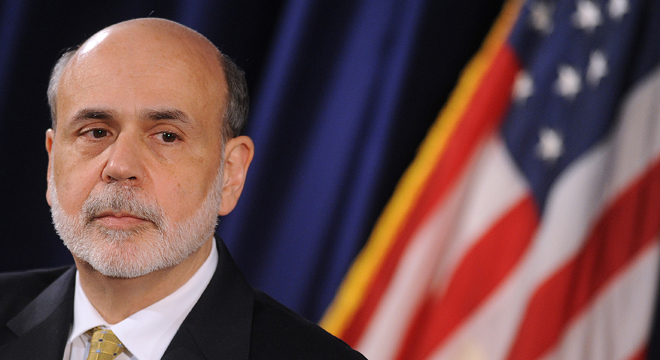

In a speech delivered at a Federal Reserve retreat in Jackson Hole, Wyo., Fed Chairman Ben Bernanke warned Friday in unusually clear terms that spending cuts at both the federal, state, and local level have become significant impediments to economic growth, and made a public case for further monetary easing — remarks which have leading fed watchers predicting that the central bank will announce a new round of asset purchases (so-called quantitative easing) in September.

“[F]iscal policy, at both the federal and state and local levels, has become an important headwind for the pace of economic growth,” Bernanke said. “Notwithstanding some recent improvement in tax revenues, state and local governments still face tight budget situations and continue to cut real spending and employment. Real purchases are also declining at the federal level. Uncertainties about fiscal policy, notably about the resolution of the so-called fiscal cliff and the lifting of the debt ceiling, are probably also restraining activity, although the magnitudes of these effects are hard to judge.”

Bernanke explained that further quantitative easing could have a substantial impact on employment, and even argued that earlier rounds of large-scale asset purchases led to the creation of two million more private sector jobs than the economy would’ve produced on its own.

The unusually explicit endorsement of past — and potentially future — fed action has led experts to conclude that the Fed’s Open Market Committee will resort to further quantitative easing when it meets two weeks from now. But fed critics see this as evidence of failure to act sooner.

“So in September the Fed is going to take actions that were already overdue in July, and necessary partly to offset earlier inaction,” tweeted University of Michigan economist Justin Wolfers. “#woohoo.”