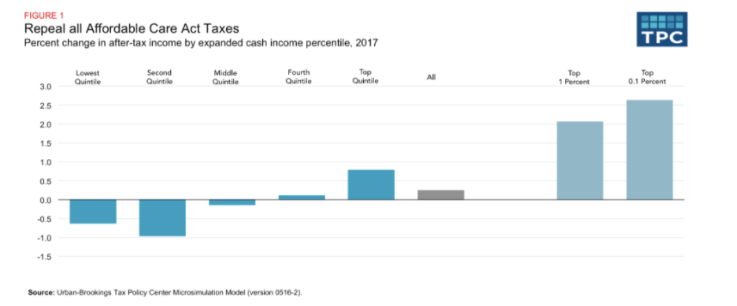

A new analysis by the nonpartisan Tax Policy Center breaks down who would benefit most and least from the tax cuts that would come with Obamacare repeal, assuming Republicans follow the model of their 2015 repeal legislation. It found that those in the top quintile would see their after-tax income rise by 0.8 percent due to the various cuts in the law, while those on the lower end of the earning scale would see their after-tax income decrease, mainly because of the loss of the law’s tax credits to subsidize buying insurance.

As the TPC explains, the multiple moving parts of an Obamacare repeal affect taxpayers in different ways and the variation is wide even within each income group. The ACA tax credits play a major role in determining the losers, but even if they are excluded from consideration, those on the bottom and the middle benefit from the tax cuts far less than those on the top.

For instance, a vast majority (94 percent) of middle-income households (making between $52,000 and $89,000) do see a small tax cut that averages around $110, but three percent of middle-income earners would see a massive tax hike, averaging $6,200, because of the elimination of the tax credits for insurance plans purchased through the individual exchanges.

High-earners see a major cut not just because they don’t stand to lose the subsidies. Two of the taxes that would be eliminated with Obamacare’s repeal are directed at individuals making $200,00 or more. All in all, those in the top 1 percent see a tax cut of $33,000. Those in the top .1 percent will see a cut of $197,000.

“middle-income earners would see a massive tax hike, averaging $6,200, because of the elimination of the tax credits for insurance plans”

I am surprised the average is a low $6200. I am middle income, family of 3, and paid upwards of $20K per year for medical insurance before ACA. Of course, I used a PPO instead of a HMO, and the latter would have been less expensive.

So upper incomes get a tax cut but we all have to pay more for uncompensated care at community hospitals. Death panels without explicitly calling them that.

It’s a two-for-one deal: You lose the $6200 and you then have to shop for insurance, assuming you can get it, on your own, at potentially much higher prices. Lose/lose for the unwashed masses, win/win for the fraction of a percent. The only mystery is why anyone would possibly be surprised by this.

So Obamacare repeal is really just the same old GOP agenda: tax cuts for the rich paid for by screwing the poor. In this case, health care is taken away, and many will die from a lack of medical care so the very rich can get money they don’t need. Why aren’t the Democrats saying this all the time?

“For instance, a vast majority (94 percent) of middle-income households (making between $52,000 and $89,000) do see a small tax cut that averages around $110…”

Crusts for the 94%.

Not even a whole loaf of bread, but plenty of awkward circuses when Trump voters find out how much health care they can buy for $110.