One of Mitt Romney’s top surrogates acknowledged Tuesday that the GOP candidate’s tax plan will only be revenue neutral if it sparks a degree of economic growth most economists regard as wildly implausible.

At the same time he warned Romney against targeting popular tax benefits as sources of new revenue to help pay for his plan to cut taxes by $5 trillion.

Taken together, the comments illustrate just how difficult it would be for any president to reform the tax code, and serve as a reminder that Romney’s tax plan is particularly dubious — and would likely require either increasing middle class taxes or tolerating significantly higher budget deficits.

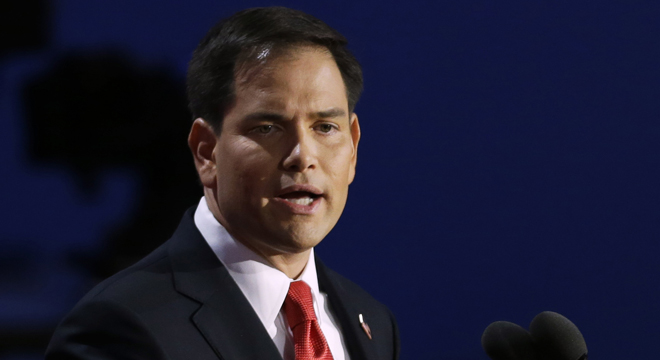

“There will be a very helpful debate about whether things like the charitable deduction, the health insurance premium, the home interest deduction should be part of the deal,” said Sen. Marco Rubio (R-FL) at a Bloomberg View event.

“[Reducing the mortgage interest deduction] is troubling, because it really helps the middle class,” he said. “Do you really want to hurt charitable giving in a country when you are saying that you want to rely less on government and more on private institutions to deal with these issues? And how are you going to raise taxes on people on their health care premiums when you are saying you want there to be a system in place where folks can have more control over their own money?”

The tax exclusion on employer-provided health care and mortgage interest deduction are the two largest expenditures in the federal tax code. Charitable giving ranks in the top 10. All three, among others, are popular and have strong bipartisan support in Congress.

That a leading surrogate would be reluctant to roll them back makes Romney’s tax math even less realistic — and thus more reliant on dubious conservative tax cut assumptions.

“Here is where you get into that debate,” Rubio said. “You don’t dynamically score these things … I know you are going to roll your eyes. But I am a firm believer that economic growth is generated by these things and the evidence is there.”

The most comprehensive analysis of Romney’s tax plan, performed by the nonpartisan Tax Policy Center, borrowed economic growth assumptions from one of Romney’s own advisers. Despite those assumptions, they concluded Romney’s plan would either require higher taxes on middle-income earners or tolerating larger budget deficits.

Rubio’s remarks that he’d want Romney to tread lightly around big, popular deductions suggest that Romney’s across the board 20 percent tax rate cuts could simply end up starving the federal government of revenue.

A Rubio spokesman did not immediately respond to TPM’s request for comment.