House Republicans are crowing about leading efforts to repeal an impending 3 percent withholding tax on government contractors as yet another way they’re rolling back the regulatory burden on businesses to help spur economic growth and job creation.

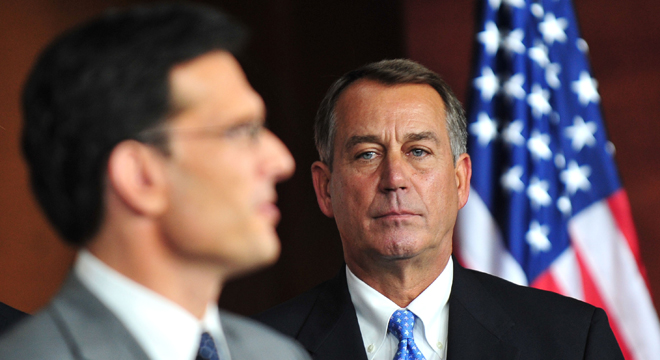

Majority Leader Eric Cantor (R-VA) on Tuesday touted the withholding repeal, which the House plans to take up Thursday, and pressed President Obama to jump on the bandwagon.

“We’re bringing up 3% withholding bill to help gov’ts & their contractors at all levels work in a more efficient way so prices don’t go up,” Cantor tweeted. “Hope the President will join us in supporting this because this is a provision in his bill & we have used a pay-for that he’s embraced.”

Boehner spokesman Michael Steel sent out a release trumpeting President Obama’s support, laid out in an official Statement of Administration Policy fully backing the bill late Tuesday, as if it were huge news.

“We’ve said for weeks that there is common ground on jobs, but getting more done will require the President to work with us and actually engage in the legislative process,” Boehner spokesman Michael Steel said. “He can start by encouraging the Senate to act on this bill and the more than 15 jobs bills that have passed the House, many with bipartisan support.”

While a good baby step, the White House said GOP leaders need to do far more to create jobs immediately.

“If Republicans think passing the smallest part of the American Jobs Act is a get-out-of-jail-free card to do something real on jobs they are 100 percent wrong,” a White House official told TPM. “As the President has said from the beginning, our response is simple: where’s the rest?”

The Cantor tweet and subsequent Boehner release also are a bit puzzling because President Obama has long made clear his support for getting rid of the 3 percent withholding tax, and turns out, Republicans were the first to try to impose the tax burden on government contractors in May 2006, although it’s been delayed ever since by both the 2009 Stimulus Act and the IRS.

In May of that 2006, 229 House Republicans, including GOP leaders John Boehner (R-OH) and Eric Cantor (R-VA), voted to implement the withholding tax on government contractors, as well as Medicare and farm payments, as a way to ensure that some tax-cheat contractors paid their fair share.

The provision was included in the conference report of the Tax Increase Prevention and Reconciliation Act of 2005, which passed by margin of 244 to 185 despite strong opposition by the Associated Builders and Contractors.

That bill extended about $70 billion in tax cuts over a five-year period, including reduced tax rates on capital gains and dividends through 2010 and a patch for the alternative minimum tax, but the 3 percent withholding tax on government contractors was also tucked into the final version of the bill with Republican support.

Sen. Chuck Grassley (R-IA), who chaired the Senate Finance Committee, at the time hailed the joint House and Senate agreement a 2005 tax reconciliation bill in a press release issued May 9, 2006. In it, he touted the tax relief provide in the bill but also acknowledged the reasons both Democrats and Republicans believed they should impose the 3 percent withholding tax on government contractors.

“The National Taxpayer Advocate has concluded that the absence of a withholding mechanism on certain non-wage payments creates several problems, including contributing to the substantial tax gap and “harming compliant taxpayers because they pay their correct liability while others do not,” the Grassley release noted.

The U.S. Chamber of Commerce is taking aim at the government contractor tax, calling for an “expeditious, unconditional, full repeal” and arguing that Obama’s jobs bill only supports a temporary repeal and Democrats support a repeal only if offsets can be found for the lost revenue. The Government Withholding Relief Coalition, a group that counts the Chamber among its members, has argued that new safeguards put in place since 2006 have helped combat the tax evasion.

And Obama has long agreed, at one point calling the pending pending tax “burdensome withholding requirements that keep capital out of the hands of job creators.”

Senate Democrats are the only ones now standing in the way of any withholding repeal effort – but only because they disagree with the way to make up for the lost revenues and are reluctant to let tax cheats off the hook.

Senate Majority Leader Harry Reid (D-NV) has suggested other ways to pay for the repeal, including eliminating the tax break for corporate jet owners, which divided Democrats and Republicans over the summer during the debt-ceiling hijinks.

But Obama and Republicans agree on how to pay for the tax repeal: by slightly changing the income calculation for eligibility for Medicaid and the State Children’s Health Insurance Program to include both taxable and non-taxable Social Security benefits. Despite some concern about tweaking eligibility, proponents argue that it simply fixes a glitch that allowed a handful of people who are doing comparatively well to get extra benefits. Here’s the Statement of Administration Policy supporting the offset.