As legislators resume going through the motions of preparing to act on COVID-19 relief, economists and advocates are warning that millions of Americans could face a loss of benefits by the end of December if Congress fails to act.

Among them are 12 million people who could lose their unemployment benefits.

“That’s the real war on Christmas” quipped Arnab Datta, a senior legislative counsel at Employ America. “It’s not just shameful, it’s gonna devastate the economy.”

“The longer this drags on, the worse it will be,” added Stephanie Aaronson, director of the Economic Studies program at the Brookings Institute. “When people face long-term unemployment or drop out of the labor force, there is a lower likelihood that they’ll go back in, so it will take even longer for the economy to recover.”

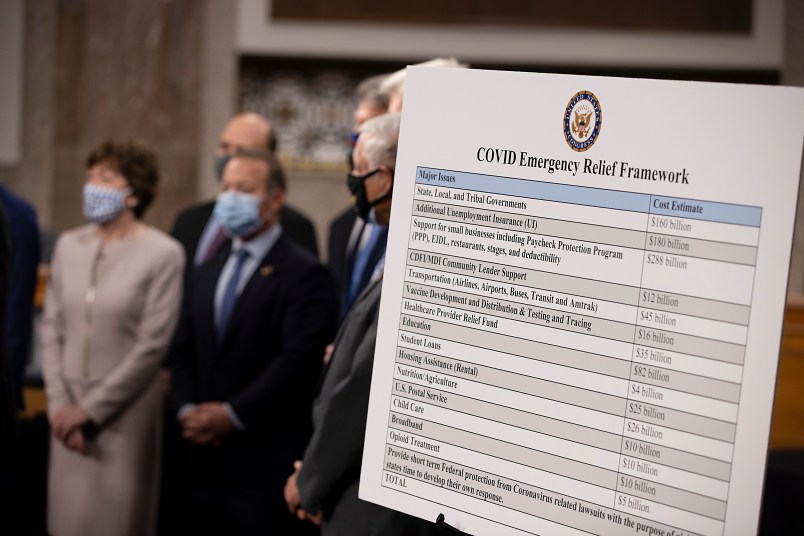

A bipartisan working group — including Sens. Mitt Romney (R-UT), Chris Coons (D-DE), Joe Manchin (D-WV) and others — unveiled a COVID relief proposal packed with concessions for both sides on Tuesday. The package, which rings in at $908 billion, includes Democratic priorities like billions for state and local governments, and Republican priorities like a short-term liability shield to protect companies from COVID-19-related lawsuits.

It’s not at all clear that the plan will coax either party’s leadership out of their months-long entrenched positions.

Treasury Secretary Steve Mnuchin also told reporters Tuesday that he’d meet with House Speaker Nancy Pelosi (D-CA) later in the day to discuss funding. While Mnuchin’s involvement seems more auspicious than, say, Chief of Staff Mark Meadows’ — someone Democrats found impossible to work with in previous COVID-19 relief negotiations — it’s still not certain that the fundamentals of the impasse have changed. Democrats still want an expansive package to cover many industries and facets of the flailing economy; Republicans want limited, smaller relief for certain parts.

The gravity of the situation has continued to worsen. Since the passage of the CARES Act last March, hundreds of thousands of Americans have died of the virus or lost their jobs. While, per the October jobs report, unemployment has been decreasing, long-term unemployment — defined as sixth months of joblessness — is growing. There is also a serious concern that any economic improvement is temporary as the cold winter months drive people indoors and rising numbers of COVID-19 cases shutter businesses.

Many have come to rely on what aid Congress has been able to pass, particularly Pandemic Unemployment Assistance (PUA) for gig workers and those not entitled to regular benefits, and Pandemic Emergency Unemployment Compensation (PEUC), federally-funded benefits for those facing long-term unemployment.

Funding for those programs expires the day after Christmas, leaving, by one estimate, 12 million people without benefits. That’s on top of the 4 million people who The Century Foundation calculates will have already run through their CARES Act aid before that date.

While the December 26 cliff has many advocates most worried, there are plenty of other holiday disasters around the corner if Congress fails to act. The CDC’s eviction moratorium expires on December 31. That’s the same day that the period of suspended payments on federal student loans ends, as does the 0% interest rate on those loans.

“I am nearly panicked about the expirations coming at the end of the year,” Wendy Edelberg, senior fellow in Economic Studies at the Brookings Institution, told TPM. “Months ago, my hoped-for goal was more fiscal support for the economy. Now my goal is at least maintaining what we have.”

And there are some coming problems that have nearly escaped notice altogether.

PUA, the benefit for gig workers, was not written with a policy to waive recoupment for overpayment, like most other unemployment insurance programs were. In other words, if someone has accidentally been overpaid for months due to an error by the agency or employer, the worker will owe that money back. That repayment could be in the neighborhood of tens of thousands of dollars, per Michele Evermore, senior policy analyst at the National Employment Law Project.

“Without congressional action, people get the notice and can’t do much about it,” Evermore told TPM. “They can appeal, but the appeals process takes forever.”

The majority of states waive the repayment of accidental overpaying if it would cause financial hardship to the recipient and is the fault of the agency or employer. Congress could write into a relief package an allowance to let states also waive repayment related to the pandemic assistance. Such a fix was included in the second incarnation of the House’s HEROES Act, an omnibus relief package passed by Democrats in October and flatly rejected by Senate Republicans.

With the pandemic assistance, it will be even more important to install the safety net than it is with regular unemployment insurance. Usually, agencies have the bandwidth to check for overpayment mistakes regularly, which helps keep the monetary amounts lower, Evermore said. But with the agencies more overburdened amid the pandemic, those checks have been less frequent, resulting in larger amounts. In addition, these pandemic programs were set up quickly, to get money out the door fast — a situation Evermore described as a recipe for potential mistakes.

“Usually overpayment is about 10 percent,” she said of regular unemployment insurance. “At its peak, 15 million people were on PUA. That rate will probably be significantly higher because of so many more mistakes — I’m thinking we could be facing up to 25 percent overpayment.”

“It’s the most important thing no one’s talking about,” she added.

All of these threats together paint a very bleak winter, if Congress doesn’t act. And the damage done will be much harder to rectify, said Aaronson of Brookings.

“That will create a level of hardship that we have not really experienced,” she said. “The longer these conditions persist, the harder it will be for us to recover. After months of unemployment when people max out their credit cards and lose their leases — that’s when the real structural damage kicks in.”

Can someone tell me the benefits of Trumpism at times like this?

Moscow Mitch is going to have to allow a relief package that actually provides help to working class individuals, state and local governments, and small businesses. He won’t be able to keep his caucus in line otherwise, too many represent states that are hurting and many will be facing re-election in 2 years.

Yeah, owning the libs isn’t going to cut it.

The Bipartisan group…headed by Joe Manchin & Susan Collins, is doomed for Success:

The group’s working title: $ 1.00 Tippers United.

Please don’t push the Republicans.

It is hard for them to figure out if they can get away with people dying, people losing their homes or apartments, businesses going under, people starving and still look like they care.

We just don’t understand.