Senate Dems give The Washington Post the jump on a new analysis that puts one of the worst kept secrets in Washington into helpful numerical context: Republicans want the broad middle class to pay more taxes than they currently do, and the upper class to pay significantly less.

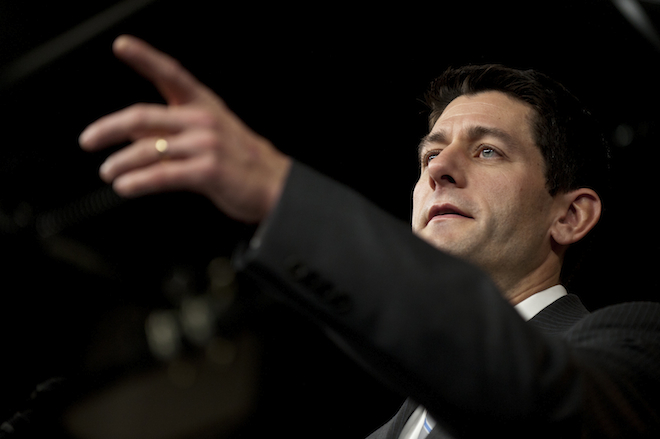

This time around, Democrats on the Joint Economic Committee, with the help of data from the Tax Policy Center, take a look at the House GOP tax plan in Paul Ryan’s budget, and reach an important conclusion: If he honors his commitment to keeping his plan revenue neutral, middle class taxpayers will see their tax burden increase, while the wealthiest Americans will enjoy a huge tax cut.

The idea is pretty straightforward.

Republicans want to dramatically lower the top tax rate and eliminate brackets so there are only two — one at 25 percent, one at 10 percent. That would put a huge amount of cash in the pockets of high income earners. For middle class earners, it’d be a much more modest sum. To make the plan revenue neutral, Ryan claims Republicans would close myriad loopholes that disproportionately benefit the upper-middle and upper classes — he just won’t say which ones.

The rub is that Ryan’s tax cuts are expensive and to pay for ithem he’d likely have to clawback the biggest middle-class tax benefits — like the mortgage interest deduction, and the tax exclusion on employer health benefits — such that the net effect for people making less than $200,000 would be a higher annual tax burden. The plan redistributes wealth upwards.

Republicans could conceivably cap the tax breaks, such that middle class people get to keep them, and only high-income earners have to give them up. But then they’d have to ditch other priorities like lowering or eliminating taxes on investment income that are, importantly, key pieces of Mitt Romney’s tax plan.

The important thing to keep in mind is that this isn’t unique to Paul Ryan’s budget. It was, to a greater or lesser extent, an implicit consequence of all the tax plans the serious GOP presidential primary contenders put forward — huge tax cuts for the wealthy that would either blow up the deficit or require the middle class to pony up more. In a way it was the unifying principle at the core of all their plans. They differed in many other ways, but in a redistributive sense they were all variations on a single theme. Super Committee Republicans wanted to pull the same trick. They can’t talk about it in blunt terms, but as far as conservatives are concerned, upward redistribution is a feature, not a bug.

Here’s how Senate Minority Leader Mitch McConell put it in an interview with CBS that aired Monday, “Almost 70 percent of the federal revenue is provided by the top 10 percent of taxpayers now. Between 45 percent and 50 percent of Americans pay no income tax at all. We have an extraordinarily progressive tax code already. It is a mess and needs to be revisited again.”

Those claims are wrong in important ways, but the implication is that the broad middle class should be paying more, and the top earners less. More on this soon.