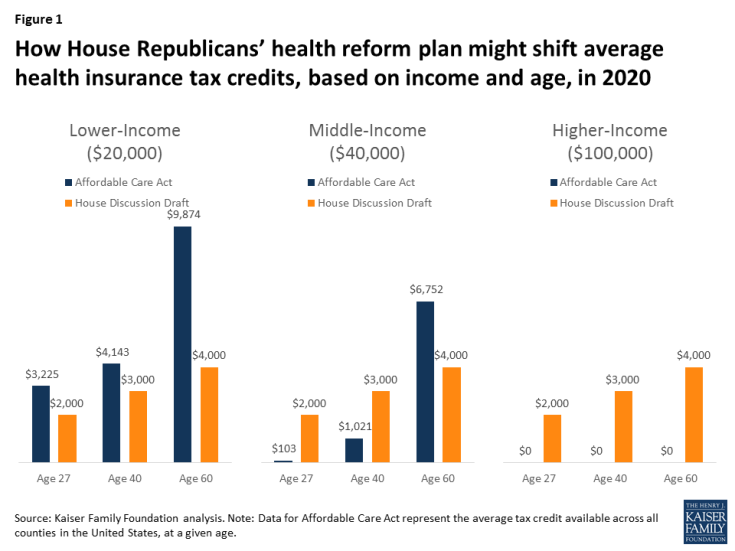

An analysis by the Kaiser Family Foundation published Wednesday of a GOP proposal to rework the Affordable Care Acts subsidies into tax credits available to everyone illustrates how the plan, which was leaked last week, would represent a major loss for lower-income people and older Americans. Those higher on the income scale stand to gain under such a plan.

Republican leadership is considering offering refundable tax credits that start at $2,000 annual for individuals under 30 and raise with age, up to $4,000 for those over 60. Unlike the ACA’s tax credits, they do not adjust with income, meaning a wealthy person would be getting the same break as a low income American. Obamacare’s tax credits end for people making 400 percent of the federal poverty line.

The rate at which the Republican tax credits grow by age is slower that those offered under Obamacare, meaning older people will be bearing a greater burden of their premiums under the GOP plan. Currently, under the ACA, older people can face premiums three times higher than younger people, and Republicans’ credits only double in size for those at the oldest end. GOP lawmakers have also proposed expanding the ratio for premiums for young and old people to one to five, which could further exacerbate the hit older people would take under the Republican plan.

Additionally, they are the same nationwide, meaning in areas with higher premiums, they don’t go as far. The Affordable Care Act’s subsidies are priced according to the second-lowest-cost silver plan in the area where the consumer lives, meaning that they reflect the geographical difference in average premiums.

Must be an early Pubbie April Fool joke. A $4,000 tax credit for somebody over 60? Somebody over 60 is very likely to have a pre-existing condition that will disqualify them from everything but a high risk pool. The last time I checked my state’s high risk pool, it would cost somebody over 60 about $1,000 per month for a policy with a $5,000 deductible. That is about $17,000 per year if you have a significant medical problem and more than 4 times the tax credit. Maybe we should thank Pubbies for being so generous towards those getting into their “golden years.”

Not to worry.

Older people will be able to pay more for health care after Republicans cut their Social Security.

Simpler chart needed! Sorry, a bit tired today.

GOP: Tax Cuts are not enough. Health care must also be free for The Rich.

House Republicans: “Well, what good are tax credits for people who don’t pay taxes?”

Me: “You mean, like Chiselin’ Trump?”