What had been a fairly non-contentious debate over Wall Street reform legislation nearly came off the rails on Tuesday after Republicans–tacitly backed (or at least unimpeded) by top Democrats–used Senate rules to block votes on far-reaching, consumer-friendly amendments, portending a potential progressive revolt.

This afternoon at 2 pm, Senate Majority Leader Harry Reid will attempt to bring debate on the financial reform bill to a close, though it remains unclear whether he has the 60 votes he’ll need to prevail.

A big reason for that? A number of Democrats–most vocally, Sen. Byron Dorgan (D-ND)–have threatened to vote against ending debate until their flagship amendments get a vote on the floor. But Republicans are standing in the way, saying they’ll filibuster those amendments, subjecting each to a 60 vote requirement, and, more importantly, several days’ worth of delay. Faced with a choice between picking a fight with Republicans over those amendments and simply moving ahead with the bill, Democratic leadership has, for now, chosen the latter.

That leaves Dorgan’s vote–along with the votes of Sens. Carl Levin (D-MI), Jeff Merkley (D-OR), Maria Cantwell (D-WA) and perhaps others–in doubt this morning. If they’re not bluffing, Reid will have to secure the votes of several Republicans to get to 60. And though a small handful of GOP swing votes appear to be in play, it could be a squeaker.

A frustrated Dorgan saw his amendment, which would eliminate trading in credit default swaps for purely speculative purposes, tabled on Tuesday and suggested strongly that his vote now remains out of play.

Levin and Merkley were all but assured a swift vote on their amendment, which would significantly restrict banks and systemically significant financial institutions from engaging in risky speculation. When Republicans decided otherwise, though, they revolted pretty strongly. Their message to leaders in both parties was simple: a vote on their proposal–the so-called Volcker rule–is more important than meeting an arbitrary deadline for finishing up the greater bill.

Likewise, Cantwell has threatened to withhold her cloture vote unless her amendment, which would segregate consumer and investment banks gets a vote–a prospect which now seems in doubt. And Sen. Tom Harkin (D-IA) has yet to receive a vote on his amendment, capping ATM fees at 50 cents.

That doesn’t make Reid’s goal of winding down the debate impossible. A number of Republicans, including Sens. Susan Collins (R-ME), Olympia Snowe (R-ME), George Voinovich (R-OH), and Chuck Grassley are said to be in play. But if the filibuster succeeds, it could easily drag the debate into next week.

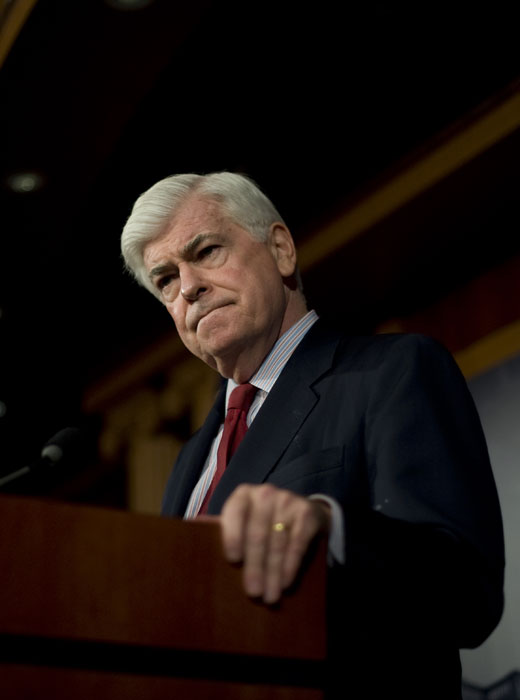

Complicating matters for Reid is electoral politics. A runoff election in Arkansas means Sen. Blanche Lincoln (D-AR), who didn’t prevail in her primary Tuesday, stands to suffer if Democrats weaken her section of the bill, which would impose strict regulations on derivative trading, and, most controversially, would require financial institutions to spin their derivatives trading desks off into separate entities. At the last possible moment on Tuesday, Senate Banking Committee Chairman Chris Dodd sneaked an amendment into the queue, which would delay, and quite possibly eliminate, the spin-off provision from ever taking effect. If Dodd wants a vote on that tomorrow morning (which is to say if he wants a vote at all) he’ll need the consent of the full Senate to bring it up right away. Lincoln may still be in Arkansas when that happens, but there’s enough discontent among Democrats and Republicans with Dodd and Democratic leadership that their attempts to scale back the derivative measure could get scotched…at least for now.

We’ll keep you updated on all of these fronts as the day goes on.