Sen. Orrin Hatch (R-UT) took to the floor of the Senate on Monday afternoon to defend comments he made last week about the poor needing to “share some of the responsibility” for shrinking the national debt.

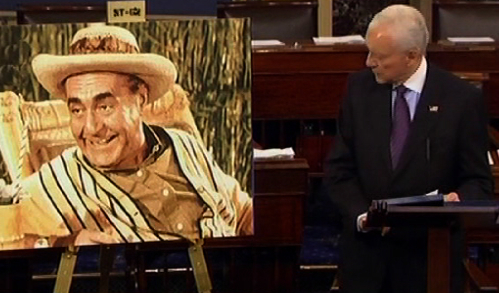

Breaking out an image of the character Thurston Howell III from Gilligan’s Island, Hatch said those with incomes of over $200,000 shouldn’t be lumped in with “Warren Buffet or Gilligan’s Island’s resident millionaire.”

Hatch set off a furor last week when he said that too many people weren’t paying federal income tax, arguing that the 51 percent of the country he claims weren’t paying income tax shouldn’t be considered poor.

“It touched a nerve because last week after I raised this issue on the Senate floor, MSNBC and the liberal blogosphere — presumably armed with the talking points from the Senate Democrat war room — went ballistic suggesting that I wanted to balance the budget by raising taxes on the poor,” Hatch said.

“I’m not surprised, but this completely misses my point and the point, and the point is this: no matter what these Democrats tell you, the wealthy and middle class are already shouldering around 100 percent of the nation’s tax burden, and 51 percent pay absolutely nothing in income taxes,” Hatch said.

“Keep in mind, I don’t believe we should tax the truly poor, but now that’s up to 51 percent in just over two years of this administration — people who don’t pay income taxes,” Hatch said. “Are they all truly poor? I don’t know. All I know is that it doesn’t sound right that the majority of people — the majority of tax units — in this country do not pay income taxes, and the minority has to carry the burden.”

Hatch said he is dedicated to changing the “awful” tax code because it is “too complicated, too large, too expensive [and] doesn’t do the job.”