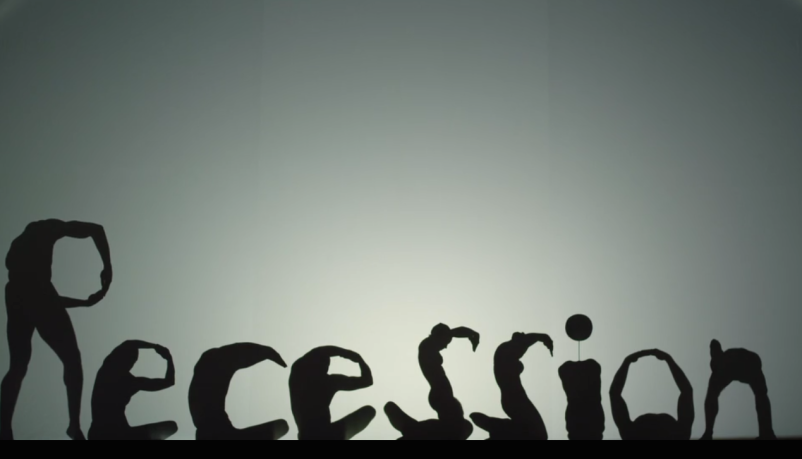

The Atlanta Fed has again lowered its projection for first quarter 2025 GDP. It had been predicting growth of 2.3%. At the end of last week that was revised to 1.5% contraction and this morning they were again down-revised 2.8% contraction, or in other words 2.8% negative growth. To be clear these aren’t final or official stats. We’re only two-thirds of the way through the quarter. They are a prediction based on current indicators. But if it’s not clear that would mean a steep move into recession. And the numbers which presage that outcome are largely tied to general economic uncertainty and various collective economic decisions based on the expectations of a dramatic ramp up in U.S. tariffs and tariff retaliation.

Normally, you wouldn’t expect that an administration would be able to manage such a stark reversal six weeks into a presidency. The first three weeks of the quarter weren’t even under Trump. What’s critical however is that consumers and businesses have known about or expected big new tariffs since mid-November. And a lot of this is an import spending spree trying to get out ahead of the onset of tariffs. So in that sense, as an economic reality, Trump’s second administration really began almost four months ago. That’s more than enough time for this kind of economic impact. The Commerce Department also released data Friday showing a sharp drop off in consumer sentiment and purchasing. And that at least directionally matches private sector data from the end of last month.

With these predictions you get a sense of why Commerce Secretary Howard Lutnick says he’s going to change the way the US government calculates GDP.

I like to avoid interpreting macro-economic data. It’s just too far out of my knowledge area. With that said, I would say the best argument for skepticism about these numbers is that a significant amount of the prediction is based on what was basically an import spending spree trying to get ahead of Trump’s predicted tariffs. And we don’t have a lot of history going back upwards of a century with private sector anticipation of dramatic increases in protectionism. So perhaps the models are locked into a somewhat unrealistic way of interpreting this data. Or perhaps they’re technically correct – this is kind of what GDP is – but in a way that would be more transitory than we’d normally expect because it’s not rooted in deeper, organic problems in the economy. But that seems like a bit of a stretch. (Curious what others with more experience with these kinds of numbers think.) It’s also worth noting that there’s a lot more economic uncertainty, just in the last few weeks. And that’s likely not fully showing up in the economic data.

Between cold weather and the Los Angeles fires there are definitely potential non-Trump drivers. But there are always things happening in the economy. The big thing, I think, is that Trump has created a climate of extreme economic uncertainty. And that’s really bad for the economy in the most fundamental way. If you’re tied to the global economy in really any way it’s hard to imagine you’d be making any big spending decisions at the moment. And that plays down to the consumer level. Meanwhile, the administration is at least trying to yank a lot of government spending out of the domestic economy. It’s hard to say how much of that is real at this moment as opposed to feared. But at least in the near term people’s perceptions about — and thus individual predictions about — the economy become self-fulfilling facts in themselves.