Fitch Ratings has lowered Japan’s credit rating as the country continues to wrestle with staggering debt.

Fitch said Monday that the government did not include sufficient measures in its budget to replace a sales tax hike it put off in the current fiscal year, which ends next March.

Japan’s debt is the largest among developed nations and more than twice the size of its economy. The country eventually has to boost taxes to cover rising costs for health and elder care as the average age in the nation rises. But a sales tax increase last spring hurt consumer and business spending as the Japanese economy slipped into a recession.

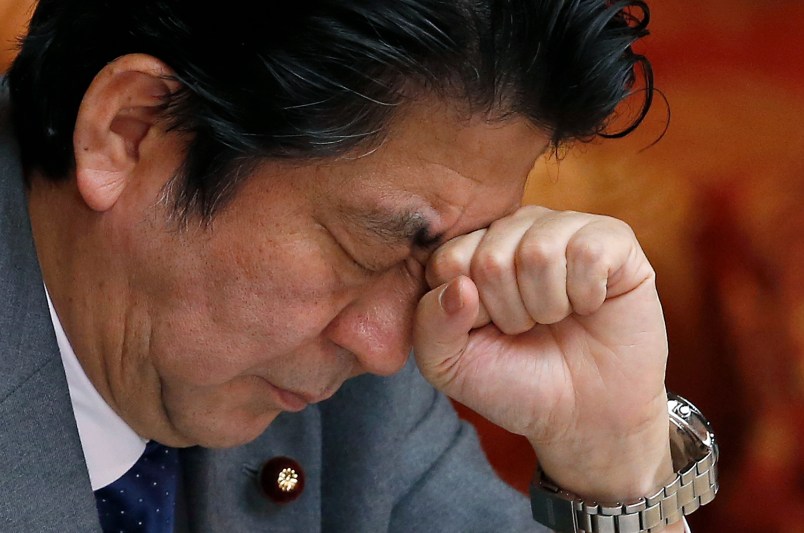

That led Prime Minister Shinzo Abe to put off a second, planned hike, illustrating the tough position in which government leaders have found themselves.

Fitch said Monday that Japan’s main credit and rating weakness is due to its high and rising level of government debt. The ratings agency noted that the government has already cut corporate tax rates and plans to do so again in fiscal 2016.

“These developments increase Fitch’s uncertainty over the degree of political commitment to fiscal consolidation,” Fitch said, noting that Japan is set to unveil a new fiscal strategy this summer. “The details of the strategy will be important, but the strength of the government’s commitment to implement it will be even more important and will only become clearer over time.”

Fitch downgraded Japan’s long-term foreign and local currency issuer default ratings to “A” from “A+.” It also lowered its senior unsecured foreign and local currency bonds ratings to “A” from “A+.”

Fitch said that strong credit fundamentals like a high-income, wealthy economy and social and political stability support Japan’s ratings.

Most of Japan’s public debt is held by the Bank of Japan and other Japanese financial institutions, so it is considered relatively stable.

Tokyo’s Nikkei shed 0.2 percent to 19,983.32, though almost all major markets were trading higher Monday.

Copyright 2015 The Associated Press. All rights reserved. This material may not be published, broadcast, rewritten or redistributed.

When you see how little understanding of economics bond rating agencies seem to have, institutionally, the role they played in creating the 2008 financial crisis becomes more comprehensible.

“The country eventually has to boost taxes to cover rising costs for health and elder care as the average age in the nation rises.”

Whuyyyy, hell gnaw! Not in Ahmurkuh we won’t!

Shore, they had them there kamakazis but we ain’t no gald-dern cowards lyke theym: we die slooooooooooo without awl thet sissy socialized medicine.

Ewe Ess Aye! No more dad-burned taxes! Let 'em die first!

Sheesh - another article by another idiot author who doesn’t know that Japan is a monetary sovereign like the United States who by definition cannot be in “debt” since its “debt” is money by fiat!

Japan’s so called “debt” just like the United State’s so called “debt” is nothing more than the total aggregate of unmatured treasury issues which turn into cold hard cash at maturity since they are money by fiat and therefore they don’t require a single cent of taxpayer money to be paid off.

Before some know-nothing replies here is a link for you to first educate yourself before replying:

At the risk of getting off into the accedemic weeds here, the issue isn’t the absolute size of the debt, it’s the ratio of public debt to GDP. The ratio for Japan is 2.26 to 1. That means that Japan’s denominated debt is 2.26 times the value produced in the country in a year… Japan’s ratio is the highest in the entire world by a comfortable margin. Number 2 is Zimbabwe at 2.02. Nobody else is above 1.5, except Greece at 1.61. The United States, for example is at 0.72, approximately 1/3 of that of Japan. in order to have the same ratio as Japan, the United States would need to have a 38 Trillion dollar public debt. It’s currently a smidge over 18 Trillion. Japan is in a huge, huge bind because they have a major generational crisis ongoing and need to expand expenditures on aged pensions and healthcare costs and fiat currency or not, monitizing an amount of that size is incredibly inflationary. Japan has many stabilizing factors, which is why their downgrade only dropped them to an A rating, but there are some serious structural problems in the Japanese economy that are likely to get worse over time.