A surprising development on Wall Street Thursday could magnify a little-discussed but key difference between President Obama and Mitt Romney — one with enormous consequences for public policy.

On a conference call with analysts, JP Morgan CEO Jamie Dimon announced that his firm had lost $2 billion investing in the same species of derivative that exacerbated the 2008 financial crisis.

Dimon claims the company is prepared to absorb the loss, but it puts the reputation of one of the only big firms to weather the 2008 financial crisis directly on the line.

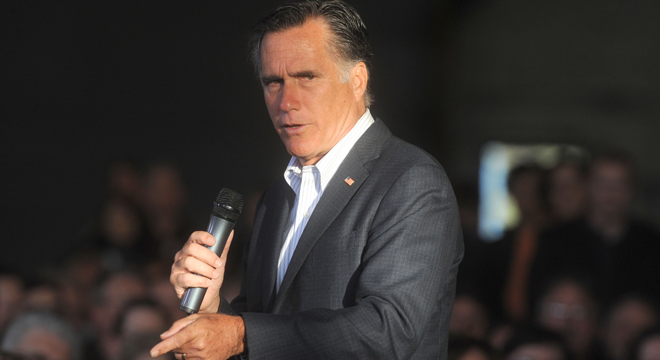

This is exactly the type of major loss of depositor money that the Obama administration sought to ban with one of the major planks of its 2010 Dodd-Frank Wall Street reform law — the Volcker Rule, named after former Fed chairman Paul Volcker. And that’s bad news for Romney, who wants to repeal the whole law, Volcker Rule and all.

Neither the Obama administration nor the Obama campaign would comment on the record about the JPM loss, or its policy implications, but an administration official did allow that it underscores the importance of fully implementing Dodd-Frank.

The Volcker Rule is still being developed by regulators, won’t be implemented until late July at the earliest. It’s intended to ban banks from gambling with depositor funds in what are known as proprietary trades. Dimon claims that the investment in question wouldn’t have violated the rule had it been in effect — he says the bets JPM made were meant to hedge against potential losses in other investments. But finance experts have cast doubt on that claim, and Dimon himself admitted that the incident will provide ammunition for the Volcker Rule supporters.

If he’s right, it’s a concern for Romney and could cement Romney’s reputation for coziness with Wall Street. His campaign isn’t backing away from Romney’s previous positions, but the needle it’s trying to thread is pretty clear.

“JP Morgan’s reported $2 billion trading loss demonstrates the importance of oversight and transparency in the derivatives market, something Gov. Romney has called for in the past,” says Romney spokesperson Andrea Saul. “JP Morgan’s investors, not taxpayers, will incur any losses from this hedging trade gone bad. As President, Gov. Romney will push for common-sense regulation that gives regulators tools to do their jobs, and that gives investors more clarity.”