WASHINGTON (AP) — Despite opposition from Republican moderates and conservatives, House leaders are pressing ahead with a budget plan whose success is critical to the party’s hopes to deliver on one of President Donald Trump’s top priorities — a GOP-only effort to overhaul the tax code.

The importance of the measure has been magnified by the cratering in the Senate of the Trump-backed effort to repeal President Barack Obama’s health care law, leaving a rewrite of the tax code as the best chance for Trump to score a major legislative win this year. The measure would require about $200 billion worth of cuts to benefit programs and other so-called mandatory spending coupled with the tax plan.

The budget plan unveiled Tuesday is crucial because its passage would pave the way to pass a tax overhaul this fall without the fear of a filibuster by Senate Democrats.

But it also proposes trillions of dollars in cuts to the social safety net and other domestic programs and puts congressional Republicans at odds with Trump over cutting Medicare. It also would sharply boost military spending.

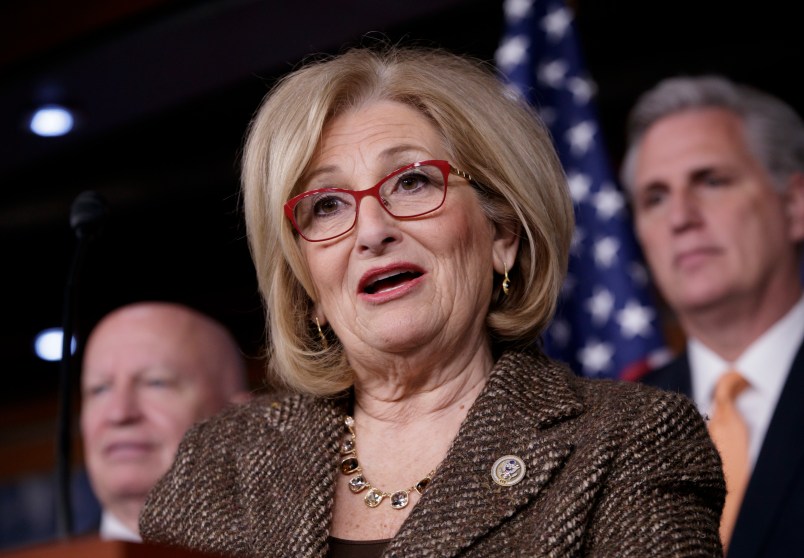

“In past years, the budget has only been a vision. But now, with the Republican Congress and a Republican White House, this budget is a plan for action,” said Budget Committee Chair Diane Black, R-Tenn. “Now is our moment to achieve real results.”

Unclear, however, is whether GOP leaders can get the budget measure through the House. Conservatives want a larger package of spending cuts to accompany this fall’s tax overhaul bill, while moderates are concerned cuts to programs such as food stamps could go too far.

“I just think that if you’re dealing with too many mandatory cuts while you’re dealing with tax reform you make tax reform that much harder to enact,” said Rep. Charlie Dent, R-Pa.

Black announced a committee vote for Wednesday, but was less confident of a vote by the entire House next week; a delay seems likely because of the ongoing quarrel between the GOP’s factions.

The House GOP plan proposes to turn Medicare into a voucher-like program in which future retirees would receive a fixed benefit to purchase health insurance on the open market. Republicans have proposed the idea each year since taking back the House in 2011, but they’ve never tried to implement it — and that’s not going to change now, even with a Republican as president.

“Republicans would destroy the Medicare guarantee for our seniors and inflict bone-deep cuts to Medicaid that would devastate veterans, seniors with long-term care needs, and rural communities,” said Democratic leader Nancy Pelosi of California.

The plan promises to balance the budget through unprecedented and politically unworkable cuts across the budget. It calls for turning this year’s projected $700 billion-or-so deficit into a tiny $9 billion surplus by 2027. It would do so by slashing $5.4 trillion over the coming decade, including almost $500 billion from Medicare amd $1.5 trillion from Medicaid and the Obama health law, along with sweeping cuts to benefits such as federal employee pensions, food stamps and tax credits for the working poor.

But in the immediate future the GOP measure is a budget buster. It would add almost $30 billion to Trump’s $668 billion request for national defense. The GOP budget plan would cut non-defense agencies by $5 billion. And of the more than $4 trillion in promised saving from mandatory programs like Medicare and Medicaid, the plan assumes just $203 billion would actually pass this year.

Democrats focused their fire on the plan’s sweeping promises to cut from almost every corner of the budget other than Social Security, defense and veterans programs. At the same time, they have little fear those cuts would actually be implemented.

Top Budget Committee Democrat John Yarmuth of Kentucky told reporters the GOP “utilizes a lot of gimmicks and vagueness to reach some semblance of theoretical balance and also hides a lot of the draconian cuts would be inflicted on the American people.”

All told, the GOP plan would spend about $67 billion more in the upcoming annual appropriations bills than would be allowed under harsh spending limits set by a 2011 budget and debt agreement. It pads war accounts by $10 billion. And, like Trump’s budget, the House GOP plan assumes rosy economic projections that would erase another $1.5 trillion from the deficit over 10 years.

The budget resolution is nonbinding. It would allow Republicans controlling Congress to pass follow-up legislation through the Senate without the threat of a filibuster by Democrats. GOP leaders and the White House plan to use that measure to rewrite the tax code.

As proposed by House leaders, tax reform would essentially be deficit-neutral, which means cuts to tax rates would be mostly “paid for” by closing various tax breaks such as the deduction for state and local taxes. However, the GOP plan would devote $300 billion claimed from economic growth to the tax reform effort.

But conservatives are insisting on adding cuts to so-called mandatory programs, which make up more than two-thirds of the federal budget and basically run on autopilot.

Oh, please, AP reporter, stop acting like we have a normal President who has a policy stance that waffles less than IHOP.

Trumpp is at odds with his campaign pronouncements on just about everything. Tough on China? Not. Intimidate the North Koreans into abandoning their missile and nuke development? Ahem. Infrastructure? No progress. ISIS destruction plan within 30 days? We’ve passed the lead to Assad and Putin. Drain the swamp? Lobbyists run the agencies. Better and cheaper healthcare covering more people? You know how that went.

Somebody will explain how “reforming” Medicare will save it and prove that he was the only President bold enough and great enough to get the job done. He’ll sign it and brag: They said it was impossible, but I got it done in record time. People are saying I’m greater than Roosevelt. I’m not sure. Probably. Greater so far.

Mexico: I’m sitting here with a checkbook and my pen, waiting for the wall.

“a GOP-only effort to overhaul the tax code.”

Some people never learn their lessons, and after shooting one toe off, must proceed until they have no toes left.

The GOP was an extremely fractured party in Jan. Continuing, and failing, to attempt to pass this massive bills without a single Dem vote, only increases those fractures.

So by all means, please proceed. I want to see some republican on republican knife fights.

One phone booth, no waiting!

And then …lick you on the face ! —