WASHINGTON (AP) — The Obama administration secretly sought to give Iran access — albeit briefly — to the U.S. financial system by sidestepping sanctions kept in place after the 2015 nuclear deal, despite repeatedly telling Congress and the public it had no plans to do so.

An investigation by Senate Republicans released Wednesday sheds light on the delicate balance the Obama administration sought to strike after the deal, as it worked to ensure Iran received its promised benefits without playing into the hands of the deal’s opponents. Amid a tense political climate, Iran hawks in the U.S., Israel and elsewhere argued that the United States was giving far too much to Tehran and that the windfall would be used to fund extremism and other troubling Iranian activity.

The report by the Senate Permanent Subcommittee on Investigations revealed that under President Barack Obama, the Treasury Department issued a license in February 2016, never previously disclosed, that would have allowed Iran to convert $5.7 billion it held at a bank in Oman from Omani rials into euros by exchanging them first into U.S. dollars. If the Omani bank had allowed the exchange without such a license, it would have violated sanctions that bar Iran from transactions that touch the U.S. financial system.

The effort was unsuccessful because American banks — themselves afraid of running afoul of U.S. sanctions — declined to participate. The Obama administration approached two U.S. banks to facilitate the conversion, the report said, but both refused, citing the reputational risk of doing business with or for Iran.

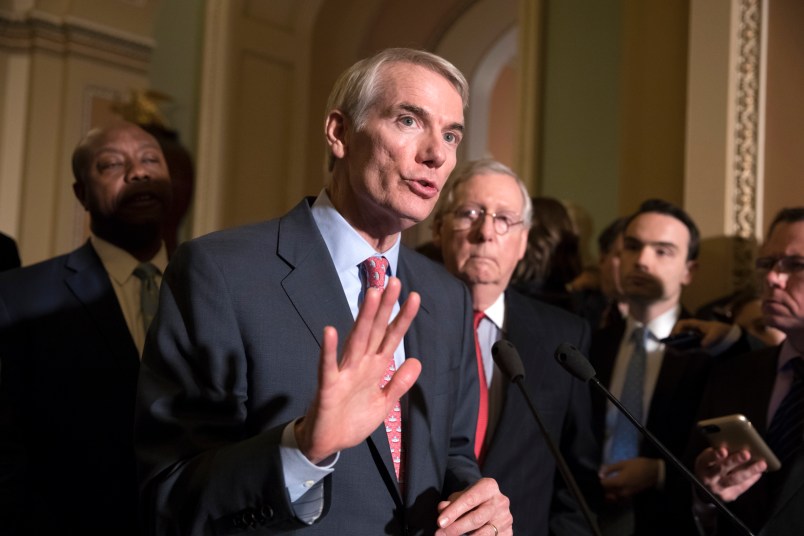

“The Obama administration misled the American people and Congress because they were desperate to get a deal with Iran,” said Sen. Rob Portman, R-Ohio, the subcommittee’s chairman.

Issuing the license was not illegal. Still, it went above and beyond what the Obama administration was required to do under the terms of the nuclear agreement. Under that deal, the U.S. and world powers gave Iran billions of dollars in sanctions relief in exchange for curbing its nuclear program. Last month, President Donald Trump declared the U.S. was pulling out of what he described as a “disastrous deal.”

The license issued to Bank Muscat stood in stark contrast to repeated public statements from the Obama White House, the Treasury and the State Department, all of which denied that the administration was contemplating allowing Iran access to the U.S. financial system.

Shortly after the nuclear deal was sealed in July 2015, then-Treasury Secretary Jack Lew testified that even with the sanctions relief, Iran “will continue to be denied access to the world’s largest financial and commercial market.” A month later, one of Lew’s top deputies, Adam Szubin, testified that despite the nuclear deal “Iran will be denied access to the world’s most important market and unable to deal in the world’s most important currency.”

Yet almost immediately after the sanctions relief took effect in January 2016, Iran began to complain that it wasn’t reaping the benefits it had envisioned. Iran argued that other sanctions — such as those linked to human rights, terrorism and missile development — were scaring off potential investors and banks who feared any business with Iran would lead to punishment. The global financial system is heavily intertwined with U.S. banks, making it nearly impossible to conduct many international transactions without touching New York in one way or another.

Former Obama administration officials declined to comment for the record.

