Conservatives are continuing their counter-protest against the so-called “47 percent.” Specifically, that’s the share of recession-era households that pay no federal income taxes. Most of them pay payroll taxes and other federal taxes (not to mention state taxes), but Republicans have chosen to depict them as the free-riding half of the country.

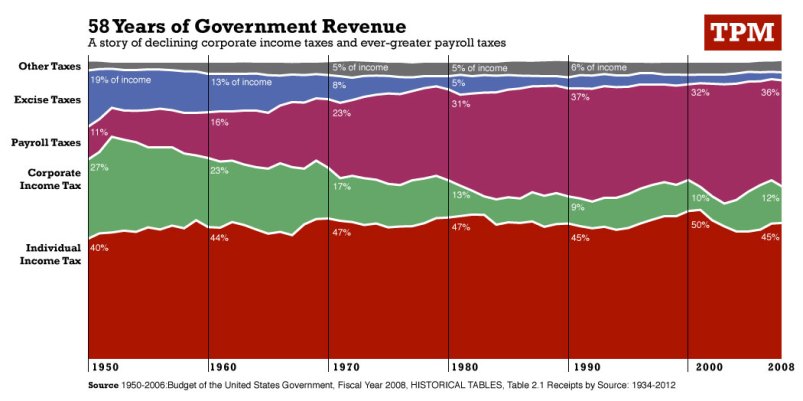

The fact of the matter, though, is that those other taxes constitute a huge chunk of federal revenues. Check out the charts below. Over the 58 years preceding the Lesser Depression, the share of federal revenues that came from individual income taxes has remained fairly stable, fluctuating between 40 and 50 percent, and peaking just before George W. Bush slashed rates in 2001.

The rest has come from corporate income taxes, payroll taxes, and various other taxes. To a surprising extent, the story of the last six decades is one of a shrinking burden on big business, and a growing burden on workers — the bulk of the “47 percent”. Since 1950, regressive payroll taxes have grown to comprise over one-third of federal revenues — they used to comprise about one-tenth. For corporate income taxes, it’s just the opposite — what used to provide the Treasury over a quarter of its revenue now provides just over 10 percent.

Income taxes, both corporate and individual, provide “general revenue” — money that the government spends on most federal programs. Payroll taxes, by contrast, are dedicated to financing Medicare and Social Security, both of which have grown considerably as a share of national expenditures in past decades. Indeed, prior to 1965, there was no Medicare, and the payroll tax’s share of revenue has grown since to reflect that. But to a wage-earner’s annual bottom line, that makes no difference.

Separately, revenue as a percentage of GDP has fluctuated over the years, climbing steadily from 1950-2000, declining in 2001 after the Bush tax cuts, then bottoming out after the financial crisis and recession. The charts below predate the recession, and the numbers have probably shifted to reflect high unemployment, lower incomes, lower profits, and a temporary but fairly significant payroll tax cut. But “the burden” politicians describe is the whole pot of federal revenue, whatever its size. And the “47 percent” have born their fair share of it.