After a bumpy ride, and a brief, unexpected revolt by rank and file Democrats, the House passed President Obama’s tax plan late Thursday night by a vote of 277 to 148. The vast majority of the ‘no’ votes were cast by Democrats.

Because the package that passed the House is identical to the version that passed the Senate earlier this week, the bill will head directly to the White House for Obama’s signature.

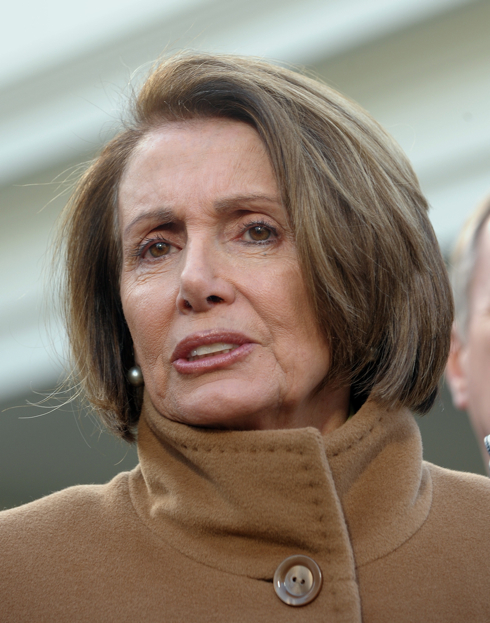

House Democratic leaders had planned to tie a bow around the Obama tax cuts early this afternoon. But a bloc of angry progressives scuttled that plan. In a move that surprised aides and members, they temporarily derailed a key procedural measure required to pass the bill. The tactic was meant to register their disapproval with the legislation, and the terms of the debate, both of which were designed without their input.

Their mini-rebellion threw the process into turmoil for several hours, until Democratic leaders devised a way to restructure the debate in a way that assuaged progressives enough to allow the package to proceed.

In exchange for stepping aside, restless Dems were given a chance to vote separately on an amendment to increase the estate tax. That measure, which once passed the House, failed tonight 194-233. Supportive members — hesitant to scuttle the tax deal, and eager to head home — voted “no” against their true preferences.

But the bulk of progressives ultimately voted against the underlying bill. It passed with the support of a coalition of Republicans — most of whom supported the compromise — and Democrats — some of whom supported it, and others of whom agreed to vote for it to break the gridlock. In the end 139 Democrats (a majority of the caucus) and 139 Republicans voted yes; 112 Democrats and 36 Republicans voted no.

The legislation extends the Bush income tax cuts for two years on all income. It provides for a 13 month extension of unemployment benefits, and a one year partial payroll tax holiday, both of which will stimulate the depressed economy. It includes an estate tax compromise that infuriates most Democrats — exempting estates valued at under $5 million and taxing larger estates at a rate of 35 percent. And it wouldn’t be Washington if it didn’t include a few billion dollars in goodies for powerful interest groups.

The resolution of the tax cut fight, and the impending Republican victory on federal spending, clear the way for the Senate to finally act on key Democratic priorities — most importantly Don’t Ask, Don’t Tell, which could be repealed as early as Sunday.