Top Senate Republicans have indicated that it’s likely that the Affordable Care Act taxes on high-earners that the initial GOP repeal bill eliminated would be be put back in the latest draft expected this week.

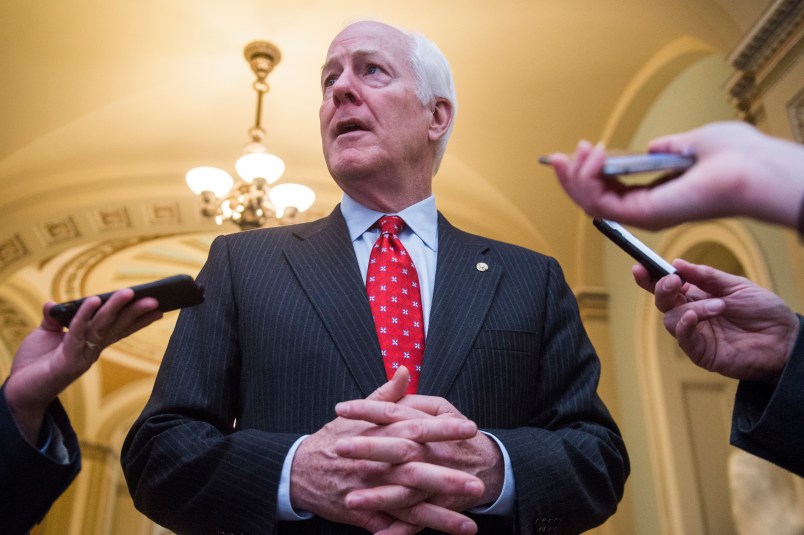

“Well, that’s the current discussion, ” Sen. John Cornyn (R-TX), the No. 2 Senate Republican told reporters Tuesday afternoon, “that they will remain in there and the goal would be to provide more stability funds to help bring premiums down and more flexibility for the governors and legislators to deal with deductibles.”

The two taxes being kept are the 3.8 percent net investment tax and a 0.9 percent payroll Medicare tax for high earners. The repeal of Obamacare’s taxes on the health care industry is expected to live on in the new version of the legislation.

The Wall Street Journal first reported earlier Tuesday that the taxes were staying in the revised version of the Senate bill, the Better Care Reconciliation Act—which is slated for release on Thursday. Sen. John Barrasso (R-WY), another member of the Senate GOP leadership, confirmed to Bloomberg Tuesday that those taxes would remain.

The initial version of the bill eliminated both taxes, with the repeal of the net investment tax going into effect retroactively. According to the Congressional Budget Office, repealing that tax cost the government more than $170 billion over the next decade—money Senate Republicans can now use to boost other provisions in their bill, like the stability fund and the credits for individual insurance. Some rank-and-file Republicans also raised concerns about the optics of cutting taxes for high earners.

It appears that the money saved by keeping the taxes will not go to softening the bill’s Medicaid cuts in any major way, which a number of Republicans were seeking in the latest round of negotiations.

Trumpanzees flinging their crap to see what sticks.

I don’t see that as sticking, as it’s most of the reason these guys want it so bad in the first place.

They could, you know, just keep Obamacare. That would be easy.

This is great, how Rs avoid talking about trumPPet, father and/or son. Cornyn on the repeal and replace bill should be ignored too.

Back on Planet Earth the Democrats are saying

So, what’s the point of ramming this thing through at all if they’re not even getting their rich people tax cuts? Are there any senators who are going to like this bill now?