For weeks, Senate Republicans have filibustered an extension of unemployment benefits on the grounds that Democrats aren’t willing to cut spending or raise taxes to pay for them. At the same time, the Bush tax cuts are set to expire, and Republicans want them to be renewed. For two days, Senate Minority Whip Jon Kyl has raised eyebrows by insisting that emergency aid to unemployed people — what he called a “necessary evil” — be paid for through either tax hikes or spending cuts, while the tax cuts (which mostly benefit wealthy people) not be offset in any way. Yesterday claimed that this view is shared by “most of the people in my party.”

He was correct.

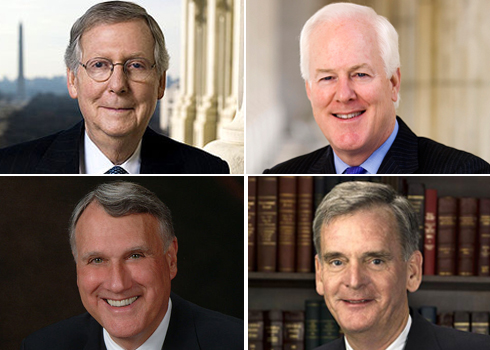

“That’s been the majority Republican view for some time,” Minority Leader Mitch McConnell told TPMDC this afternoon after the weekly GOP press conference. “That there’s no evidence whatsoever that the Bush tax cuts actually diminished revenue. They increased revenue, because of the vibrancy of these tax cuts in the economy. So I think what Senator Kyl was expressing was the view of virtually every Republican on that subject.”

The CBO and other budget experts strongly disagree. And Democrats want to preserve the Bush tax cuts for people making less than $200,000-$250,000 a year — but only for them. Allowing them to expire for wealthier people would raise hundreds of billions of dollars over 10 years, which could allow them to offset the spending Republicans currently decry.

However, the GOP’s top budget guy, Sen. Judd Gregg (R-NH), disagrees. He said Kyl’s prescription — offset spending with tax increases or program cuts, but treat tax cuts differently — is exactly right. “It makes a lot of sense, because, you know, when you’re raising taxes you’re taking money out of peoples’ pockets,” said Gregg when asked by TPMDC. “When you’re spending money, you’re spending money that is — it’s not the same thing because it’s growing the government. So I tend to think that tax cuts should not have to be offset.”

The expert view is that giving unemployed people money to spend stimulates the economy much more than does preserving tax cuts for the rich. But this view is not shared by the chairman of the Republican Senate re-election committee.

“I think the urgency of deficit neutral extension of unemployment insurance has increased because of the size of the deficit and the size of the debt,” Sen. John Cornyn (R-TX), another member of the GOP leadership team, told TPMDC yesterday. “I’m aware in the past some extensions have not been paid for, but if there’s one thing that I’m hearing from my constituents it’s that deficit spending has to stop, and I think this is a good place to do it.”

Extending tax cuts to wealthy Americans is a different story.

“The problem is, you know, when you raise taxes, which is what that will be if no action is taken, taxes will go up on dividends and on capital gains on a whole lot of people who aren’t rich. And the problem with that in a recession is it further contracts capital formation and investment which means it has a negative impact on jobs. I really can’t think — if you really set out to try to come up with ways to discourage people from investing and creating new jobs and growing their business, I can’t think of a more comprehensive agenda for doing that than what we’ve seen over the last year and a half.”

To be sure, a few moderate Republicans have supported the idea of extending unemployment benefits without paying for them. But, as Kyl implied, they are the distinct minority.

“If we extend the president’s tax cuts — if we wanted to do new tax cuts, I think we ought to cut spending to pay for them,” said Sen. Tom Coburn (R-OK), one of the most conservative members of the GOP. “But the tax cuts that we have today?” The answer to that rhetorical question, presumably, is no.