To pay for their Obamacare replacement provisions, House Republicans are considering imposing a major change to the tax treatment of employer-based insurance plans as part of their legislation to repeal the Affordable Care Act.

House members coming out of a GOP-caucus meeting Thursday on their health care overhaul plans said that capping the tax exclusion for employer plans — i.e. imposing a monetary limit at which point health benefits are taxed like other forms of income — was discussed as a potential revenue booster. The proposal is somewhat like the ACA’s Cadillac tax, which was hated by Democrats and Republicans alike, and is often included in GOP replacement plans, including the “Better Way” outline offered by Speaker Paul Ryan last summer. Capping the exclusion could solve the problem for Republicans of how to pay for their replacement, as many of them have said that the ACA’s current taxes need to be repealed right away. But since it will affect the types of plans used by a vast plurality of Americans, it won’t come without a political fight.

“Capping the exclusion, which is to me a Cadillac tax … it was discussed. I disagree,” Rep. Pete Sessions (R-TX) told reporters after the meeting. Other members, such as Rep. Tom Cole (R-OK), signaled they weren’t comfortable with the idea.

So far, like many of the other proposals discussed in Thursday’s meeting, the details of how the cap would be structured are vague. Republicans are waiting for the Congressional Budget Office to score pieces of the legislative text before making decisions in terms of revenue.

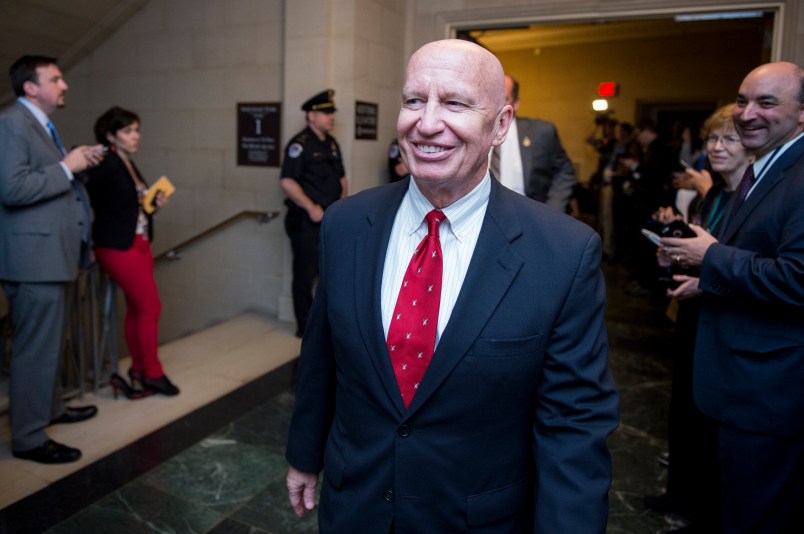

House Ways and Means Chairman Kevin Brady (R-TX), a key Republican in the repeal effort, confirmed that capping the tax exclusion was among the “whole range of options” GOP lawmakers are looking to finance the individual tax credits that they expect to put in their replacement plan.

“We visited with conference about the wide range of options. They’re thinking about it, and we’re going to come back ready to legislate,” Brady said.

The ACA’s Cadillac tax placed a 40 percent levy on employer plans that exceeded a certain threshold. It was hated by Republicans because, well, it was a tax — and an Obamacare-related tax to boot. Democrats were skeptical of it because it was loathed by unions, who over the years have bargained for the sort of generous health plans for their members that would have been the tax’s target.

Asked if he would be comfortable with capping the tax exclusion, Rep. Leonard Lance (R-NJ) said after the meeting he “would examine all options.”

“But let me say that we want to make sure that health care plans that are provided by employers continue to exist, because that is the way that most Americans, or at least, the greatest number of Americans receive their health care,” Lance continued. “This is related of course to the Cadillac tax, and unions quite appropriately are opposed to the Cadillac tax. I am in favor of the union movement in this county, and unions have fought for the members so that they have decent health care coverage.”

Congress included a delay of the Cadillac tax’s implementation until 2020 as part of a larger tax packaged passed in 2015.

But its supporters argue that proposals aimed at the tax exclusion of employer plans are crucial in bending the curve of health care costs. Additionally, the tax exclusion amounts to the largest single subsidy in the entire tax code. Proponents also say that capping the exclusion could help raise wages for low-income workers, as employers are currently more incentivized to pay them in generous health benefits, given the preferential treatment of health plans by the tax system.

“If you really want to fix health care, and make health care available for all, then you’ve got to look at the imbalance between the way employers buy health care coverage and the way families buy health care coverage,” Rep. Bill Flores (R-TX) said. “Somewhere those disparate treatments need to be broken down and equalized.”

He acknowledged that “it was a tough approach,” in terms of the political dynamics.

On the Senate side — where in a symbolic vote, members in 2015 voted 90-10 to kill the Cadillac tax — Republicans were maintaining an open mind until they saw the details.

“I think until you know if they defined the cap, you don’t know,” Sen. Bill Cassidy (R-LA) said, when TPM asked him if the Senate would support a cap to the exclusion.

“It’s an idea on the table,” Sen. Lamar Alexander (R-TN), who chairs one of the committees with jurisdiction over repeal, told TPM. “There’s a lot of support for repealing all the Obamacare taxes. We want to put in place a conservative approach to helping people who need help buying insurance, and you have to pay for it somehow, so that’s one option.”

A potential fight over the tax exclusion cap is just one of many debates bogging down Republicans’ Obamacare repeal effort.

“The question is finding 51 votes in the Senate for something that moves the ball forward on repealing and replacing Obamacare,” said Sen. Tim Scott (R-SC), who has raised concerns about major changes to employer plans in the past. “I am more concerned about getting 51 than getting exactly what I want.”

“I am more concerned about getting 51 (and reelected)than getting exactly what I want.”……

Anti-taxers propose new tax.

I do hope the voters in his district wipe that shit-eating grin off his face. There walks a man who really needs a swift kick in the pants. Note that HIS healthcare insurance will not be touched. “Only for me, not for thee.” Bet he calls himself a good Christian, too.

So they’re willing to make employer-based coverage more expensive and raise taxes substantially on most Americans in order to fulfill their promise to kill a hated (by Crazy Base Land, but broadly popular) president’s overcomplicated (but broadly and increasingly popular) market-oriented healthcare coverage program, teeing up a Medicare-for-all vote when the Dems take it all in 2020? Please proceed, Republicans.

This is remarkably short-term thinking from a remarkably long-term project to roll back the last vestiges of social democracy and elevate the plutocracy. Do these House guys know they’re up for election in under two years?

Yes, please proceed “conservatives” (who ‘conserve’ nothing whatsoever).

We’ll get a really good chance to see just how effective your gerrymandering has been after the next election.

I predict a bloodbath if this moves forward.

I also predict they’ll be too cowardly to actually pull the trigger.