Barnes & Noble’s stock took a beating on Thursday after the company revised its fiscal year guidance downward and announced it was contemplating spinning-off the Nook part of its business into a separate company. Shares of Barnes & Noble closed down over 17 percent to $11.24 and fell further still in after hours trading.

The startling announcement that Barnes & Noble was conducting a strategic review of its Nook operation — with no timetable for a decision given — led to head-scratching from investors and analysts, who wondered just why Barnes & Noble appeared to be contemplating sacrificing what it admitted was the main growth engine of its entire company.

But Barnes & Noble’s chief financial officer Allen Lindstrom told TPM in an exclusive interview that in way, the Nook division was quite distinct from the rest of the company already.

“What you have is almost a couple of different companies together,” Lindstrom told TPM via a telephone interview. “You have a tech company, a book retailer and an online content provider. This announcement is all about unlocking the value of the Nook.”

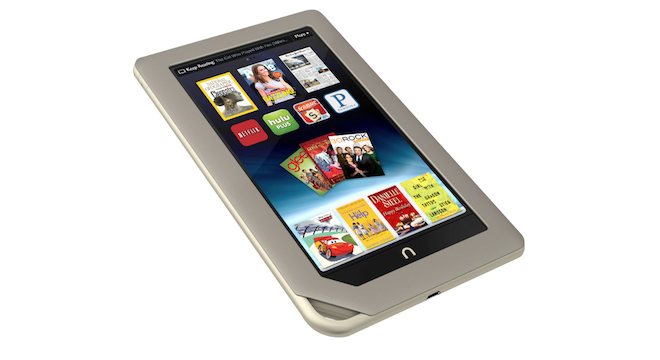

Lindstrom declined to provide details on the various strategic options that Barnes & Noble was considering in deciding exactly how that “unlocking” process would be achieved, also declining to say precisely when Barnes & Noble initiated it. However, he repeatedly told TPM that the reason the Nook was being even considered for a decoupling from the rest of the Barnes & Noble businesses at all was because of its booming success over the past nearly three years, following the unveiling of the first Nook in October 2009. That’s not necessarily the same thing as admitting the spinoff is due to the increasing costs of scaling the Nook business, as other media outlets had surmised.

“This kind of growth is a great story,” Lindstrom told TPM, referring to the Nook’s latest holiday sales figures — some $448 million in Nook device and content sales.

Still, as Lindstrom pointed out, the Nook’s value wasn’t adequately being reported under the current Barnes & Noble financial model, as Nook device and content sales are factored into the company’s retail chain sales numbers and online store sales numbers respectively, rather than being shown as an entirely separate component of the business.

As such, Barnes & Noble reported in its slightly conflicting release on Thursday that “the Company is evaluating its reporting segments. The evaluation is expected to be complete by the end of this fiscal year, which may result in reporting NOOK as a separate operating segment.”

So by April, the end of Barnes and Noble’s fiscal year, the company may move to reporting the Nook as its own entirely distinct operation.

“That would be helpful,” Lindstrom admitted to TPM, “But if it does result in that, certain accounting rules come into effect. We’d have to change things behind the scenes quite a bit.”

Still, the fact that Barnes & Noble is suggesting that it will begin reporting the Nook separately on its own financial statements in April suggests that the company will hold off spinning it of at least until then.

And Lindstrom told TPM that the company was continually focused on delivering content, and an overall great experience, to Nook customers, no matter what decision it made regarding the potential spinoff.

“What happens to Nook customers?” Lindstrom asked. “We will certainly take that into serious consideration as we look through which alternatives we may decide to pursue.”