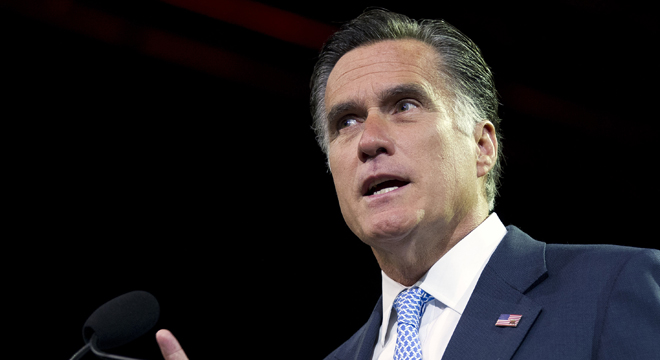

The more details Mitt Romney provides about his tax plan, the closer he gets to validating the conclusion of a nonpartisan study that found his proposal is “not mathematically possible.”

“I want to keep the current progressivity in the code,” Romney told CBS’ “60 Minutes” Sunday. “There should be no tax reduction for high income people. What I would like to do is to get a tax reduction for middle-income families by eliminating the tax for middle-income families on interest, dividends, and capital gains.”

In other words, the Republican nominee promises that, after his across-the-board rate cuts and elimination of unspecified loopholes benefitting high income earners, the tax burden will be reduced for the middle class and remain constant for the wealthy. And yet he promises the plan won’t add to the deficit.

“I don’t want a reduction in revenue coming into the government,” he said.

Conservative economists have tried make the numbers work. Martin Feldstein — a Harvard professor and president emeritus of the National Bureau of Economic Research — released a paper arguing that the targets could be met if “middle class” is defined downward — specifically if Romney increases the tax burden on incomes between $100,000 and $250,000 to pay for tax rate cuts for everyone else. Feldstein’s report ratified the Tax Policy Center’s broad thesis that Romney’s 20 percent tax rate cuts could not be offset merely by unwinding deductions and credits for the wealthy — families typically defined by both parties as middle class would also have to take a hit.

Romney has trumpeted Feldstein’s study in interviews. But when pressed about the unflattering specifics, he demurred, “I haven’t seen his precise study.”

What the study found was that there isn’t enough money in tax loopholes for people in top tax brackets to offset the trillions of dollars Romney’s promised rate cuts would cost. Perks that benefit middle income earners like the mortgage interest deduction, and deductability of employer-based health insurance, charitable giving and state and local taxes would need to be limited or eliminated.

All of this gives the Obama campaign an easy opening to claim Mitt Romney’s rate cuts would require raising taxes on the middle class by up to $2,000 or increasing the deficit. It’s an attack the pro-Romney SuperPAC Crossroads GPS is spending millions of dollars to dispute — but does so by boasting of his promise to cut rates and eliding entirely the fact that Romney has promised to make his plan revenue neutral.

Romney unveiled his sweeping but incomplete tax plan this spring while he was still working to secure the Republican nomination for the presidency. But now, with Election Day just six weeks away, his advisers are trying to absolve him of charges that he’ll effectively increase middle class taxes, arguing that he’d more likely make up the revenue difference by keeping income tax rates on top earners higher than he’d like.

“Governor Romney says he can get to 28 percent [tax rates for the rich],” Romney adviser Kevin Hassett said Monday. “But if Congress won’t give him the base-broadening he needs to get to 28 percent, there’s no way in hell that anyone believes that he’s going to increase taxes by $2,000 on people with incomes below $20,000.”