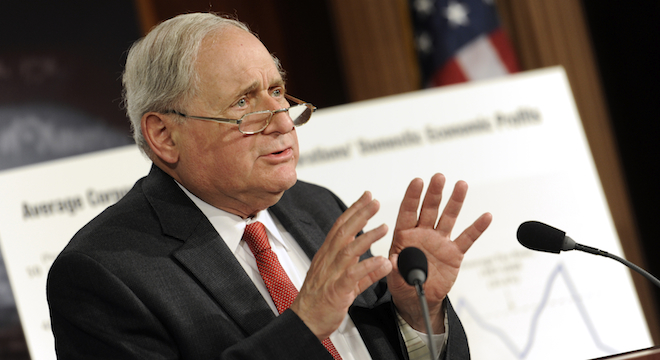

Sen. Carl Levin (D-MI) took aim at Facebook in his speech to the Senate floor on Wednesday, calling upon Congress to pass a bill he introduced that would close a tax loophole that allows companies going public to take up a massive tax deduction for shares sold to early investors and founders. In the case of Facebook, Levin said the company could stand to receive a $3 billion deduction once it begins trading.

“Mr. Zuckerberg and his company have become a remarkable American business success story,” Levin said in his prepared statement. “As part of that success, Facebook is in the process of making its initial public offering of stock. The public documents Facebook is required to file as part of that offering tell another compelling story, about one of our tax code’s unjustified corporate loopholes.”

Levin pointed out that according to Facebook’s S-1 filing, Zuckerberg plans to exercise his option to purchase 120 million shares of Facebook common stock at the “par value,” or minimum price of six cents a share. Of course, when Facebook actually does debut on the stock market later this year (a precise date hasn’t been determined yet), the shares will likely go for many times that amount, up to 600 times as much, according to Levin.

Yet due to a provision in the U.S. Code (Title 26, Section 83) governing “property transferred in connection with performance of services,” Facebook is allowed to record an expense on its books to the tune of the smaller, 6 cents per share price that Zuckeberg is allowed to purchase the stock for. At the same time, Facebook can for tax purposes claim that the company’s expense was the much larger amount that the market will surely price the shares at.

This, in effect, allows Facebook to keep its own shareholders happy by stating that the company didn’t lose that much in distributing stock. Meanwhile, Facebook also gets a much larger tax deduction from the U.S. government based on whatever the trading price of the stock turns out to be.

As Levin stated in his speech: “When it comes time to pay taxes, to pay Uncle Sam, the loophole in the tax code allows the company to take a tax deduction for a far larger expense than they show on their books.”

In fact, as Levin noted, that deduction is actually retroactive for 2 years into the past, meaning that Facebook can claim that it should be refunded for up to a half billion dollars for the various state and federal corporate taxes it paid during that period.

As Facebook openly states in the S-1: “We could generate a corporate income tax deduction that exceeds our other U.S. taxable income in that year, which would result in a taxable loss for U.S. corporate income tax purposes that reduces our U.S. corporate income tax liability to an immaterial amount for that year.”

All in all, Facebook could receive a “tax break of up to $3 billion,” Levin noted.

As such, Levin called upon the Senate and Congress to pass his “CUT Loopholes Act,” a massive bill designed to shore up the entire U.S. tax code (especially concerning offshore corporate accounts), which Levin introduced at the beginning of February, but that is basically the same as previous legislation he’s been pushing since 1997. So far the bill has been read twice and is currently stalled in the Senate Finance Committee.

Facebook declined the opportunity to comment to TPM about the legislation, but a number of proxies and free-market advocates have since stepped up to slam Levin for what they see as a measure that will stifle innovation.

“While Sen. Levin singles out Facebook as an obvious success story, his IPO tax would really hurt countless small start-ups who struggle to attract investors as well as employees with the promise of large pay-offs in the future,” wrote Berin Szoka at the libertarian Tech Liberation Front.

“Eight years ago Facebook did not exist, but today its employees and the entire ecosystem it generated will deliver billions in state and federal tax revenues,” said an emailed statement from Rey Ramsey, president and CEO of TechNet, a trade organization that represents a wide swath of the nation’s tech companies, including Facebook. Ramsey continued:

“TechNet has long called for broad tax reform that can help drive the creation of more such high-growth companies. The tax code was last updated more than 25 years ago — before many of today’s largest cutting-edge companies even existed. We look forward to working with Congress in developing a modern tax code that doesn’t stifle entrepreneurs but instead encourages the kind of innovation and risk-taking that have made this nation the global hub of the technology.”

In a similar statement, Steve DelBianco, an advisor to the Congressional Internet Caucus and the executive director of NetChoice, another trade organization made up entirely of Web businesses, said: “Facebook employees are set to deliver billions in tax revenue to state and federal coffers this year while spawning a flurry of spinoff companies. But Senator Levin’s first thought is to slam these employee-owners for complying with the present tax laws. On one hand, the Senator calls for more taxes on the IPO engine that brings new companies to market, while on the other hand he calls for tax breaks that specifically benefit his home state auto industry.”

Indeed, Levin’s efforts to protect the auto industry from steeper taxes and to encourage tax credits for hybrid vehicles are well known.

Yet it is also worth noting that Facebook is just the most convenient and headline-grabbing example of the kind of corporate tax dodging that he’s been trying to crack down on for years. In June 2007, when pushing similar legislation, Levin produced a study on executive tax compensation that specifically pointed the finger at Apple, Monster, Cisco and Mercury Interactive (now owned by HP), as well as non-high tech companies Occidental Petroleum, UnitedHealth, Converse and Safeway, for costing the U.S. a combined $1.26 billion in lost revenue the year prior due to the loophole.

Correction: This article originally misidentified Sen. Levin as speaking on the House floor, not the Senate. In addition, this article stated that Facebook could record the stock options as a “loss” when the more correct term is “expense.” Finally, this article stated that Facebook could be eligible for a deduction on two years worth of corporate income tax on stock options, when it fact, the company would be eligible for state and federal tax refunds. The changes have been corrected in copy. We regret the errors.