Since President Biden took office, the comparisons have not been so much to his predecessor.

While the country faces a severe case of whiplash as it moves from Trump to the calmer and more collected Biden, many observers are focusing on a finer distinction: between Biden and President Obama.

One of the areas in which that difference in American politics between the two administrations has been most pronounced is the current silence where cries demanding austerity were once deafening.

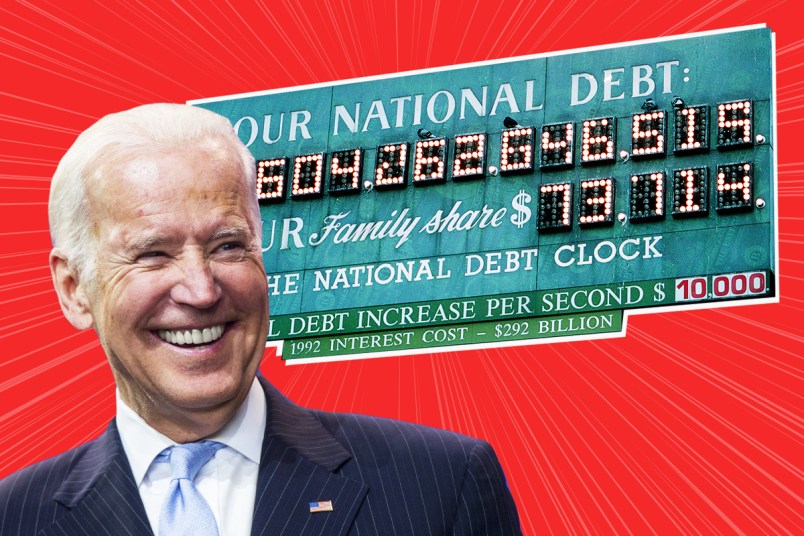

Instead, under Biden, that space has so far been replaced by curious speculation about whether the new President can take credit for a generational political pivot away from fears about the size of the national debt, and towards a future that the White House’s supporters describe as a leap into a new, post-Reaganite era.

Meanwhile, Republicans have been notably tepid when voicing their usual calls to rein in spending. Whenever someone tries to argue in the press that concerns about servicing the national debt in the future should outweigh present spending, they’re shouted down.

So where have the austerity hawks gone?

Bad faith

As Biden’s victory became certain in the first week of November, Sen. Lindsey Graham (R-SC) declared his priority should Republicans hold the Senate: addressing the national debt.

The GOP did not hold the Senate, but, even then, Graham’s ploy was painfully obvious: use concerns about the national debt as an excuse to prevent progressive priorities from passing.

That’s a departure from the early years of the Obama administration. Then Obama played at least some homage to fears around rising deficits, pledging in February 2009 to cut the deficit his administration inherited by half before the end of his first term.

That may have been a rhetorical ploy meant to cut GOP deficit-mongers off from oxygen, caving to their concerns as a way of muzzling the criticism. Others, like Columbia University Professor Adam Tooze, contend that Obama aides were ready in the late 2000s to fight a crisis, but not the one that came. Rather, they had prepared for a situation in which the bond market balked at the size of the national debt, fleeing it and causing interest rates to skyrocket.

But developments over the past decade have shown how even sincere concerns about the size of the debt are profoundly flawed, as the predictions of the austerity alarmists — inflation, rising interest rates, a collapse in bond marketing financing — did not come true. Meanwhile, Republican politicians who stoked the concerns passed a massive tax cut once in power, revealing the extent of the bad faith made in peddling those claims. Now, it’s almost embarrassing to be seen to take these concerns seriously, argued Mike Konczal, Director of Progressive Thought at the Roosevelt Institute.

Since the early 2010s, when the GOP was aided by economics professors arguing that the size of the national debt would lead to another economic crash, not only have none of those predictions come true, but the Republicans themselves passed a massive tax cut in 2017 which further ballooned the size of the national debt.

“A lot of electeds were like, ‘wow, we really were caught off guard by how cynical that was,'” Konczal told TPM.

He added that Democrats had since held the line in not voting for the 2017 tax cuts not on concerns about the national debt, but about the way the cuts distribute huge amounts of money towards the already-wealthy.

“And that’s going to be sustainable, that reflects a real shift, we’re not going to prioritize these concerns,” he added.

Infrastructure generation

With the passage of the $1.9 trillion American Rescue Plan earlier in March, the incoming push for a two-part, potential $3 trillion infrastructure bill has further raised expectations about the extent to which the Biden administration may be unconstrained by austerity concerns.

Biden is set to give a speech on Wednesday announcing his vision for the legislation in Pittsburgh.

But the fate of the infrastructure package may better reveal the extent to which austerity alarmism has really faded away.

So far, the legislation has not been pitched as a crisis-fighting measure in the same way that last year’s CARES Act was, or that the American Rescue Plan was. Rather, it’s being portrayed as a long-term investment for the country’s future, giving the U.S. a push to adjust for climate change, modernize national transportation networks, and strengthen the safety net.

Beyond that, the White House reportedly is considering using tax increases to finance the infrastructure program. That goes further than other proposals in rejecting austerity concerns, in part because alarmism about the debt so often translates to worry that taxes will go up on the wealthy in order to pay it off.

Konczal argued that it’s too soon to tell whether the rejection of austerity concern-trolling signaled a new era, but that the results of the Biden administration’s actions would likely set the tone.

“If there’s a swift recovery, there’s nothing like success to make people more sensible,” he said.

I’m still here!

Cap Gains tax increases, transaction taxes on the bots, and increased corporate taxation welcome.

Never.

Yes, you’re still here.

If only the alarmists were proposing what you’re proposing!

“Deficits don’t matter” was coined by a Republican.

Nuff said.

When you’ve run up over $8 Trillion in debt in 4 years, it’s a little hard to pivot. Not to mention the annual budget deficit tripled under Reagan/Bush I compared to Carter, then Clinton balanced the budget. Then Bush II left a trillion dollar deficit, which Obama brought down to around $300 Billion. Then the King of Debt went hog wild.

If there were any doubt that Republicans don’t care about debt, they just want to punish the American people for putting a Democrat in office, this last go around on ARP put that to rest.

Or as I tell my Republican friends, “The sore losers are back! Time to punish the country for voting against you.”