Updated 5:26 pm ET, Thursday, January 5

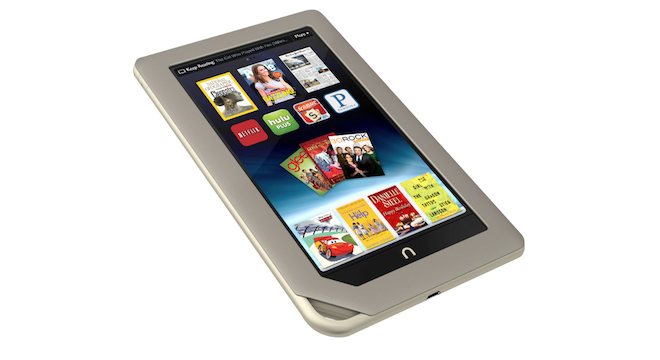

Barnes & Noble has managed to avoid some of the pitfalls of rival physical book retailer Borders (which declared bankruptcy almost a year ago in February 2011), in part thanks to its savvy decision to surprise everyone and launch an e-reader running a heavily modified version of Android, the Nook, in late 2009.

Since then, Barnes & Noble has released four iterations of its Nook line, which have gone on to sell unspecified millions, netting $448 million this holiday season alone and potentially $1.5 billion for the year, according to a company press release on Thursday.

But within that release there was a striking admission: Barnes & Noble is contemplating spinning-off or selling-off its Nook division entirely.

One more time, in corporate speak: “In order to capitalize on the rapid growth of the NOOK digital business, and its favorable leadership position in the expanding market for digital content, the Company [Barnes & Noble] has decided to pursue strategic exploratory work to separate the NOOK business.”

The release makes it sound as though Barnes & Noble is the victim of its own success, or rather, that it can’t effectively seize the momentum the Nook business has attained to create new business opportunities due to the fact that its original business — dead-tree book selling — is dragging it down.

That’s what some tech writers have interpreted as well.

But that reading is complicated by the fact that not every Barnes & Noble Nook product is doing well.

Although the company did report a 52 percent increase in holiday Nook sales from a year ago, that was down from 2010’s 78 percent increase.

More to the point, Barnes & Noble also noted that is also revising its guidance for 2012’s total earnings downward to between $150 million and $180 million, causing shares of Barnes & Noble stock to plunge 20 percent in midday trading.

The reason for the downward guidance revision? Not the brick and mortar retails outlets doing worse than expected, as one might believe based on the hype around the Nook’s success. Rather, as Barnes & Noble painfully points out: “The change in guidance is due primarily to a shortfall in the expected sales of NOOK Simple Touch, as well as additional investments in growing the NOOK business, such as advertising to support new products and international expansion in the back half of the year.”

In fact, right up front, Barnes & Noble states that ” sales of NOOK Simple Touch lagged expectations, indicating a stronger customer preference for color devices.”

Another wrinkle to consider: Barnes & Noble is reportedly considering selling off its paper publishing unit as well, according to an article in the Wall Street Journal published late Wednesday.

So if Barnes & Noble isn’t going to be in the digital e-reader selling space anymore, nor the physical publishing space, where does that leave the company’s business. Or rather, “what” does that leave for the company to trade in?

As Nate Hoffelder, longtime ebooks blogger, smartly speculates at The Digital Reader:

“At the very least, you could put the 2 stories together and reach an interesting conclusion. B&N wants to pull back from creating products (publishing books and developing the Nook) to simply selling them.

Perhaps B&N senior management has decided that they’re investing too much in developing the products and the platform? While they like being able to sell the product, having to pay all the costs to develop it might not be as appealing as it was back in 2009.”

Indeed, Barnes & Noble’s own release Thursday alludes to this fact, noting that digital content sales — that is the sales of ebooks and Nook apps through Barnes & Noble’s online store — are shaping up to be the future breadwinner of the company, which expects “fiscal 2012 digital content sales to be approximately $450 million. By fiscal 2012 year-end, based upon forecasted device sales, the Company expects annualized U.S. digital content sales will achieve a run-rate of approximately $700-$750 million.”

Even Barnes & Noble’s CEO William Lynch said as much in his statement, pointing out that: “In NOOK, we’ve established one of the world’s best retail platforms for the sale of digital copyright content.”

As long as Barnes & Noble can spin-off the physical manufacturing and maintenance of the Nook to someone else and maintain its digital content sales, well, that would seem to be a win-win, at least from a cost-savings perspective. But finding a buyer to meet that proposition, who won’t just box Barnes & Noble out — would seem to be a tall order.

More to the point, the tablet space — which Barnes & Noble entered wholeheartedly in November with the launch of the Nook Tablet — is heating up fast: Now Google is reportedly working on its own 7-inch, low-cost, “highest-quality” Android tablet for release in March or April 2011, timed to compete with the Kindle Fire and whatever iPad Apple comes out with next.

In any case, we should know more about what, exactly, Barnes & Noble plans to do with the Nook by the “end of this fiscal year,” or April. Updated: Or maybe not. See below.

Late update: Barnes & Noble’s chief financial officer Allen Lindstrom contacted TPM to answer some of our questions about the proposed spin off.

To begin with he clarified that the aforementioned reference to “end of this fiscal year” in Thursday’s release referred to the time when the company would decide whether or not to report the Nook as a separate operating segment in Barnes & Noble’s official third quarterly filing, not necessarily when it would announce what it would be doing with the Nook business. Currently, the Nook is reported in Barnes & Noble’s financial statements as components of other business.

For example, Nook retail sails count towards Barnes & Noble’s retail sales total, while online sales count towards the online total. Lindstrom conceded that reporting the Nook as its own operating segment “would be helpful,” but noted that due to accounting rules, that would entail extra “behind the scenes” work on Barnes & Noble’s part to ensure it was all in compliance. More to follow. Stay tuned.

Correction: This article originally stated that Barnes & Noble’s fiscal year ends in February. In fact, that’s when the third quarter results are to be published. The fiscal year actually ends in April. We have since corrected the error in copy and regret it.