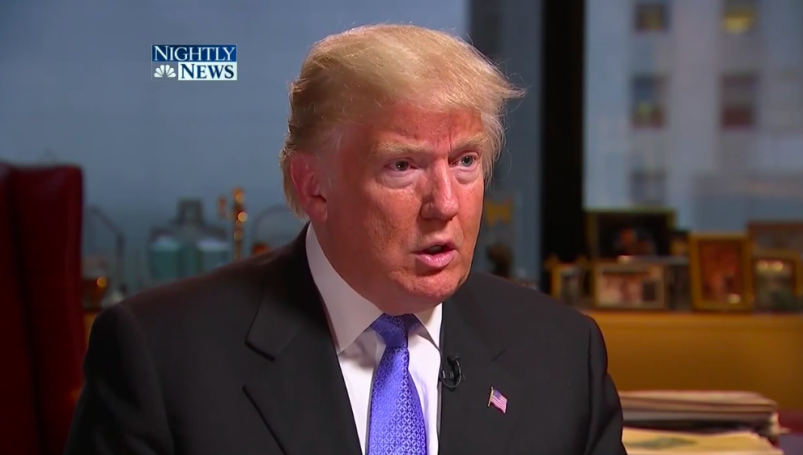

News comes today that Donald Trump is digging in his heels on not releasing his tax returns ever, telling George Stephanopoulos “it’s none of your business” how much tax he pays or at what rate. But last night TPM Reader JJ sent in a link to a … well, it’s just a harrowing revelation that makes me think that actually releasing his tax returns could be like heading to the ego guillotine for Trump.

Some clever sleuthing by Crain’s New York Business reveals that Mr Trump, as members of the entourage call him, qualified for a tax break that requires your income be less than $500,000 a year. Yes, if you make more than half a million dollars a year, you can’t qualify. But Trump did qualify.

So here’s the story. New York state has something called the Star program, the New York State School Tax Relief Program. For a married homeowner to qualify your income needs to be less than $500,000 a year. The benefit itself is pretty measly for a real high roller – just a $302 break on Trump’s penthouse apartment in Trump Tower.

How did Crain’s find this out if Trump hasn’t released his taxes?

Check out the Crain’s piece to get the full details. But the gist is that it shows up on property tax records with New York City. (If it were most publications I’d figure they didn’t understand something about the tax code. But this is one of New York’s premier business and real estate news publications. I doubt it’s a dumb error on their part.)

Now, $500,000 is still a pretty snazzy income. And it is of course important to note that you can be massively rich and even make a huge annual income in laymen’s term and yet still have taxable income that is dramatically lower. The Crain’s piece says that for the purposes of the program New York State defines income as “federal adjusted gross income minus the taxable amount of total distributions from annuities or individual retirement accounts.”

When Crain’s asked the Trump campaign about Trump being virtually in the poorhouse, wartime campaign manager Corey Lewandowski said it was “an error on the part of the city of New York.” Trump has received the benefit for the last three years even though he never asked for it, according to Lewandowski.

So, another error by incompetent New York big government? The City says it checks with state authorities every year to confirm that recipients make less than $500k. And Crain’s confirmed it with state authorities too.

The city’s Finance Department said it checks with New York state tax authorities every year to make sure applicants for the STAR benefit have income under $500,000. A spokesman for the New York State Department of Taxation and Finance said STAR recipients had to provide a social security number in 2013 as part of statewide registration program.

Shortly after Crain’s initial report in March, New York City officials said they believed Trump had received the tax break in error and asked Trump to pay up. But it wasn’t clear that New York City was saying he’d received the tax break in error because of his taxable income on file with the state. It seemed either to be because of his publicly professed wealth or because the Trump Tower apartment may not even have been his primary residence. He’s apparently listed two primary residences in New York City. So, as Crain’s notes, New York City’s statement still suggests that Trump’s income was at some point in the last three years less than $500k. (This follow up article from Crain’s gives the best, though rather byzantine, explanation of how Trump got the tax break in 2014, 2015 and 2016. The key detail is that however Trump got set with the STAR tax break, the “city’s Department of Finance … checks yearly with state tax authorities to ensure STAR participants are earning less than $500,000. A state tax official confirmed that the state receives a list of STAR recipients every year and notifies the city of who is eligible.”)

So what’s up? In real terms, even what we see on TV – the fancy suits, limos, private jets – would be impossible to sustain on $500k a year. But maybe Trump really is only worth $200m or $300m, as biographer Timothy O’Brien reported a decade ago. Or perhaps he actually is a billionaire but has things arranged so aggressively that he managed to report less than $500k in income on his tax returns. Or maybe he’s just an inveterate tax cheat who can’t resist a minuscule tax break he doesn’t qualify for?

Of course, it could simply be an error as Lewandowski claims – don’t you hate it when the government keeps force feeding you tax breaks you tell them over and over you don’t qualify for? That steams the hell out of me. So, could be, but based on the currently available evidence, Trump makes less than $500k a year – the highlife by the standards of us mere mortals but down and out and desperate by plutocrat standards.