The shady anti-financial reform group Stop Too Big To Fail today announced a new TV advertising push in three key states that features an out-of-context quote from former Labor Secretary Robert Reich to bolster its case to kill financial reform.

As TPMmuckraker has reported, Stop Too Big To Fail is the project of a veteran astroturf operation called Consumers for Competitive Choice, and it’s using the services of an ad agency that worked with the Swift Boat Vets For Truth in 2004. It has already spent $1.6 million on anti-reform ads and won’t say who’s funding the group’s efforts.

Stop Too Big To Fail previously featured progressive economist Simon Johnson on one of its media conference calls before he realized the goals of the outfit and demanded it stop using his name. Now, Stop Too Big To Fail has turned to using Reich to add credibility to a message designed to sound progressive, while in fact advocating to kill the financial reform legislation.

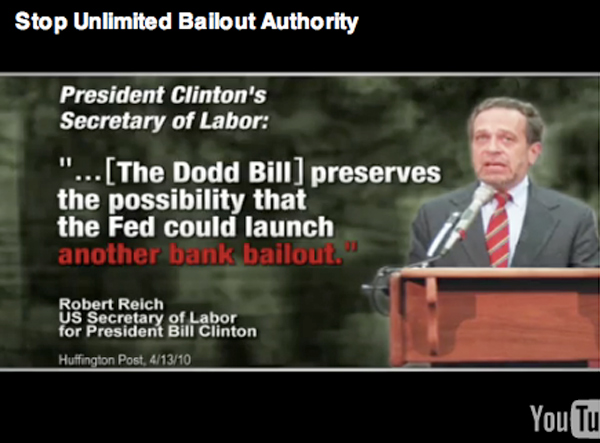

The new ad, which is running in Virginia, Missouri, and Nevada, claims in an ominous voice-over: “Congress is considering so-called financial reform that gives our government unlimited executive bailout authority. Unlimited bailouts for big banks, paid for by you and me.

Even President Clinton’s secretary of labor said, ‘it preserves the possibility that the Fed could launch another bank bailout.'” The ad demands: “No more bailouts with our money.”

It finishes by asking viewers to call their senators and ask them to vote against financial reform. (Watch the ad below.)

If the messaging sounds familiar, that’s because it’s what we’ve been hearing from Republican opponents of reform in recent weeks: keep talking about bailouts while seeking to slow-walk or kill the reform bill.

Now, as it happens, if you read the column the group cites in the ad, Reich was actually describing the very strategy employed by Stop Too Big To Fail. In part of that column, he critiques the Dodd bill as not being tough enough on big banks — but he’s arguing for tougher reform, not for no reform at all.

Here’s a taste of Reich’s column, “The Republican Strategy on Financial Reform: Make Democrats Look Like Patsies for the Street” (emphasis ours):

Senate Republicans today debuted their new strategy for financial reform: Refuse to cooperate with Democrats on grounds that the Dems are too willing to give Wall Street what it wants. …

But the Street thinks the Dodd bill goes way too far, and wants its Republican allies to water it down with more loopholes, studies, and regulatory discretion. Republicans figure they can accommodate the Street by refusing to give the Dems the votes they need unless the Dems agree to weaken the bill — while Republicans simultaneously tell the public they’re strengthening the bill and reducing the likelihood of future bailouts.

Reich has described the Dodd bill as a “modest” step in the right direction.

He has also critiqued the “bailout fund” rhetoric employed by Republicans as well as Stop Too Big To Fail. The other day, Reich called out Senate Minority Leader Mitch McConnell for using Reich’s name in much the same way as Stop Too Big To Fail.

We’ve reached out to Reich, and we’ll let you know when we hear back.

Here’s the new ad:

Late Update: In an email to TPMmuckraker, Reich blasted the group for using his name:

“They’re cynically and purposefully distorting what I said. As I’ve repeatedly noted, the Dodd bill’s liquidation fund is not a bailout fund. The quote they took out of context was my argument that because the Dodd bill fails to limit the size of the biggest banks, the Fed would have to bail them out if several get into trouble at the same time — as the big banks did when the housing bubble burst,” he wrote. “Those who sponsor this ad — Wall Street and its supporters who want to torpedo the Dodd bill — would never support limiting the size of the big banks.”