However, they said the decision to grant the license had been made in line with the spirt of the deal, which included allowing Iran to regain access to foreign reserves that had been off-limits because of the sanctions. They said public comments made by the Obama administration at the time were intended to dispel incorrect reports about nonexistent proposals that would have gone much farther by letting Iran actually buy or sell things in dollars.

The former officials spoke on condition of anonymity because many are still involved in national security issues.

As the Obama administration pondered how to address Iran’s complaints in 2016, reports in The Associated Press and other media outlets revealed that the U.S. was considering additional sanctions relief, including issuing licenses that would allow Iran limited transactions in dollars. Democratic and Republican lawmakers argued against it throughout the late winter, spring and summer of 2016. They warned that unless Tehran was willing to give up more, the U.S. shouldn’t give Iran anything more than it already had.

At the time, the Obama administration downplayed those concerns while speaking in general terms about the need for the U.S. to live up to its part of the deal. Secretary of State John Kerry and other top aides fanned out across Europe, Asia and the Middle East trying to convince banks and businesses they could do business with Iran without violating sanctions and facing steep fines.

“Since Iran has kept its end of the deal, it is our responsibility to uphold ours, in both letter and spirit,” Lew said at the Carnegie Endowment for International Peace in March 2016, without offering details.

That same week, the AP reported that the Treasury had prepared a draft of a license that would have given Iran much broader permission to convert its assets from foreign currencies into easier-to-spend currencies like euros, yen or rupees, by first exchanging them for dollars at offshore financial institutions.

The draft involved a general license, a blanket go-ahead that allows all transactions of a certain type, rather than a specific license like the one given to Oman’s Bank Muscat, which only covers specific transactions and institutions. The proposal would have allowed dollars to be used in currency exchanges provided that no Iranian banks, no Iranian rials and no sanctioned Iranian individuals or businesses were involved, and that the transaction did not begin or end in U.S. dollars.

Obama administration officials at the time assured concerned lawmakers that a general license wouldn’t be coming. But the report from the Republican members of the Senate panel showed that a draft of the license was indeed prepared, though it was never published.

And when questioned by lawmakers about the possibility of granting Iran any kind of access to the U.S. financial system, Obama-era officials never volunteered that the specific license for Bank Muscat in Oman had been issued two months earlier.

According to the report, Iran is believed to have found other ways to access its money, possibly by exchanging it in smaller quantities through another currency.

The situation resulted from the fact that Iran had stored billions in Omani rials, a currency that’s notoriously hard to convert. The U.S. dollar is the world’s dominant currency, so allowing it to be used as a conversion instrument for Iranian assets was the easiest and most efficient way to speed up Iran’s access to its own funds.

For example: If the Iranians want to sell oil to India, they would likely want to be paid in euros instead of rupees, so they could more easily use the proceeds to purchase European goods. That process commonly starts with the rupees being converted into dollars, just for a moment, before being converted once again into euros.

U.S. sanctions block Iran from exchanging the money on its own. And Asian and European banks are wary because U.S. regulators have levied billions of dollars in fines in recent years and threatened transgressors with a cutoff from the far more lucrative American market.

GOP-mendacious, untruthful mean unworthy of trust or belief. dishonest implies a willful perversion of truth in order to deceive, cheat, or defraud

But at the same time we’re screaming about the crap going on in the current administration, the whataboutisms for this will overshadow with the right. This might not have been a willful perversion of the truth, as this situation didn’t appear to make a difference in the end, but I can hear the screams from Hannity and company to lock Obama up over this, which is of course ridiculous.

This will take the news cycle for a day or two. It would be nice if Mueller would take some new action to remind the idiots in charge that he’s still out there, but I don’t have any confidence that even perp walks would make a difference at this point.

The report by the Senate Permanent Subcommittee on Investigations revealed …

Where is this fine subcommitee in the investegation of the man who has betrayed America ,and who overtly lies to Americans over his crimes on a daily basis? Listen to Portrman on most subjects for a couple of minutes to understand he is a political hack…duplicitous and dangerous.

If we use the current president’s logic, then there is no way President Obama could break the law because as chief executive he is above the law. Everything done, therefore, is legal because the Executive branch can’t act illegally and, if deemed to do so, he could pardon himself because that is his right. My hunch is that this confusing and illiterate logic will not be applied retroactively to other presidents.