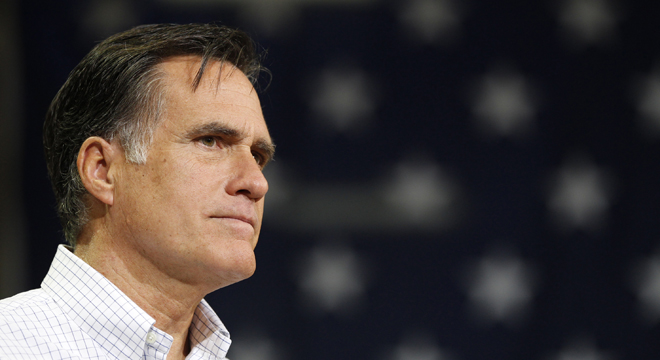

Mitt Romney took a surprisingly populist tack when he announced the topline details of his new tax plan. But the framework his advisers presented to the press on Wednesday is still short on details, and on the surface it appears to benefit wealthy Americans disproportionately, just as his original plan did.

Romney is advertising the plan as neutral — or maybe even progressive — since it would cut tax rates by exactly 20% for every income bracket. In addition, Romney said earlier today that the rate cuts would be offset in part by eliminating tax deductions that mostly benefit the wealthy, adopting the language of Occupy Wall Street protestors along the way to make his point.

“In order to limit any impact on the deficit, because I do not want to add to the deficit, and also in order to make sure we continue to have progressivity as we’ve had in the past in our code, I’m going to limit the deductions and exemptions particularly for high income folks,” Romney said earlier on Wednesday. “And by the way, I want to make sure you understand that, for middle income families, the deductibility of home mortgage interest and charitable contributions will continue. But for high income folks, we are going to cut back on that, so we make sure the top 1% pay their fair share or more.”

It’s not the first time Romney has pledged to focus on the middle class over the wealthy in those terms: “The 1% is doing fine. I want to help the 99%,” he told Univision last month.

But the plan doesn’t seem to live up to the populist rhetoric. At best, it’s too vague to judge without more information. He has offered little details regarding which deductions he would nix or scale back (or, if the latter, by how much). And his plan is silent about benefits such as the Earned Income Tax Credit that overwhelmingly help middle and low income families. TPM has reached out to the Romney campaign for more information about which deductions would be off limits.

In addition, the proposal still includes many of the same components that led the Tax Policy Center to conclude that his original plan would constitute an enormous boon for the wealthiest Americans. It assumes that the Bush tax cuts will be made permanent — a premise that implies deeply inadequate tax revenue, and that permanently enshrines benefits like a 15% top tax rate on capital gains and dividends that are a bonanza for high net-worth individuals. Romney also wants to eliminate the estate tax entirely, a significant giveaway to the wealthiest families in the country, and he assumes savings from repealing the Affordable Care Act — a law that is projected to reduce the deficit in part thanks to new taxes on high-end health plans and investment income that mostly affect the rich.

To put it in terms that have underlined this campaign’s narrative, there’s little indication Romney will have to pay a higher effective tax rate than the 13.9% he paid in 2010, since he’s proposed no concrete changes to the capital gains tax rate that applies to most of his investment income. Closing the carried interest loophole, which allows private equity fund managers like Romney to pay the lower capital gains rate on their profits, would result in Romney and other wealthy investors paying higher taxes. But in his new plan Romney merely pledges to ask the future Treasury Secretary to further scrutinize that loophole — not to eliminate it altogether.

None of this counts the impact of the budget cuts Romney’s campaign says will be required to offset the revenue lost by giving all earners a tax cut. Romney’s economic adviser, Glenn Hubbard, told TPM that since Romney favors means testing for entitlement benefits like Social Security and Medicare, the rich will bear some of the burden. But Romney would also raise the retirement age on Social Security — a famously regressive benefit cut. And he has released few details about whether or to what extent his proposed Medicare overhaul — turning the program into a subsidized private insurance market with a competing public option — would save money or require greater out-of-pocket costs for seniors.