Goldman Sachs is preparing an aggressive defense of emails released over the weekend by Sen. Carl Levin (D-MI), which appear to show that the investment bank made money betting against the mortgage market — and mortgage securities that it was selling to investors.

The emails, Goldman shot back yesterday, were “cherry-picked” from “the 20 million pages of documents and emails” provided to a Senate subcommittee.

“It is concerning that the subcommittee seems to have reached its conclusion even before holding a hearing,” said Goldman Sachs spokesman Lucas van Praag.

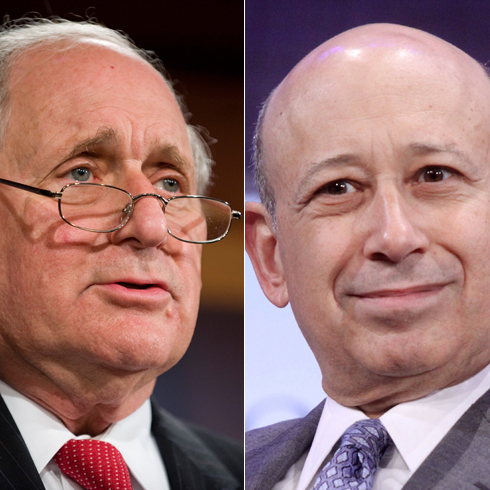

The Senate Permanent Subcommittee on Investigations released the emails in advance of its Tuesday hearing examining the role of investment banks in the financial crisis. Goldman Sachs CEO Lloyd Blankfein is expected to testify.

Earlier this month, the SEC charged Goldman with civil fraud over its marketing of a mortgage-related security — which allegedly was secretly designed to fail.

As for the emails: In a November 2007 email released over the weekend, Blankfein wrote to other top execs that the firm made money by shorting the mortgage market. “”Of course we didn’t dodge the mortgage mess. We lost money, then made more than we lost because of shorts.”

In another email, from July 2007, CFO David Viniar, responded to a report showing that the firm netted more than $50 million in a single day by shorting the failing mortgage market by writing: “Tells you what might be happening to people who don’t have the big short.”

In another email thread, Goldman’s Deeb Salem wrote that the “bad news” about the “imminent” collapse of a security and the “wipeout” of another was that Goldman would lose $2.5 million — but that the “good news” was that the firm would make $5 million from a bet it had placed against the same securities, which it had also put together and sold to investors.

Read the emails here.

In a statement accompanying the release of the emails, Levin said:

Investment banks such as Goldman Sachs were not simply market-makers, they were self-interested promoters of risky and complicated financial schemes that helped trigger the crisis. They bundled toxic mortgages into complex financial instruments, got the credit rating agencies to label them as AAA securities, and sold them to investors, magnifying and spreading risk throughout the financial system, and all too often betting against the instruments they sold and profiting at the expense of their clients.

“These e-mails show that, in fact, Goldman made a lot of money by betting against the mortgage market,” Levin said.

Levin’s not the only one jumping on the emails. Sen. Sherrod Brown (D-OH) said on ABC yesterday that, “These e-mails signify that there are all kinds of conflicts of interest on Wall Street, that Wall Street is working for its clients and working against its clients in the same sort of bundled toxic securities.”

Senior White House Adviser Larry Summers said the emails show “the importance of transparency, the importance of things being in the open, the importance of it being known who is in a position to benefit from what.”

Goldman is already planning an aggressive defense.

According to the Washington Post, which obtained an 11-page Goldman document prepared for senior executives (and which will serve as the basis of Blankfein’s testimony), Goldman will argue that it wasn’t a big player in the mortgage market — and that revenue from that sector accounted for less than 1 percent of the firm’s total in 2007.

The Post reports:

The document acknowledges that Goldman at times shorted the overall market but describes those periods as temporary while the firm was rebalancing its portfolio to limit losses if mortgage securities were to lose more value.

Read the emails here.