs, California, to attend a dinner at the Koch political network’s donor summit. He didn’t hitch a ride on a jet owned by a friend. Instead, he flew there on a chartered plane: a jet available through an Uber-like service that lets wealthy individuals rent other people’s planes. The owner of the jet at the time, Connecticut real estate developer John Fareri, confirmed to ProPublica that he didn’t provide the plane to Thomas and that the Palm Springs flight was a charter flight. That means someone else — not the owner — paid.

A Koch network spokesperson said the network didn’t pay for the flights. Because Thomas didn’t disclose the trip, it’s still not clear who chartered the plane. Jet charter companies told ProPublica the flights could have cost more than $75,000.

Experts told ProPublica they couldn’t think of an argument that would justify not disclosing the Palm Springs trip. “Even using Thomas’ flawed logic about the personal hospitality exception, there’s no way this chartered flight fits into that exception,” said Kedric Payne, a former deputy chief counsel at Congress’ ethics office.

Thomas and his attorney did not respond to questions about why he didn’t disclose the flight or if he paid for it himself. After the Palm Springs donor event, the plane flew to an airport outside Denver, where Thomas appeared at a ceremony honoring his former clerk, then back to northern Virginia, where Thomas lives.

Thomas’ undisclosed trips to the Bohemian Grove present a similar issue. As ProPublica reported last month, Thomas has for 25 years been a regular at the Grove, an all-men’s retreat held on a 2,700-acre property in California. Thomas has been hosted by Crow, who is a member of the secretive club, and stayed at a lodge there called Midway. Members typically must pay thousands of dollars to bring a guest, according to a Grove guest application form obtained by ProPublica and interviews with members.

Crow does not own the Grove nor does he own the lodge where Thomas has stayed. Experts said in these instances again, even by Thomas’ own characterization of the rules, he appears to have violated the law by not disclosing the trips.

“It makes a mockery of the statute,” said Richard Painter, who served as the chief ethics lawyer for the George W. Bush White House. Painter said that if charter flights and trips to Grove don’t need to be disclosed, “you could call everything personal hospitality. Broadway show tickets. A first-class ticket on Delta Air Lines. A trip on the Queen Mary.”

Following ProPublica’s reporting on Thomas’ failure to disclose gifts earlier this year, members of Congress sent a complaint to the Judicial Conference, the arm of the judiciary responsible for implementing the disclosure law. In April, the Judicial Conference said it had referred the matter to a committee of judges responsible for reviewing such allegations.

The law says that if there is “reasonable cause” to believe a judge “willfully” failed to disclose information they were required to, the conference should refer the matter to the U.S. attorney general, who can pursue penalties. But that would be unprecedented. As of May, the Judicial Conference said it had never made such a referral. The committee’s process appears to be ongoing.

In his filing in August, Thomas said that his view of the disclosure rules was based in part on conversations he had with staff at the Judicial Conference. Thomas did not respond to questions about the advice he received. A judiciary spokesperson declined to comment on whether it was ever the Judicial Conference’s position that gifts of private jet flights didn’t need to be reported.

This March, the judiciary revised its regulations to make explicit that private jet travel must be disclosed because transportation is not covered by the personal hospitality exemption. Experts said the update merely clarified what was always the case. (ProPublica reviewed other federal judges’ financial disclosure filings and found at least six recent examples of judges disclosing gifts of private jet travel before the regulations were updated.)

More than a decade ago, Thomas’ disclosure practices came under scrutiny following research by a watchdog group and a story in The New York Times about his relationship with Crow. Democratic lawmakers wrote to the Judicial Conference in 2011, saying that Thomas had failed to report the sources of his wife’s income and that he “may” have also received free private jet trips without reporting them.

What happened after that remains opaque.

In a four-sentence letter the following year, the secretary to the Judicial Conference said that the complaint had been reviewed. “Nothing has been presented,” he wrote, “to support a determination” that Thomas improperly failed to report gifts of travel. The letter did not detail what steps the conference took, the reasoning behind its decision or what information it had been presented with.

At the time, nothing in the public record had established that Thomas had ever accepted undisclosed private jet flights. But Thomas’ attorney Elliot Berke has cited the 2012 letter as vindication of Thomas’ practices. “The Judicial Conference issued a letter confirming that Justice Thomas had not improperly failed to disclose information concerning his travel,” Berke wrote.

ProPublica asked the Judicial Conference for details on the 2012 episode, including whether the committee conducted an investigation and an explanation of its ultimate conclusion: Did it determine that private jet flights need not be reported? Or did it determine that it wasn’t clear if Thomas had actually accepted such a gift?

A Judicial Conference spokesperson declined to comment.

Yes, many issues have been raised, many, many thoughtful questions being asked, and furrowed brows as well, but here’s how it will play out:

Behold, the arrogance of power.

So there’s the English language and common understanding of the English language, then there’s what lawyers say is the English language?

If Clarence can’t get his travel expenses reimbursed by his employer, the U.S. Government, then it’s PERSONAL. His – and Ginni’s – federal income tax returns should be released. No more of this “range” of incomes and property values.

BECAUSE I’M CLARENCE THOMAS, BITCH!

This is all of the explanation that is necessary.